Fast Take

Bitcoin’s latest efficiency has defied conventional monetary metrics, with the digital asset reaching new heights towards the US 20+ 12 months Treasury Bond ETF (TLT), the S&P Regional Banking ETF (KRE), and the Japanese Yen.

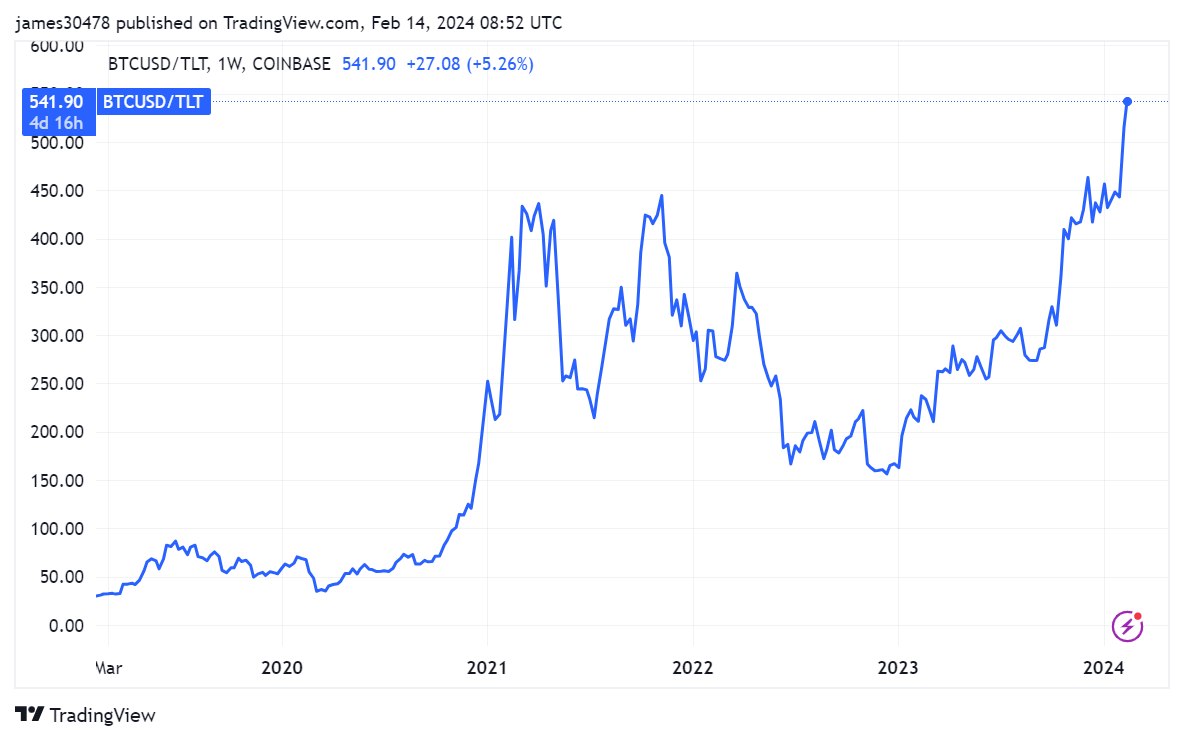

In a direct comparability with TLT, a globally acknowledged benchmark for comparatively secure property, Bitcoin had surged, underlining its rising acceptance as a viable funding.

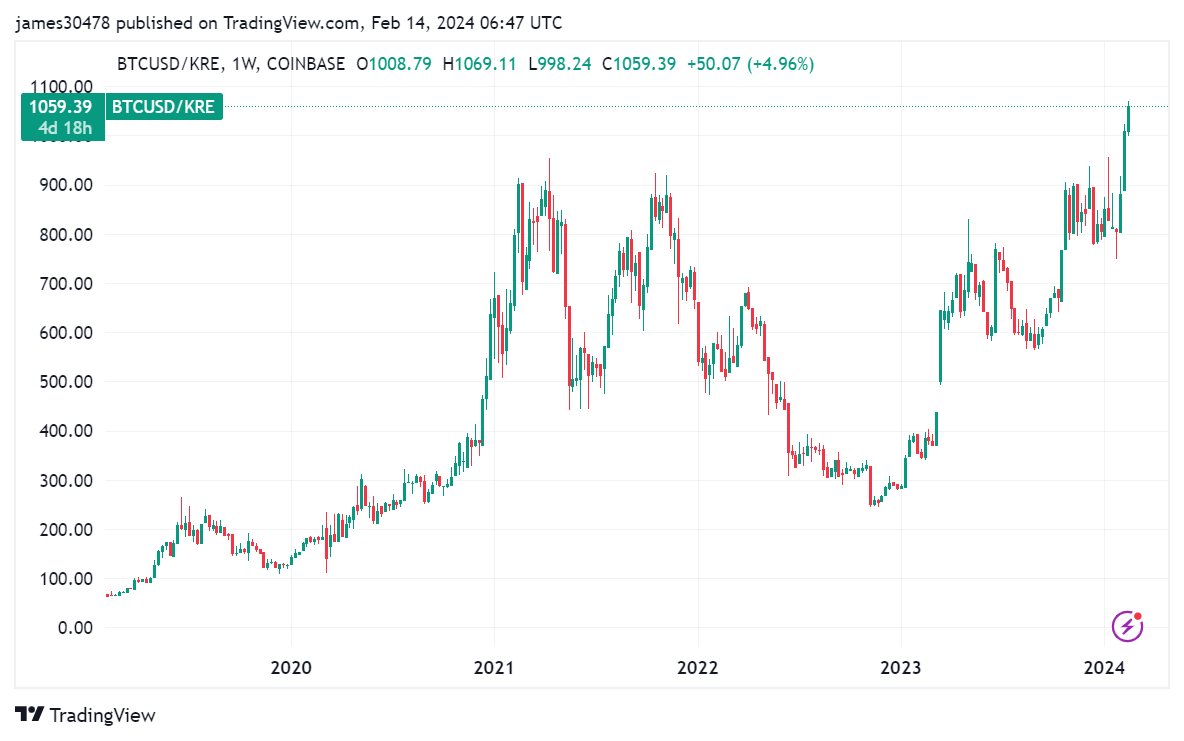

Moreover, its efficiency towards the KRE, which had seen an 11% drop year-to-date, additional emphasizes the robustness of Bitcoin, with the trade price shifting from roughly 900 KRE to 1 Bitcoin in 2021 to the present 1060.

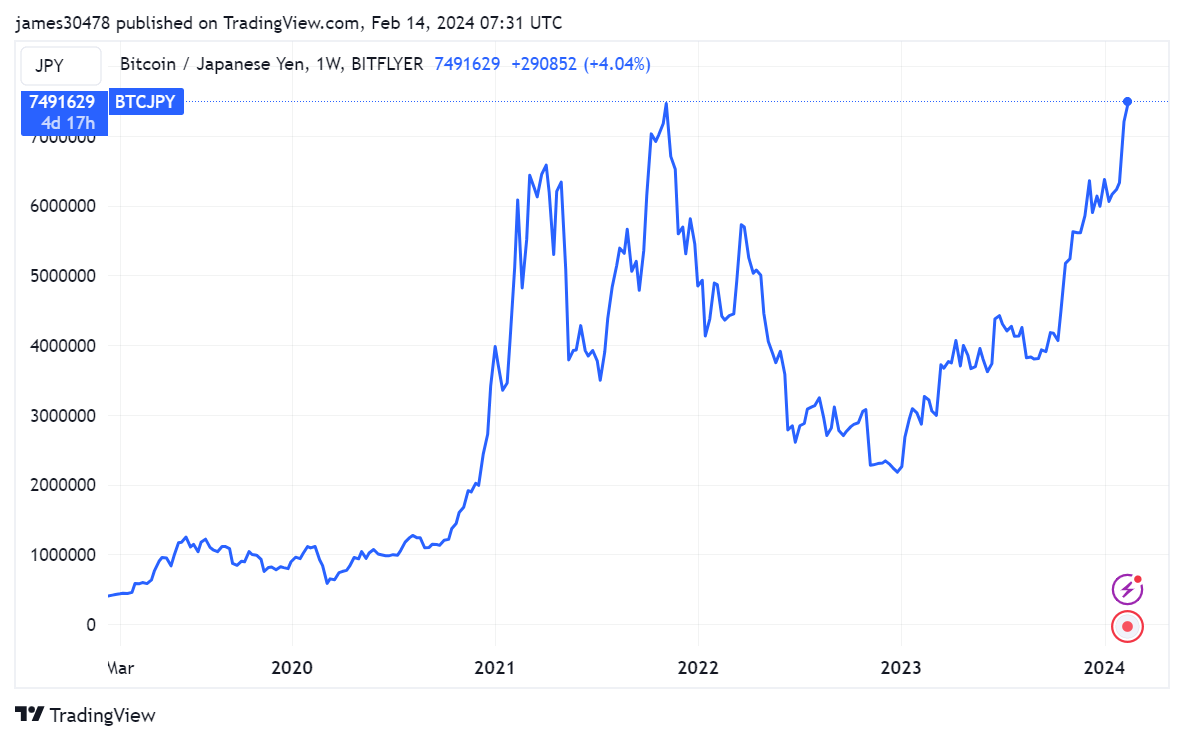

Furthermore, Bitcoin is nearing all-time highs towards the Japanese Yen, the third most traded foreign money within the FX market and used as a reserve foreign money, in line with the Company Finance Institute. With present charges hovering round 7.5 million Yen to 1 Bitcoin, matching ranges seen in 2021, Bitcoin continues to say its power because it hovers across the $50,000 mark.

The submit Bitcoin hits all-time excessive towards conventional asset benchmarks appeared first on CryptoSlate.