On Tuesday, the Bitcoin worth plunged from $49,900 to $48,300 following the discharge of the US inflation knowledge. As NewsBTC reported, the information got here in hotter than anticipated. As a substitute of two.9%, headline CPI got here in at 3.1%, whereas the core CPI was even at 3.9% as a substitute of the anticipated 3.7%.

The standard monetary market reacted negatively and dragged Bitcoin down with it, as expectations for rate of interest cuts have shifted additional into the longer term. The prediction markets are actually pricing in solely 4 price cuts in 2024 after CPI inflation reached 3.1% in January.

It is a enormous drop in expectations as simply over a month in the past the markets have been nonetheless pricing in 6 price cuts. The Fed’s most up-to-date forecast was for 3 price cuts in 2024. The likelihood of a price minimize in March is under 10% and the likelihood of a price minimize in Might is falling quickly.

In distinction to the S&P 500, nevertheless, the Bitcoin worth confirmed a robust response and rapidly rose once more to $49,900. The response of the Bitcoin market is sort of telling for the short-term future. And the Bitcoin worth is displaying simply that at this time. At press time, BTC rose above $51,500, marking a brand new yearly excessive. Listed below are 4 key causes:

#1 File-Breaking Bitcoin ETF Inflows

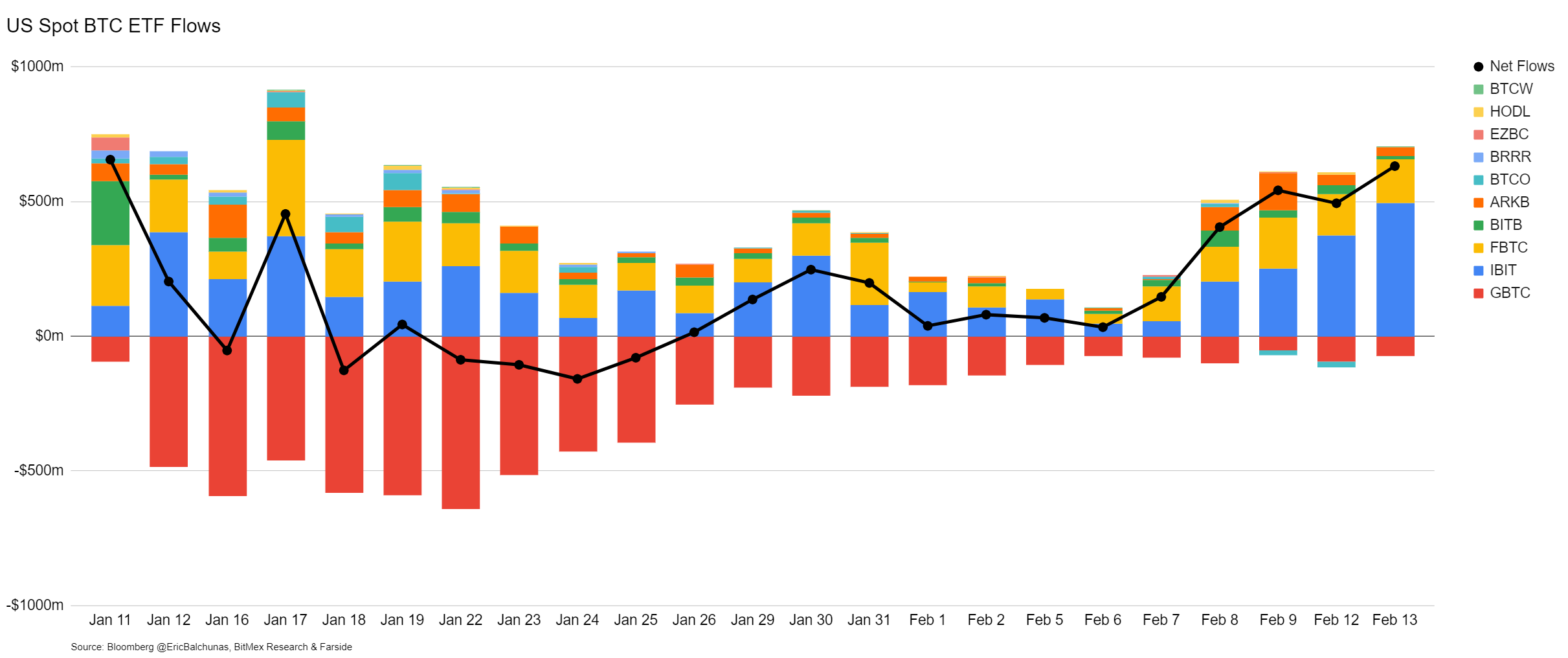

The surge in Bitcoin ETF inflows marks a pivotal second for Bitcoin, reflecting a big shift in investor sentiment and market dynamics. On a record-breaking day on Tuesday, the web inflows into spot Bitcoin ETFs reached $631 million, led by The 9 with an influx of $704 million, signaling a considerable accumulation of Bitcoin.

Key gamers like Blackrock and Constancy performed a big position on this inflow, with Blackrock experiencing almost half a billion {dollars} ($493 million) in inflows and Constancy $164 million. The general internet influx of $2.07 billion over 4 buying and selling days, averaging over half a billion per day, highlights the staggering sustained demand for Bitcoin.

This demand is notably new capital, as GBTC outflows remained steady at $73 million, indicating these inflows should not merely a rotation from GBTC however characterize contemporary investments. Matt Hougan, CIO of Bitwise emphasised the importance of this motion:

IMHO the [numbers] undercounts the basic new investor demand for these ETFs. Folks assume the entire cash flowing out of GBTC up to now is rotating into different bitcoin ETFs. However a great chunk of it’s from inorganic holders […] Lengthy-term buyers have backfilled that and added $3b extra on high. I think the actual new investor-led new demand is north of $5b, and reveals no indicators of slowing.

#2 Genesis GBTC Liquidation Issues Alleviated

Fears of a Bitcoin crash, just like FTX’s sale of GBTC, triggered by Genesis’ deliberate liquidation of Grayscale Bitcoin Belief (GBTC) shares have been alleviated, as reported at this time on Bitcoinist. The liquidation, essential as a consequence of Genesis’ chapter, was initially seen as a possible market downturn catalyst.

The bankrupt lender must liquidate roughly 36 million shares of GBTC, valued at round $1.5 billion, as a part of its technique to resolve monetary challenges stemming from vital loans and regulatory settlements.

Nonetheless, the proposed Chapter 11 settlement includes in-kind repayments to collectors, decreasing direct promoting stress on Bitcoin. This technique aligns with the pursuits of long-term Bitcoin holders, doubtlessly limiting market volatility. Greg Schvey, CEO at Axoni, highlighted:

The proposed Ch 11 settlement requires Genesis to repay collectors in type (i.e. bitcoin lenders obtain bitcoin in return, reasonably than USD). […] Notably, in-kind distribution was a precedence negotiation subject to forestall long-term BTC holders from recognizing beneficial properties when receiving USD again (i.e. a pressured sale). This would appear to point a considerable quantity of lenders don’t plan to promote instantly.

#3 OTC Demand Exceeds Provide

The assertion by CryptoQuant CEO Ki Younger Ju that “Bitcoin demand exceeds provide at OTC desks at the moment” is a big indicator of underlying market energy. OTC transactions, most popular by massive institutional buyers for his or her discretion and minimal market impression, are reflecting a strong demand for Bitcoin. This demand-supply imbalance at OTC desks suggests that enormous gamers are accumulating Bitcoin, a bullish sign for the cryptocurrency’s worth outlook.

#4 Futures And Spot Market Dynamics

The evaluation of futures and spot market indicators by @CredibleCrypto sheds mild on the technical components signaling a bullish continuation for Bitcoin. The analyst factors out, “Knowledge supporting the concept that that was ‘the dip’. – OI reset again to ranges earlier than the final pump – Funding lowering by means of this native consolidation – Spot premium is again.”

These observations steered a wholesome market correction reasonably than the beginning of a bearish development, with the reset in open curiosity and the lower in funding charges indicating that the market has absorbed the shock and is primed for upward motion.

In conclusion, The mix of file ETF inflows, alleviated issues over Genesis’ GBTC liquidation, sturdy OTC demand, and favorable futures and spot market dynamics supplies a compelling case for Bitcoin’s potential rally. Every of those components, supported by knowledgeable insights and market knowledge, underscores a rising investor confidence.

Featured picture created with DALL·E, chart from TradingView.com

Disclaimer: The article is offered for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding choices. Use info offered on this web site fully at your individual threat.