On-chain knowledge exhibits the Bitcoin miners have been making an unusually excessive variety of transactions to centralized exchanges not too long ago.

Bitcoin Miner To Alternate Transactions Metric Has Simply Seen A Spike

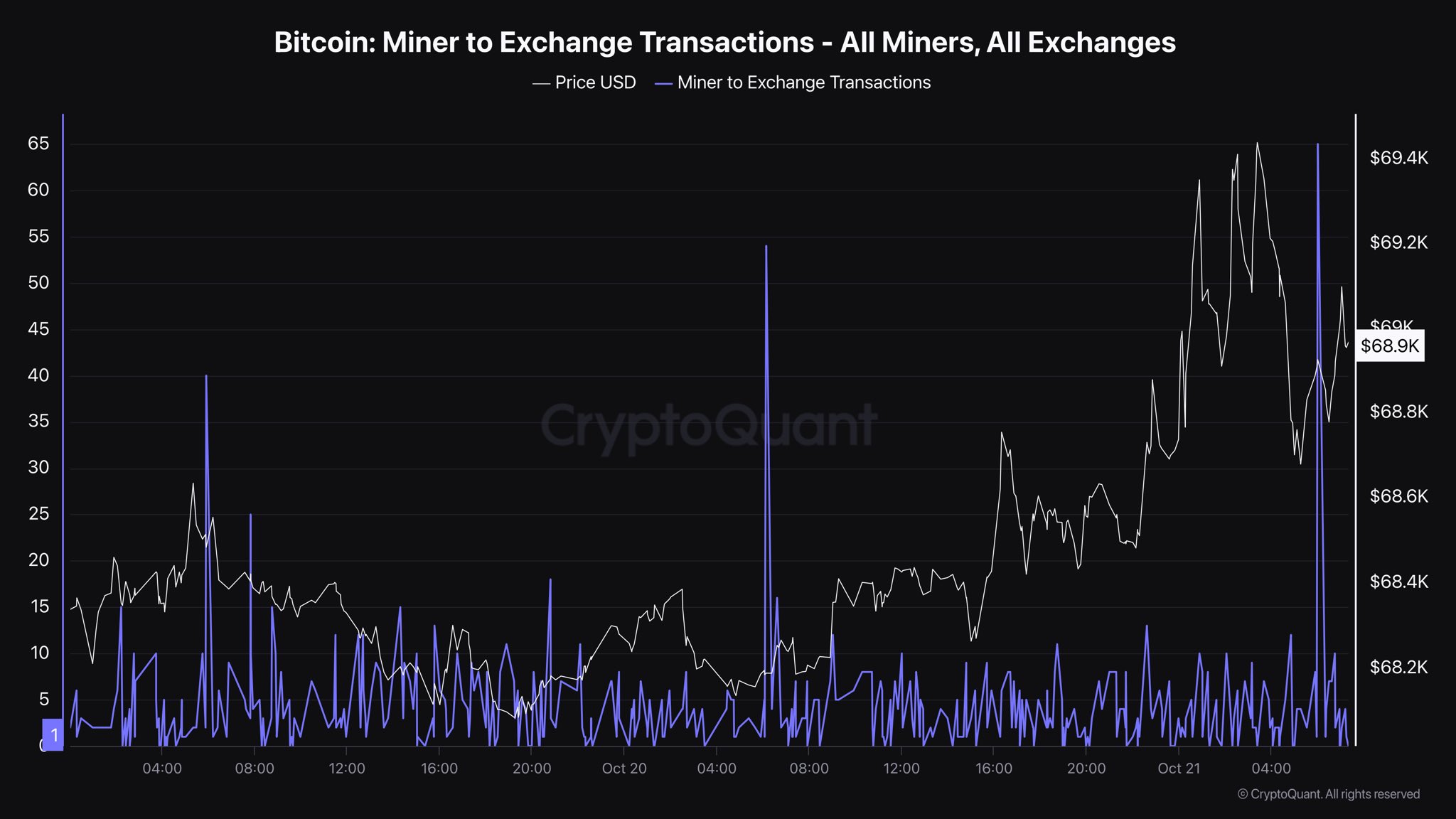

As identified by CryptoQuant writer IT Tech in a brand new publish on X, the Miner to Alternate Transactions indicator has been excessive not too long ago. The “Miner to Alternate Transactions” retains observe of the overall variety of transfers that the miner-associated Bitcoin wallets are making to addresses linked with exchanges.

When the worth of this metric is excessive, it means the miners are making a considerable amount of strikes to those platforms. As one of many fundamental explanation why these chain validators would deposit to exchanges is for selling-related functions, this type of pattern can have a bearish impact on the BTC value.

Associated Studying

Alternatively, the indicator being low implies miners aren’t making inflows to exchanges, probably as a result of they plan to carry onto their cash for some time. Naturally, this HODLing from this cohort is usually a constructive signal for the asset.

Now, here’s a chart that exhibits the pattern within the Bitcoin Miner to Alternate Transactions over the previous couple of days:

As displayed within the above graph, the Bitcoin Miner to Alternate Transactions has registered a big spike in the course of the previous day, suggesting that the miners have simply made numerous strikes to those platforms.

It’s potential that this is a sign of a selloff from these chain validators, however whether or not this potential promoting would really have an effect on the cryptocurrency is determined by the precise scale of cash that’s concerned within the transactions.

The analyst has additionally shared the info of an indicator that gives info associated to it, known as the Miner to Alternate Move:

From the chart, it’s seen that this metric’s worth has additionally shot up alongside the spike within the Miner to Alternate Transactions. At its top, the metric touched 225 BTC, which is equal to somewhat underneath $15.4 million on the present value.

This isn’t a small sum in itself, however when contemplating the dimensions of the overall Bitcoin market cap, these alternate inflows hardly weigh to a lot. Thus, even when the miners plan to promote these cash, the market ought to have the ability to take in the stress simply advantageous.

Miners are entities which have fixed working prices within the type of electrical energy payments, so that they are usually common sellers. More often than not, their promoting stays restricted, which might make the latest worth of the Miner to Alternate Move according to the norm.

Associated Studying

The variety of particular person transfers to exchanges that the miners have made, nonetheless, is definitely uncommon, so these indicators could possibly be to regulate within the coming days, in case extra spikes pop up.

BTC Value

Bitcoin had surpassed the $69,000 stage on Sunday, however the asset seems to have dropped again to $68,200 right now.

Featured picture from Dall-E, CryptoQuant.com, chart from TradingView