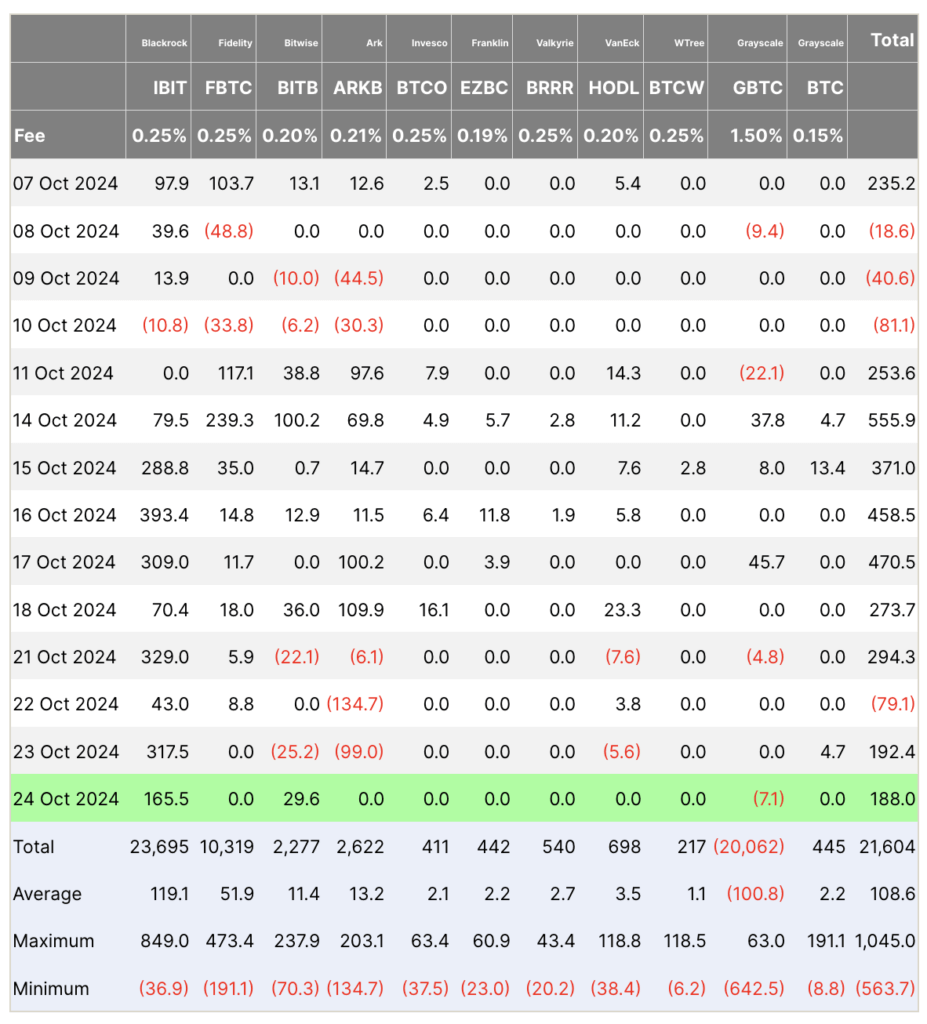

Bitcoin exchange-traded funds (ETFs) confirmed blended exercise over the previous two days, following a internet outflow of $79.1 million on Oct. 22 that ended a seven-day influx streak totaling over $2.4 billion since Oct. 14.

On Oct. 23, ETFs registered a internet influx of $192.4 million. The iShares Bitcoin Belief (IBIT) led with $317.5 million in new investments, whereas ARK’s Bitcoin ETF (ARKB) noticed vital outflows of $99 million. Bitwise’s BITB additionally recorded an outflow of $25.2 million.

The next day, Oct. 24, ETFs continued to draw capital with a internet influx of $188 million. IBIT maintained its sturdy efficiency, bringing in an extra $165.5 million. Bitwise’s BITB reversed its earlier day’s outflow by gaining $29.6 million. Nonetheless, Grayscale’s BTC fund skilled a minor outflow of $7.1 million.

The sustained inflows into IBIT spotlight its distinguished function in providing conventional funding publicity to Bitcoin. President of the ETF Retailer, Nate Geraci, identified BlackRock’s efficiency on Oct. 24 alone “would simply put IBIT in high 10% of all launches in 2024 (out of 575+ ETFs).” Conversely, the outflows from ARKB recommend doable profit-taking or shifts in funding methods.