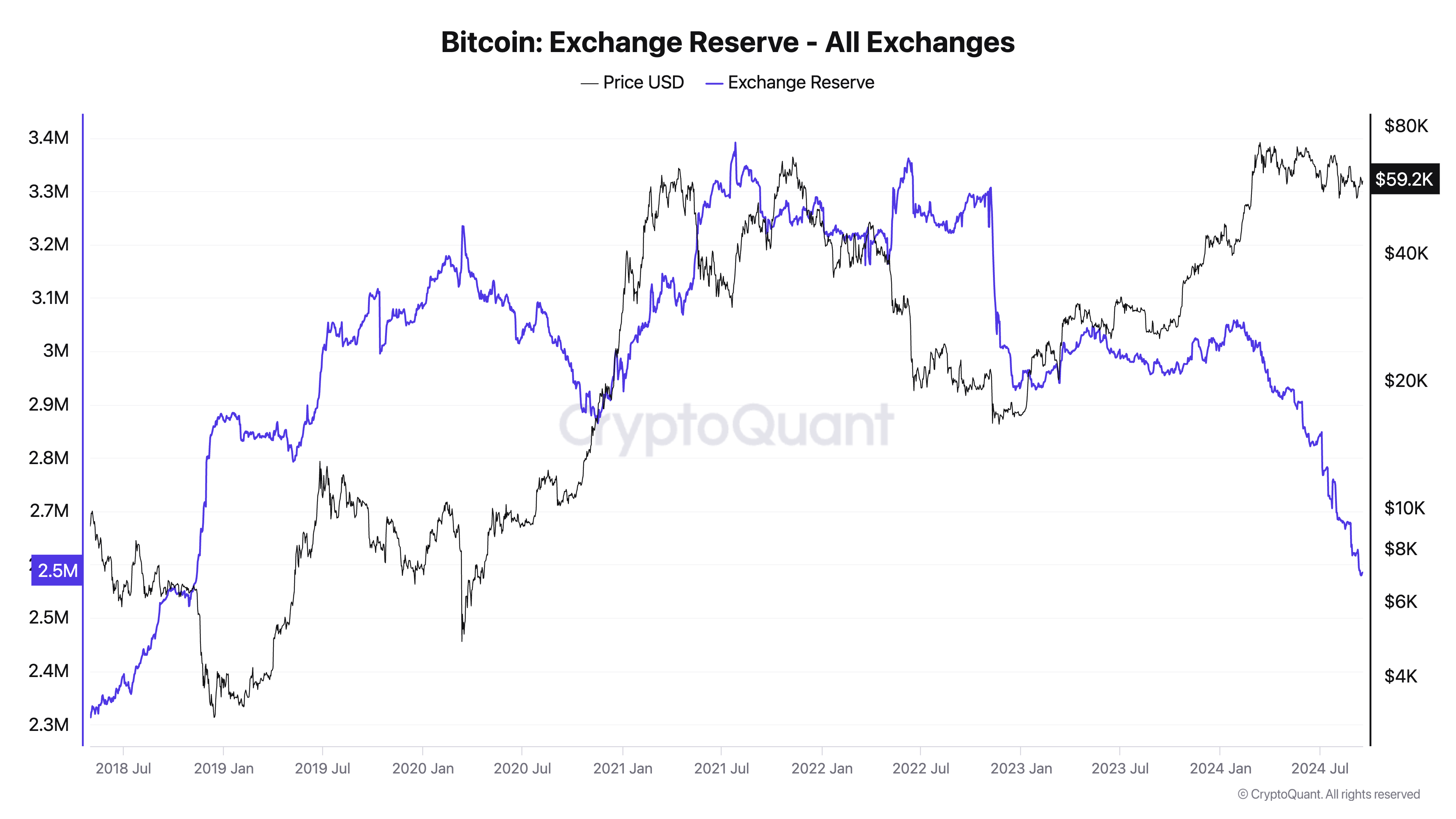

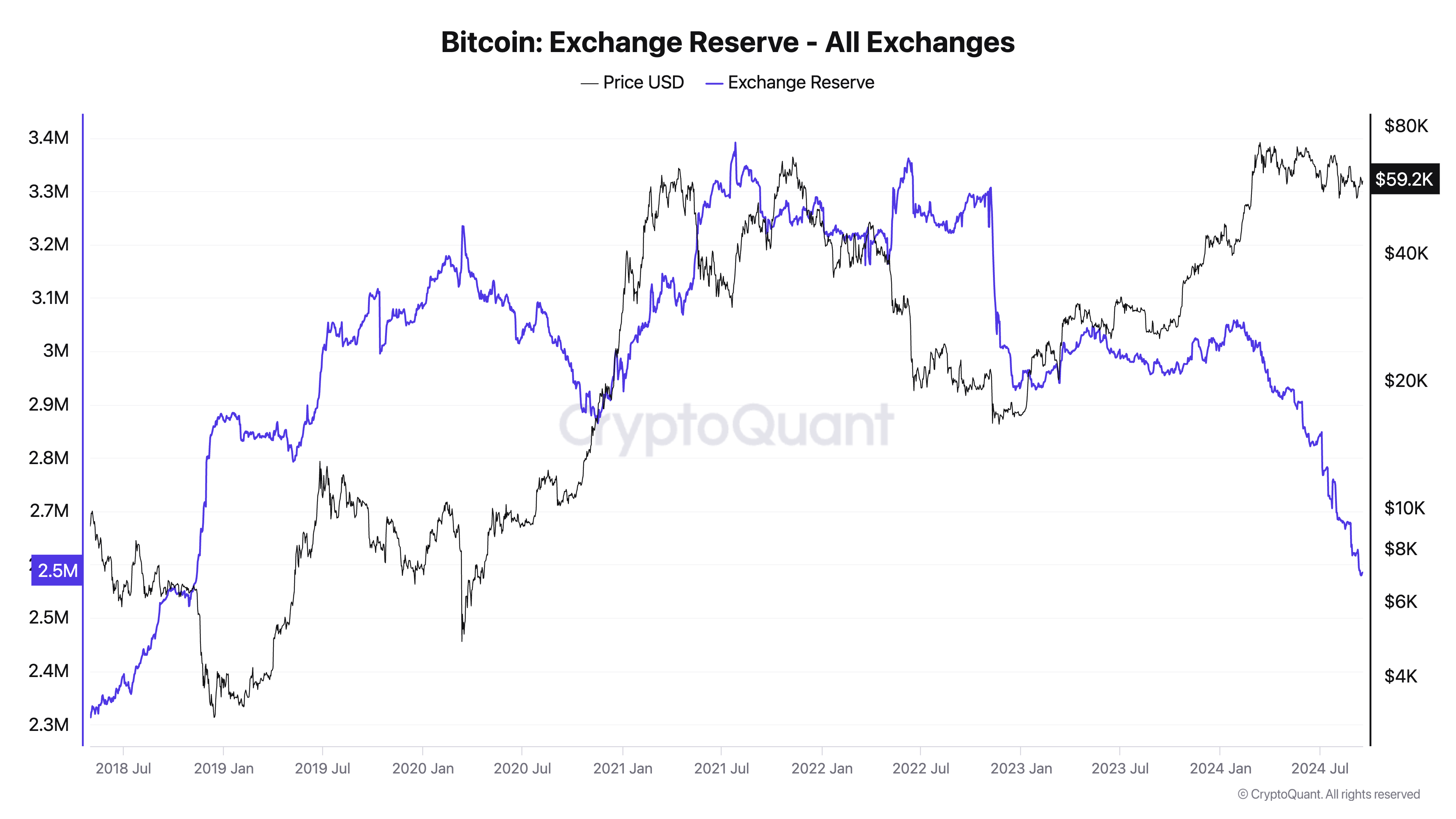

The variety of Bitcoin held on exchanges considerably declined in September, dropping to ranges final seen in mid-November 2018.

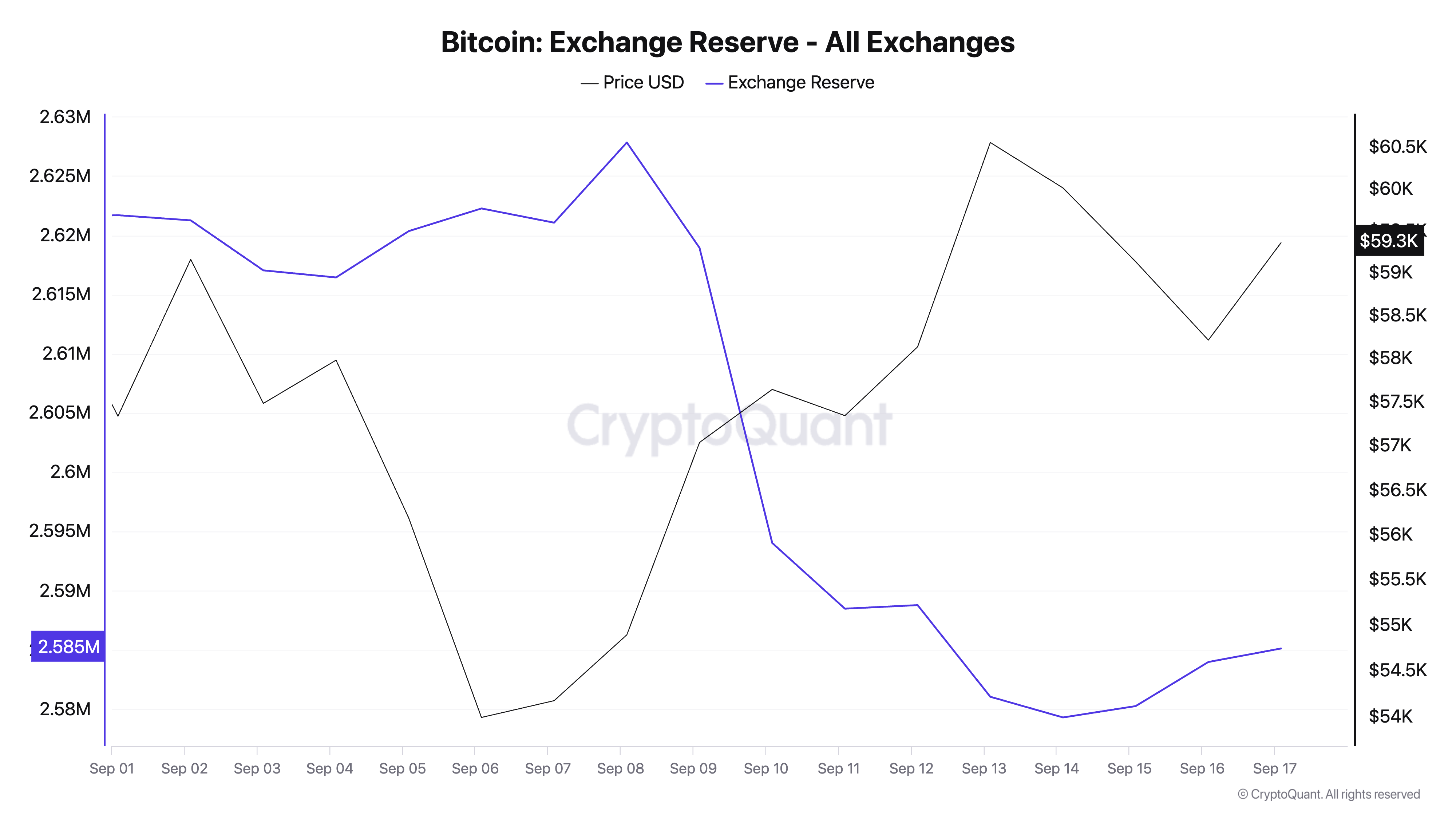

For the reason that starting of the month, Bitcoin trade reserves have dropped from roughly 2.62 million BTC to 2.58 million BTC. This decline of almost 38,000 BTC in simply over two weeks follows a continued pattern of Bitcoin flowing out of exchanges at an accelerated tempo.

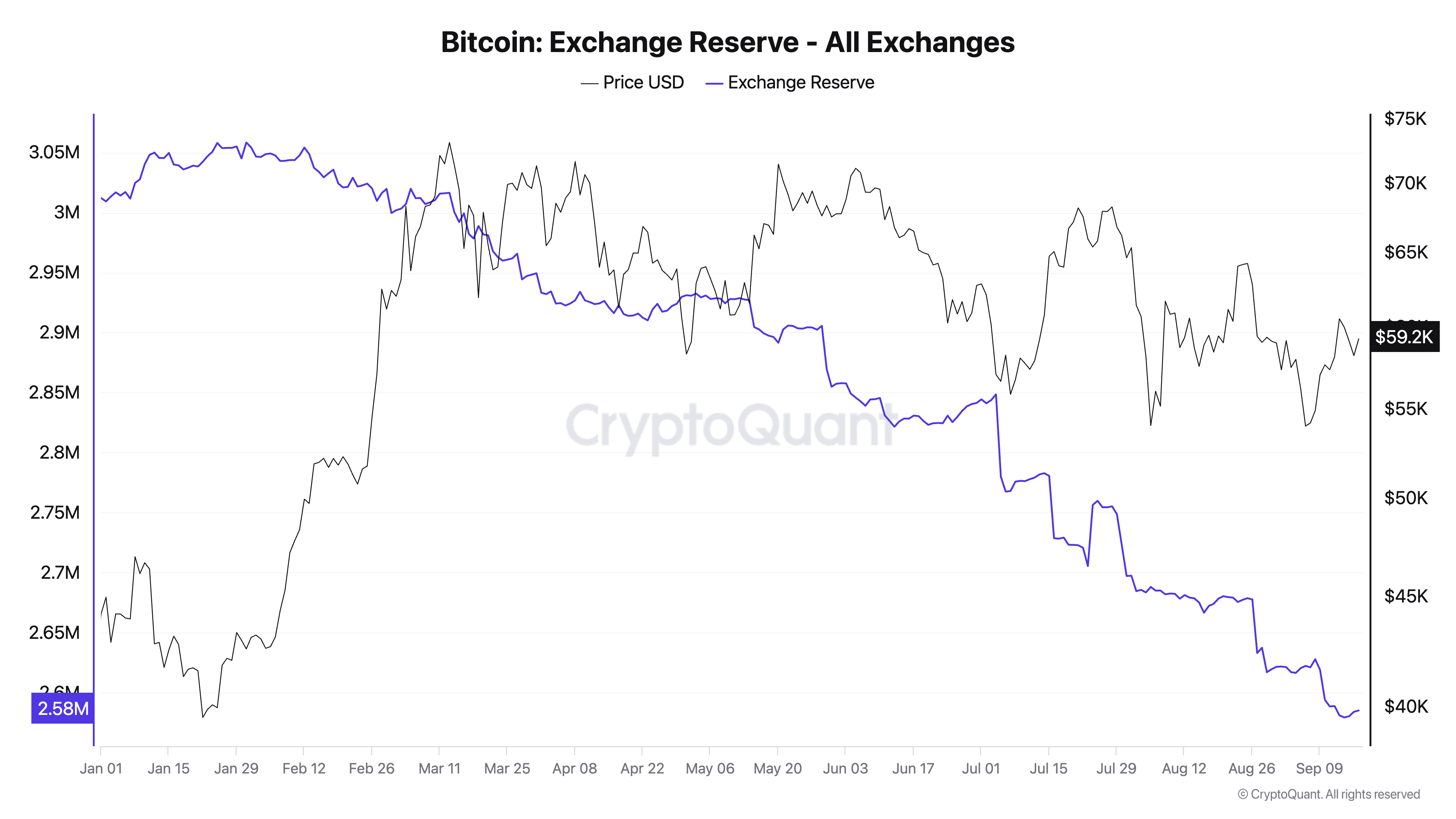

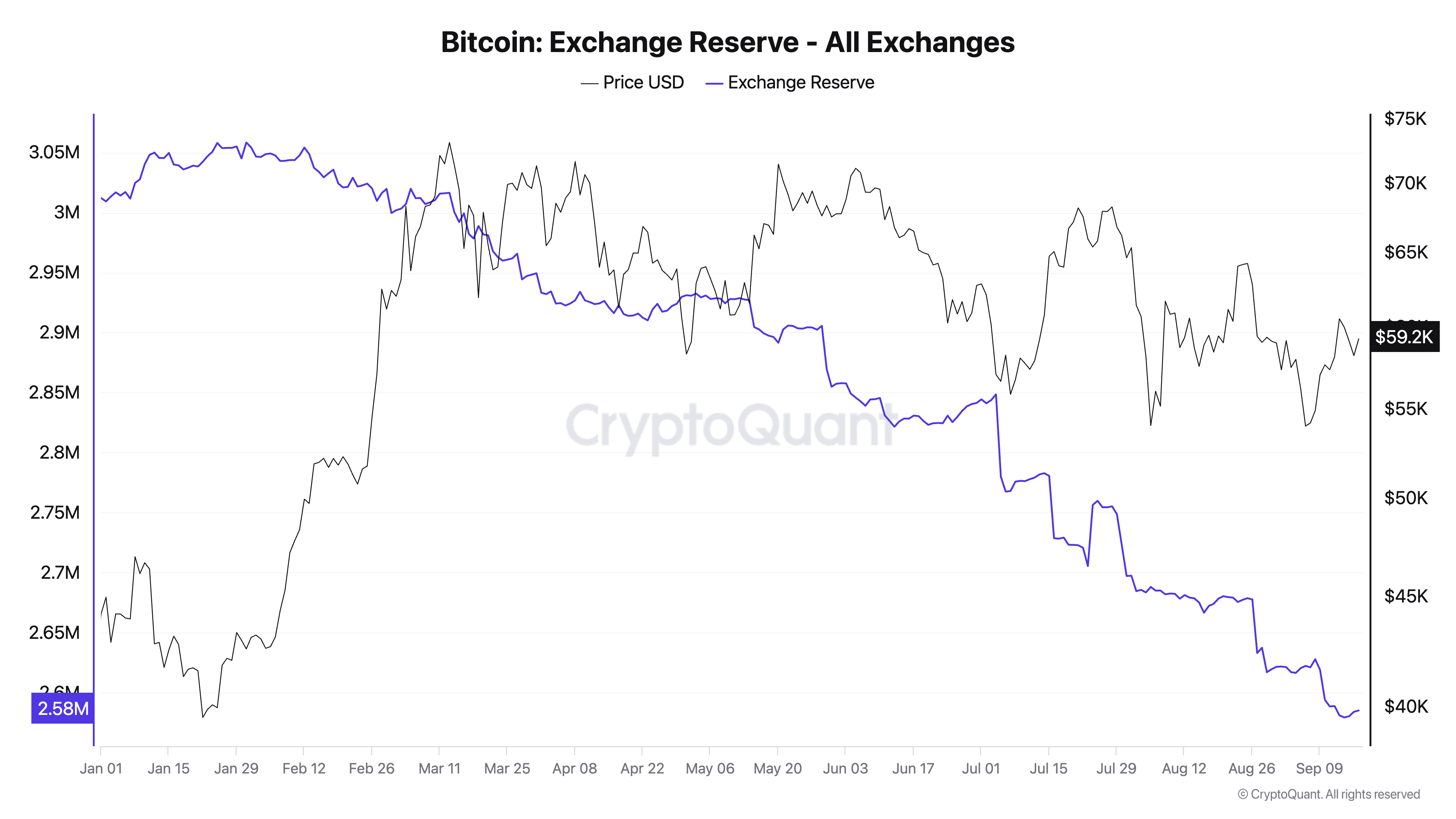

The yearly pattern exhibits a fair bigger drop, with reserves having decreased by about 430,000 BTC because the starting of the 12 months.

A lower in Bitcoin trade reserves usually signifies that buyers are shifting their holdings off exchanges, choosing long-term storage in private wallets. This motion is usually interpreted as an indication of confidence in Bitcoin’s future value potential, because it reduces the instant provide obtainable for buying and selling, doubtlessly setting the stage for a provide squeeze.

The return of trade reserves to 2018 ranges is especially telling. In November 2018, Bitcoin emerged from a serious bear market, and buyers started accumulating Bitcoin in anticipation of future features. At the moment, the parallel is obvious: buyers are withdrawing Bitcoin from exchanges once more, probably signaling an accumulation section within the present market cycle. This transfer may indicate that market individuals are making ready for a big value motion pushed by the shortage of obtainable Bitcoin on exchanges.

The low ranges of trade reserves counsel a market leaning in direction of long-term holding somewhat than short-term buying and selling. Such conduct can improve value volatility, particularly if demand surges amidst a constrained provide.