On-chain metrics recommend Bitcoin (BTC) might be headed for sideways motion or extra correction amid weakening shopping for stress, in response to the crypto analytics agency Glassnode.

Glassnode says on the social media platform X that BTC’s short-term demand momentum has dwindled.

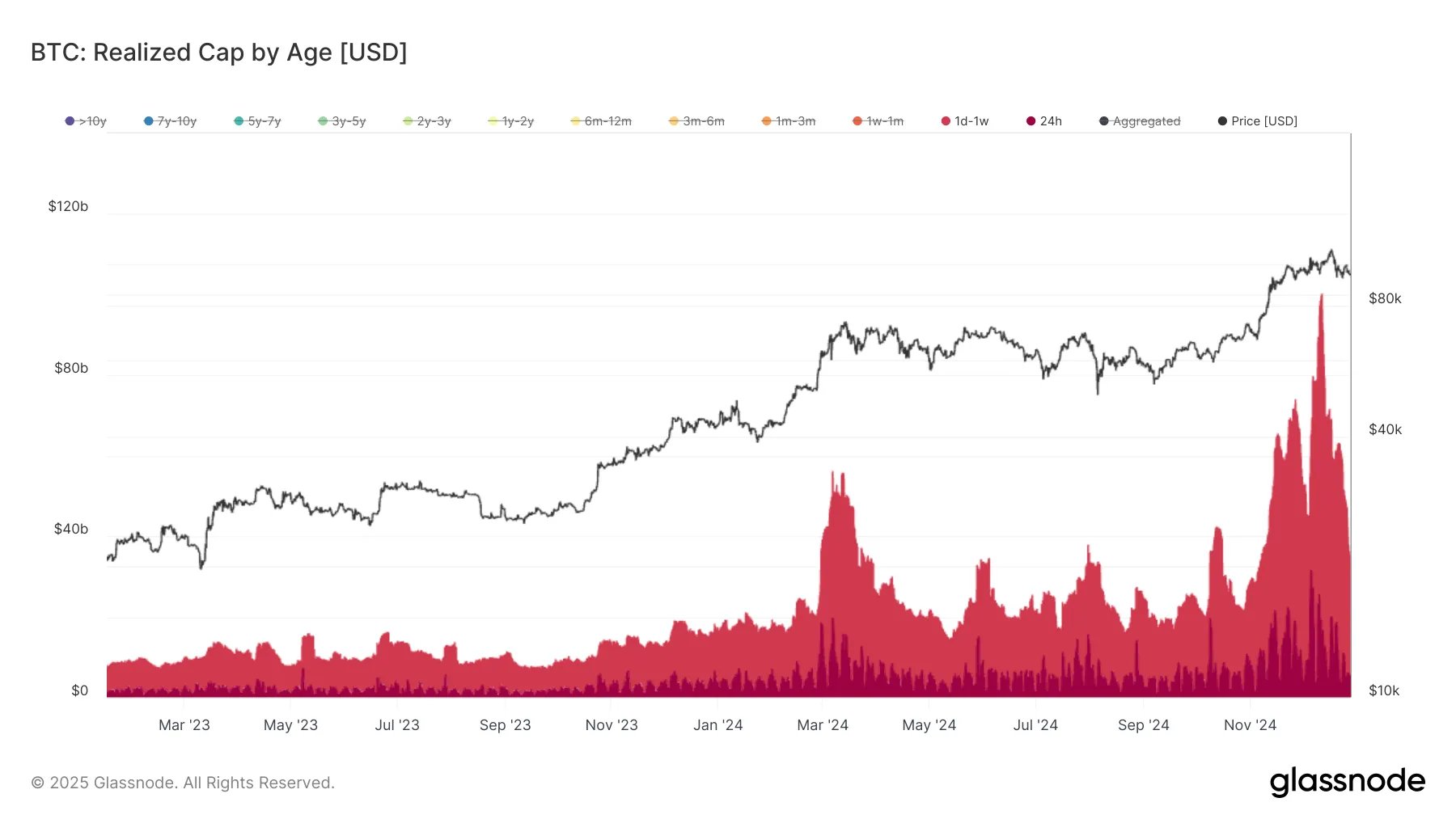

“One key indicator: Scorching Capital (capital revived over the past 7 days) has plunged 66.7% from its December twelfth peak of $96.2 billion to $32.0 billion.”

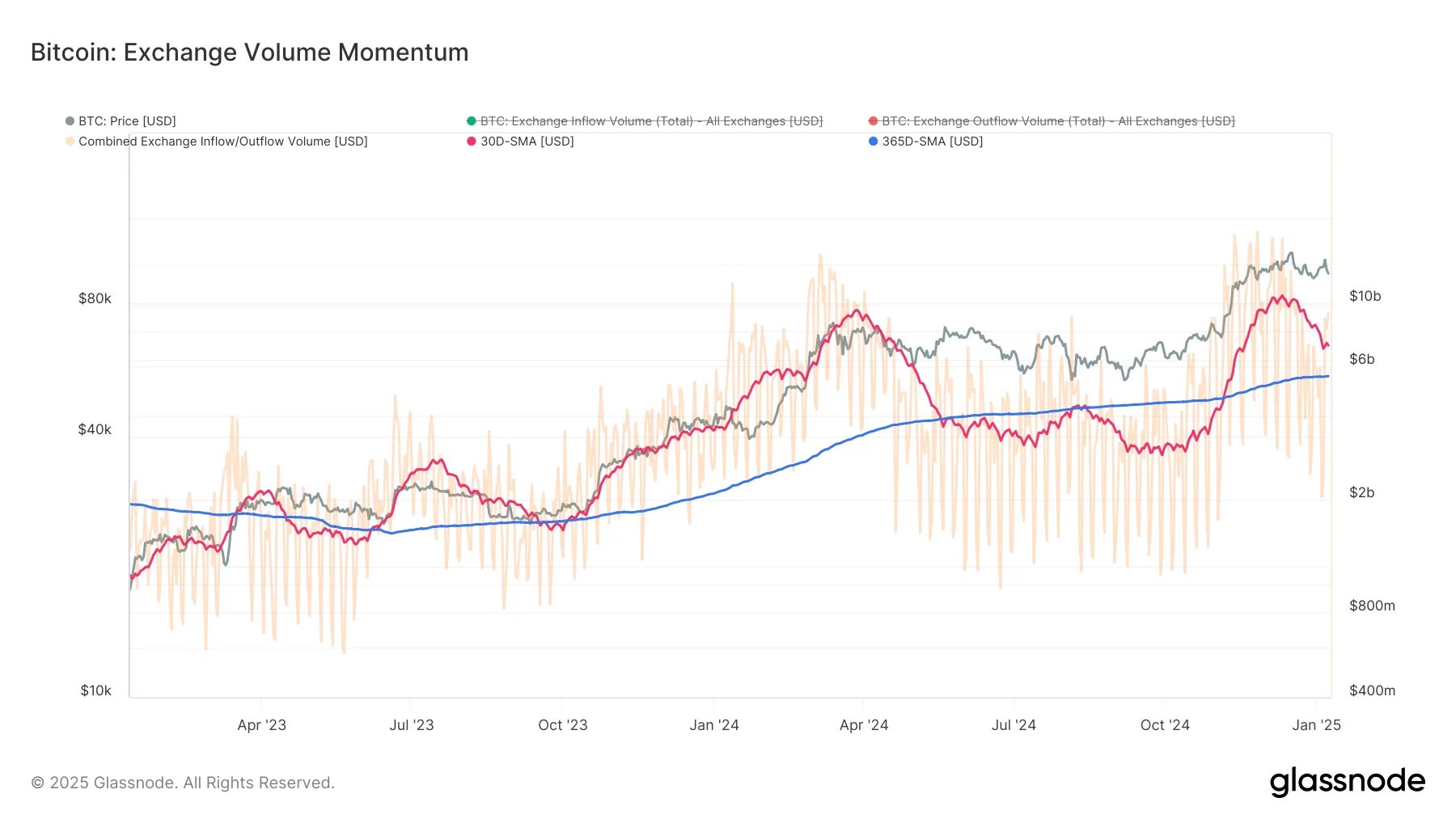

The agency notes that BTC’s diminishing trade quantity momentum and low funding charges additionally trace at diminished demand.

“The 30-day common of trade quantity is nearing the 365-day common, reflecting diminished capital flows because the December market prime.

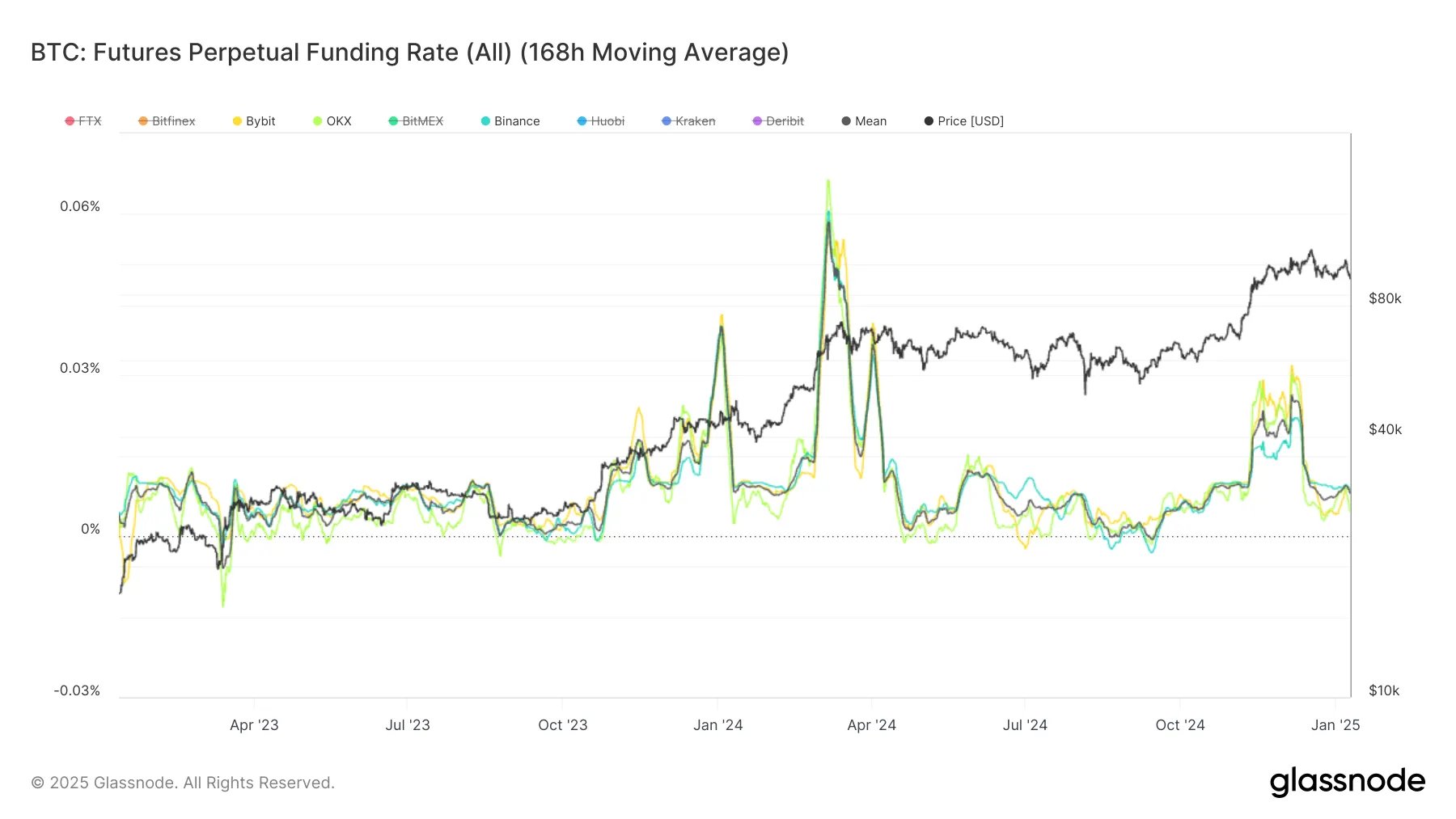

The seven-day shifting common of the imply funding charge, in addition to the funding charges from the highest three perpetual markets, stays beneath the impartial worth of 0.01%. This means a continued absence of demand from aggressive patrons, regardless of the quick rally towards $102,000.

With out a new catalyst, the waning short-term demand suggests both a sideways consolidation interval or a heightened probability of additional correction.”

Bitcoin is buying and selling at $92,579 at time of writing. The highest-ranked crypto asset by market cap is down almost 3% previously 24 hours and greater than 4% previously seven days. BTC additionally stays greater than 14% down from its all-time excessive of $108,135, which it set in December.

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Examine Value Motion

Observe us on X, Fb and Telegram

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl usually are not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal threat, and any losses it’s possible you’ll incur are your accountability. The Day by day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Day by day Hodl an funding advisor. Please notice that The Day by day Hodl participates in affiliate marketing online.

Generated Picture: Midjourney