The brand new yr hasn’t introduced stability to Bitcoin’s value, with BTC experiencing important volatility this week. The volatility peaked on Jan. 9, with the value opening at $95,057 and reaching a excessive of $95,346 earlier than dropping sharply to $90,707. This $4,640 buying and selling vary represented a drop of round 4.9%.

Intense volatility like that tends to considerably improve spot buying and selling on exchanges, with retail merchants including to the promoting strain.

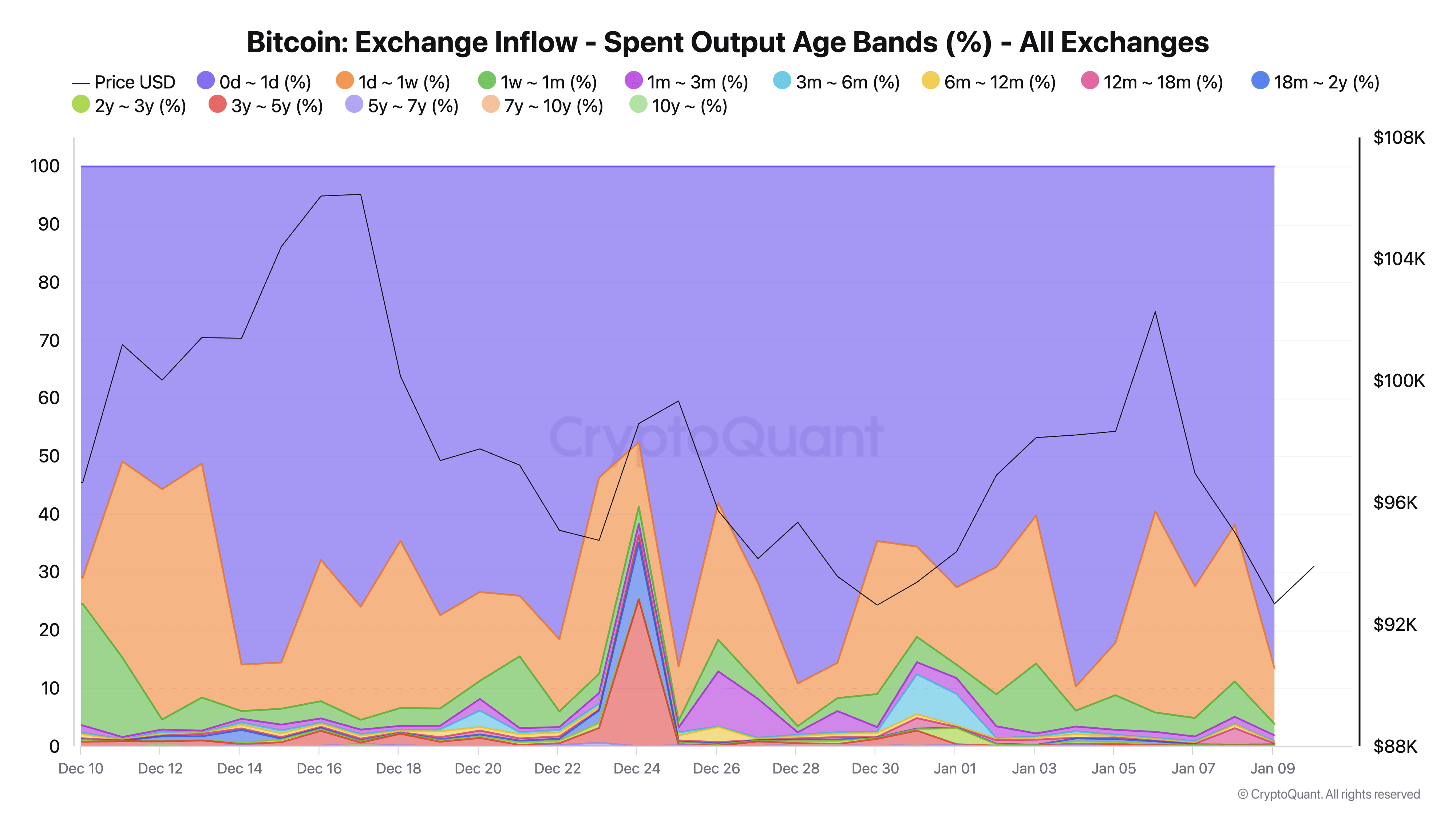

Change influx information exhibits that 86.53% of all cash transferring to exchanges throughout this era got here from the 0-1 day band, indicating an unusually excessive stage of short-term buying and selling exercise. For context, this share considerably exceeds typical each day patterns we’ve seen up to now month, the place 0-1 day previous UTXOs usually account for 50-70% of change inflows.

The dominance of short-term coin actions was additional emphasised by the distribution throughout different time bands, with 9.62% of inflows coming from cash held for 1-7 days and just one.97% from cash held for 1 week to 1 month. Cash held for longer than one month accounted for lower than 2% of whole change inflows, suggesting minimal participation from long-term holders throughout this market motion. This distribution sample is especially related because it exhibits that the day’s value volatility was primarily pushed by short-term buying and selling exercise moderately than a shift in long-term holder sentiment.

The truth that long-term holders remained largely inactive throughout this value motion signifies they seen the volatility as a short lived market phenomenon moderately than a basic shift that requires portfolio adjustment. This habits sample usually emerges throughout corrections, the place short-term value actions are absorbed with out triggering broader market participation.

From a market construction perspective, the focus of exercise within the 0-1 day band, regardless of the substantial value decline, suggests sturdy market depth and resilience. Whereas the inflow of short-term cash to exchanges created quick promoting strain, the shortage of long-term holder participation helped include the value decline. That is essential for creating market stability, as elevated exercise from longer-term holders throughout value declines usually signifies deeper market stress and might result in extra sustained downward strain.

The buying and selling quantity throughout this era additional helps this evaluation, displaying elevated exercise in keeping with the excessive share of short-term coin actions. The amount, value motion, and change influx patterns confirmed that the broader market maintained its place.

CryptoQuant’s information displaying short-term and long-term holder exercise throughout value volatility helps us distinguish between momentary market changes and extra important shifts in market construction. When mixed with value and quantity information, change influx patterns by coin age present much-needed context for market actions.

The publish 86% of Bitcoin’s sell-off pushed by short-term retail merchants appeared first on CryptoSlate.