At this time’s Ethereum-Bitcoin (ETH/BTC) buying and selling pair slid beneath 0.04, a stage final seen in April 2021. The declining ETH/BTC ratio may have a number of implications for the broader altcoin market.

Altcoins Would possibly Undergo Due To Weak Ethereum

One of many key indicators to gauge the resiliency of the altcoin market is the ETH/BTC ratio. The ratio primarily tracks the relative worth power of Ethereum in opposition to Bitcoin and is broadly thought-about a metric that would point out the long run potential worth motion of altcoins.

As of September 16, 2024, the ETH/BTC ratio sits at 0.039, a stage it final touched 3 years in the past in April 2021. In reality, after hitting a excessive of 0.088 in December 2021, the ETH/BTC ratio has been on a long-lasting decline, barring the occasional useless cat bounce, earlier than additional eroding in worth.

Associated Studying

Concerning altcoin worth motion, a surging ETH/BTC ratio signifies that Ethereum is performing properly in opposition to Bitcoin. Conversely, a declining ratio means that Bitcoin outperforms Ethereum and different altcoins, which may set off a shift in confidence away from Ethereum towards Bitcoin.

Consequently, the broader crypto market may witness a sell-off in altcoins as capital seeks extra secure and better-performing property.

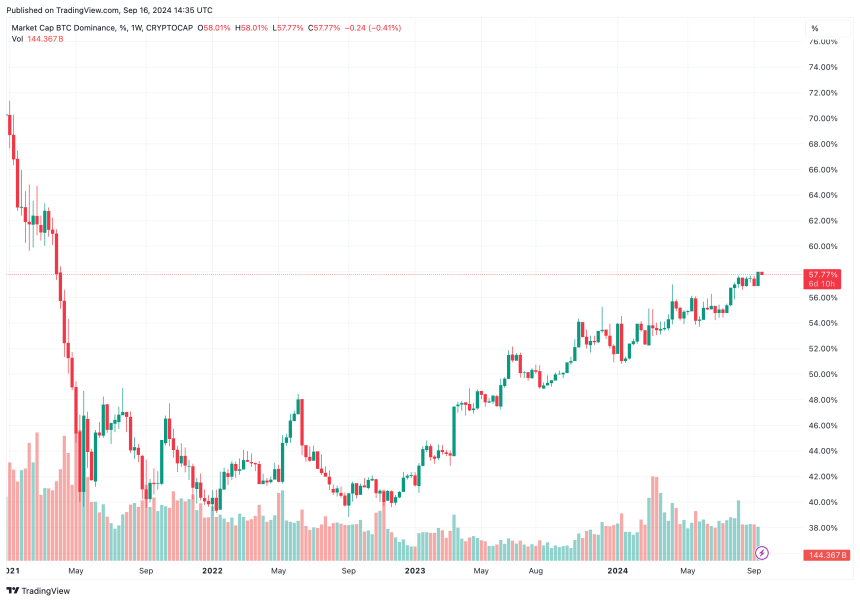

Presently, Bitcoin dominance (BTC.D) sits at 57.78%, and it may be noticed that the metric has been on a gradual uptrend since November 2022. A rise in BTC.D additional solidifies a weakening altcoin market, hinting that liquidity is exiting small-cap tokens, which could result in unstable worth motion and fast worth drawdowns.

It’s price highlighting that the US Securities and Trade Fee’s (SEC) approval of Ethereum exchange-traded-funds (ETFs) didn’t fairly change into as important an occasion for ETH worth because it did for BTC.

Information from crypto ETF tracker SoSoValue reveals that the cumulative web outflow for US Ethereum ETFs is $581 million, whereas the online influx for US Bitcoin ETFs is $17.3 billion.

Can Ethereum Worth Change Its Momentum?

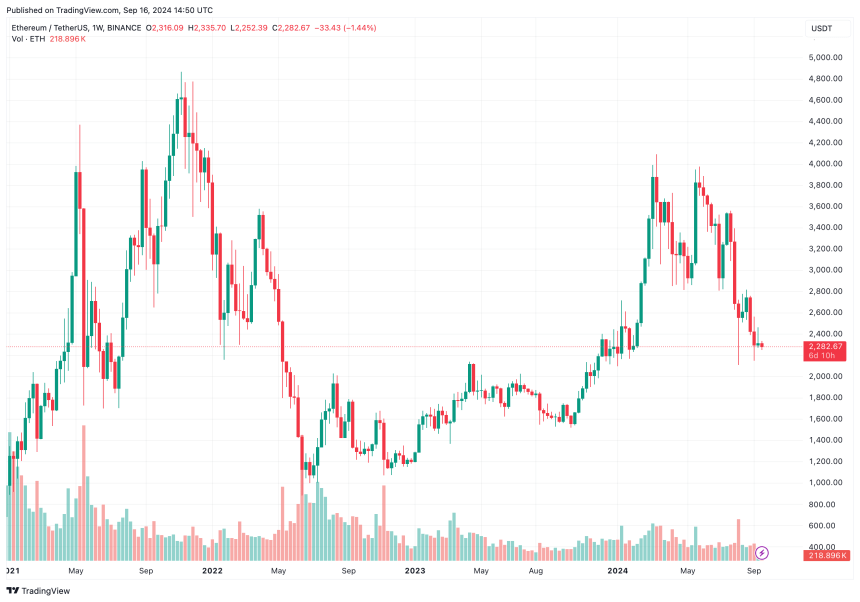

Ethereum is exchanging fingers at $2,282, a worth stage it final touched in January 2024. Notably, the second-largest cryptocurrency by market cap briefly touched the $3,900 mark, earlier than shedding all its beneficial properties.

Most just lately, it was reported that 112,000 ETH was moved to crypto exchanges in in the future, suggesting that buyers won’t be too eager on holding ETH whereas its worth relative to Bitcoin weakens.

Associated Studying

Some consultants opine that now is perhaps an excellent time to transform BTC holdings to ETH as they see a possible 180% surge within the battered ETH/BTC ratio.

The continuous promoting stress on Ethereum has additionally moved ETH to oversold territory, giving hope to ETH holders that the digital asset has doubtless bottomed and may quickly see a powerful worth restoration.

Featured picture from Unsplash, Charts from Tradingview.com