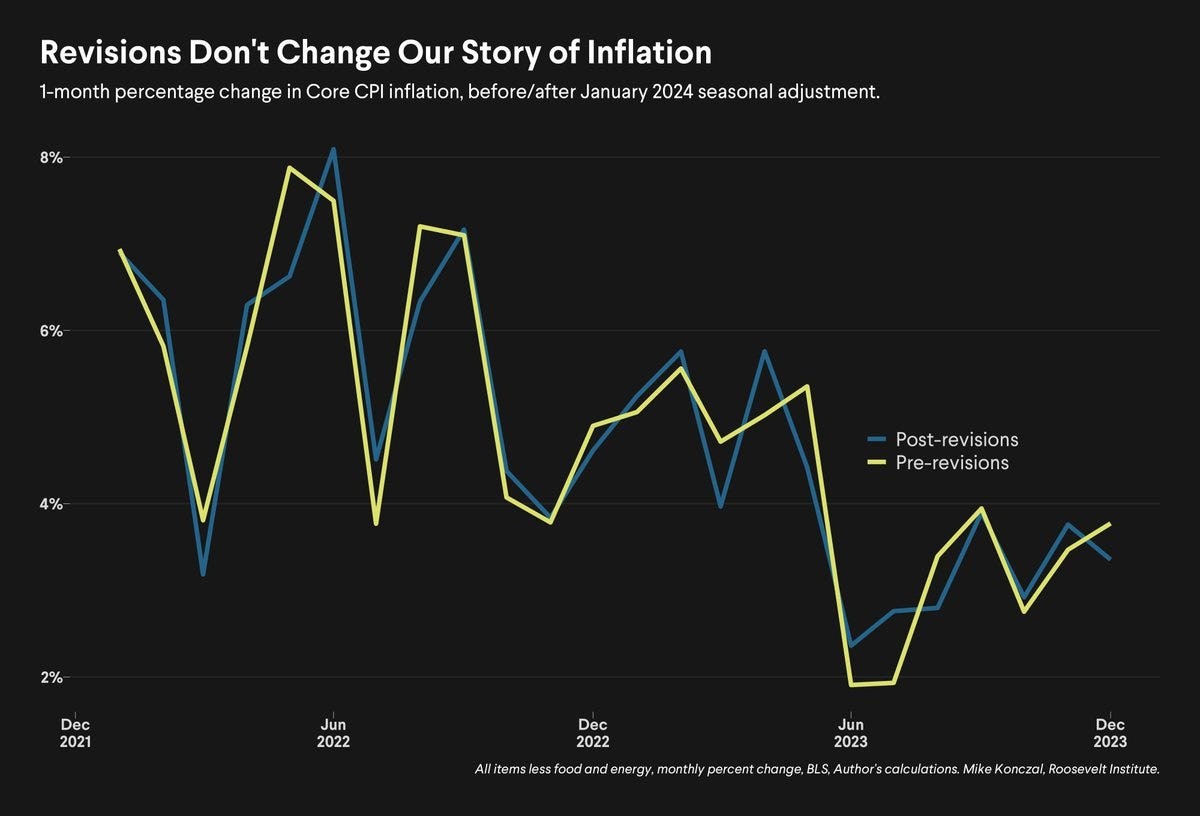

The patron value index knowledge was seasonally adjusted, however the revision didn’t drastically have an effect on the general image; the core CPI continues to be at +0.3% m/m, which is in keeping with expectations:

Revised Core Shopper Value Index Information

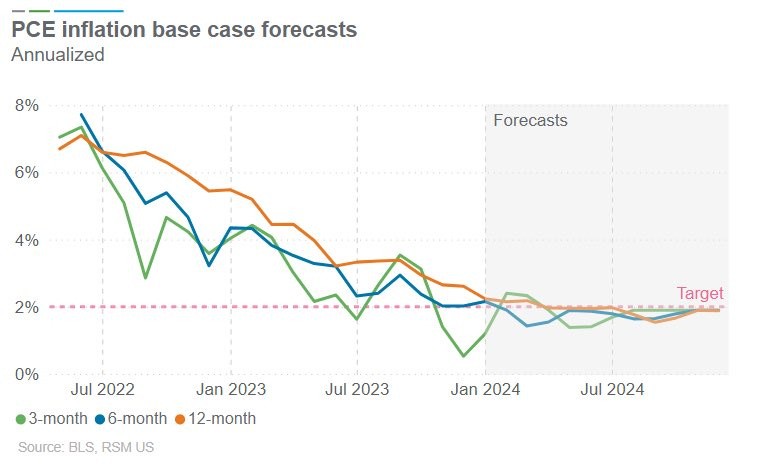

The market’s up to date forecast for inflation is that it’s going to exceed the two% goal within the close to time period after which finish the yr at or close to:

PCE Inflation Forecast

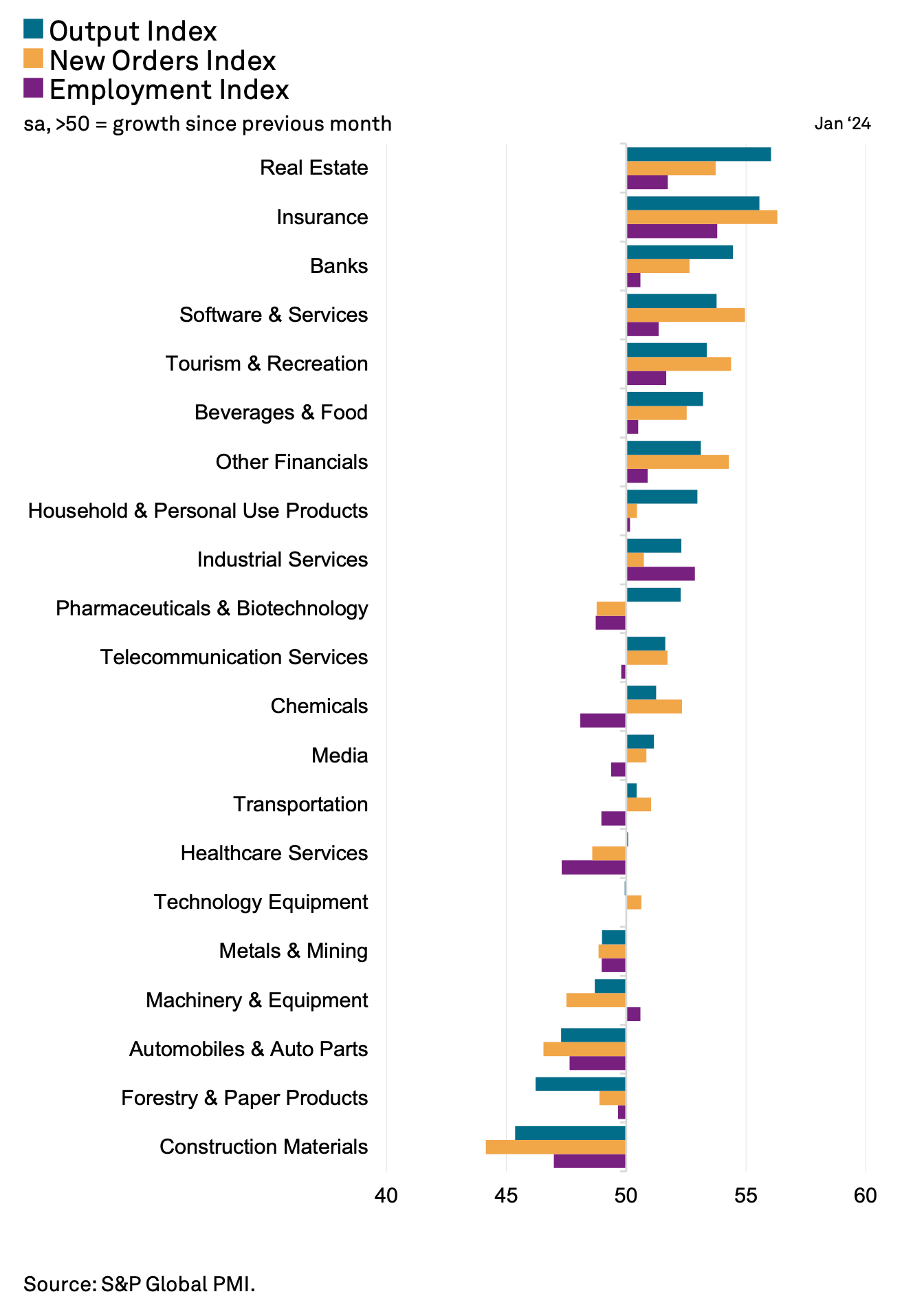

The newest PMI from S&P World confirmed some indicators of enchancment within the world financial system throughout the first month of 2024, with 15 of the 21 sectors tracked posting their strongest positive factors since June final yr:

S&P World PMI, sector indicators

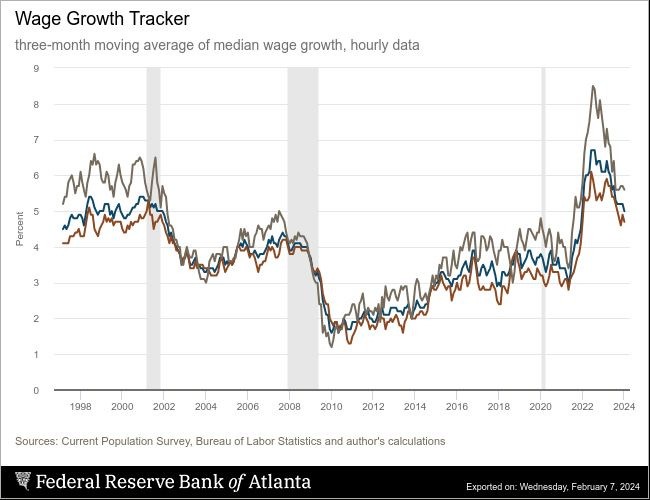

The Atlanta Fed’s wage indicator fell from +5.2% to +5.0% in January (lowest in +2 years). Wage progress additionally slowed for individuals who stay at work (to +4.7% from +4.9%) and for individuals who change jobs (to +5.6% from +5.7%):

Atlanta Fed wage indicator

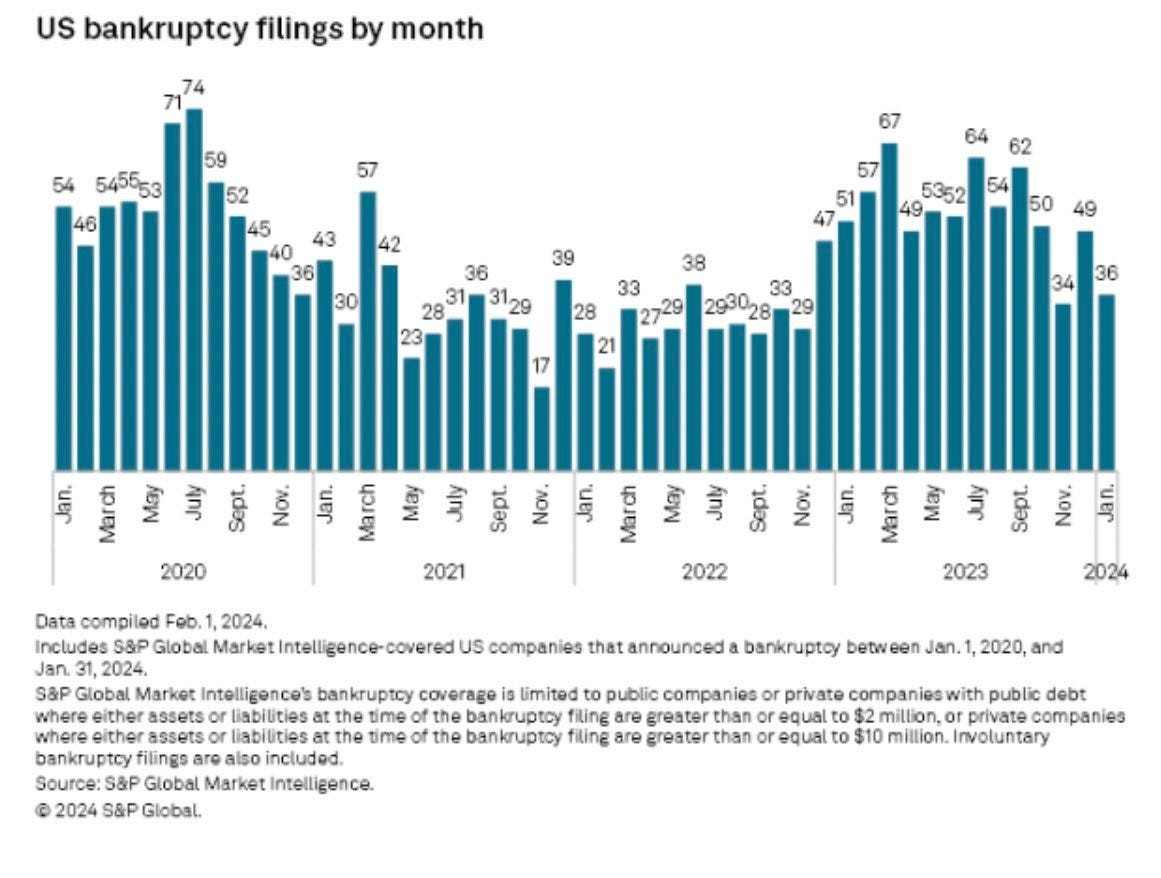

In January, the variety of company chapter filings in america slowed in comparison with the earlier month:

Variety of company chapter filings in america

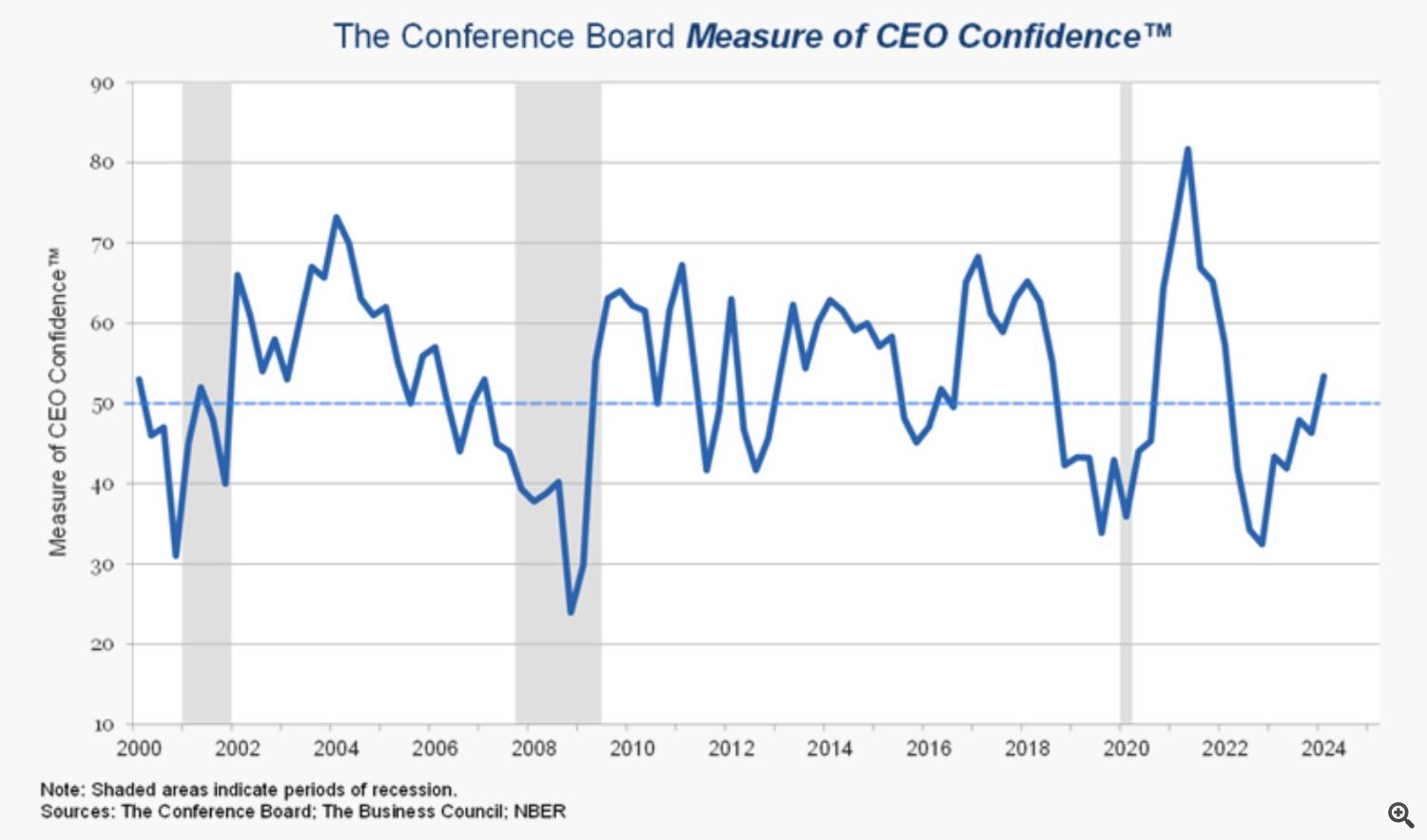

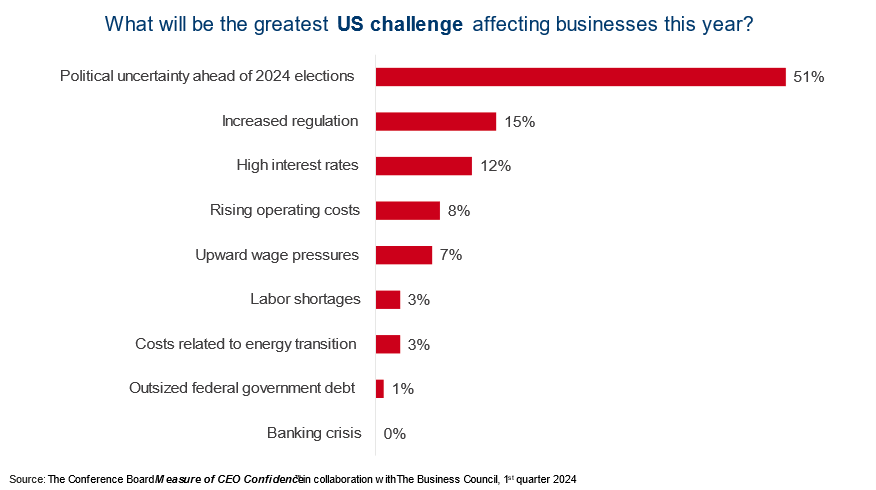

CEO confidence elevated from 46 to 53 for the primary quarter, marking the primary optimistic studying (above 50) since Q1 2022. On the similar time, executives think about political uncertainty the most important problem for enterprise in america this yr:

CEO Confidence Index

The largest problem for US enterprise by 2024, in line with CEOs

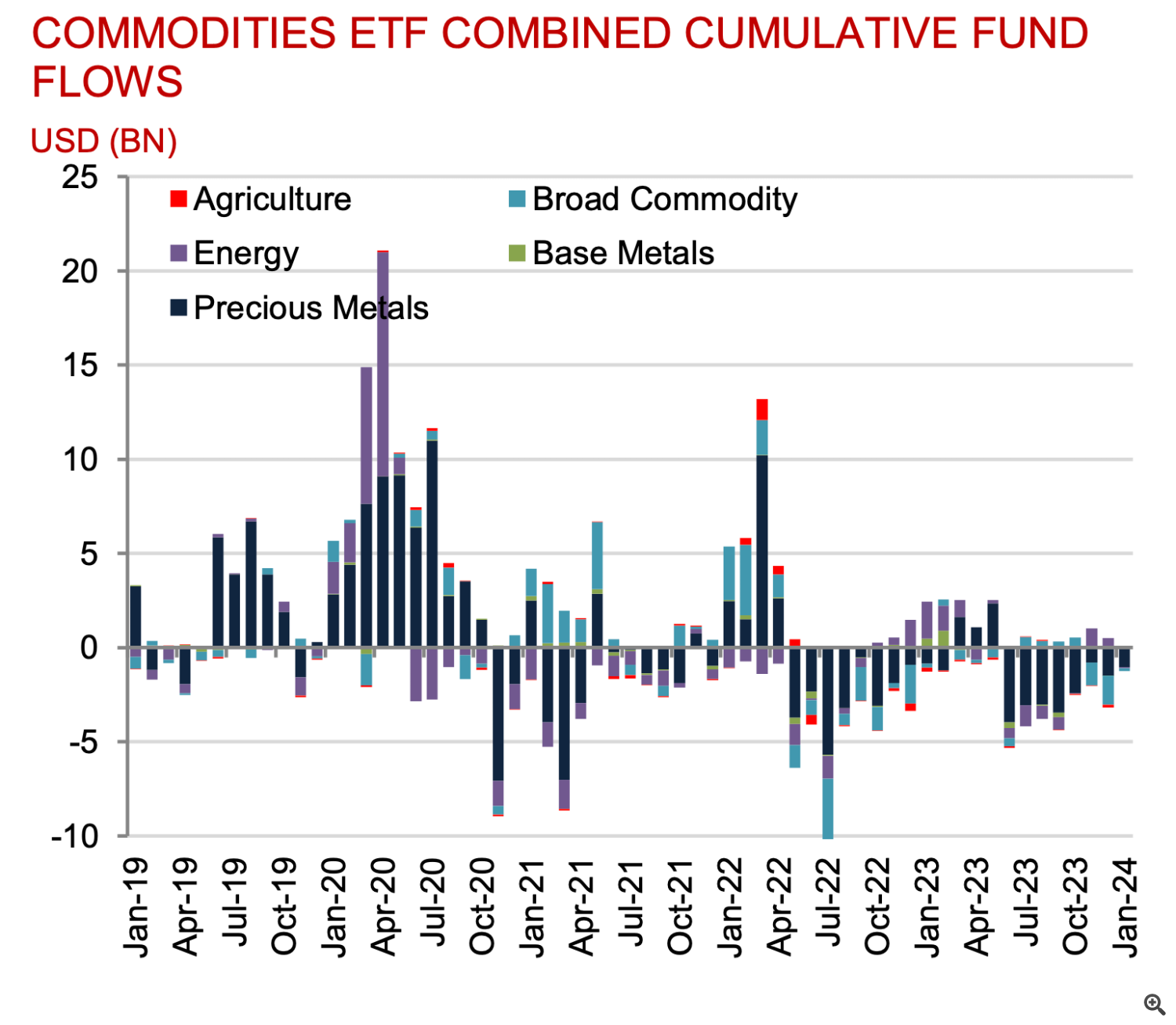

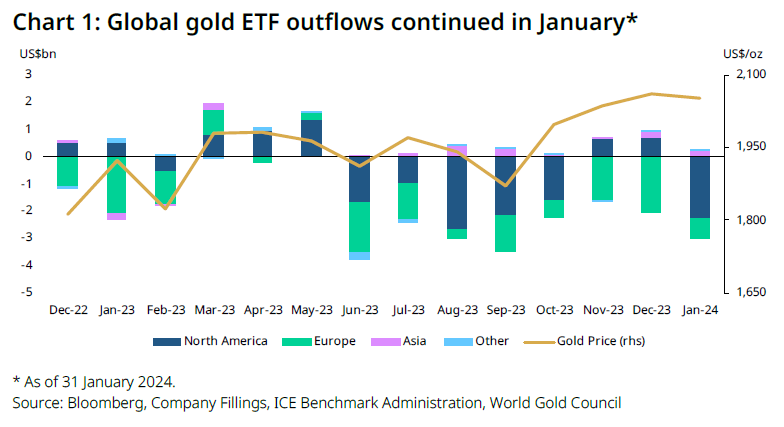

Internet outflows from gold ETFs have been -$2.8 billion (~51 tons) in January, marking the eighth consecutive month of outflows. Consequently, complete AUM decreased to USD 210 billion (-2% MoM):

Flows into gold ETFs

Commodity ETF Fund Flows by Class

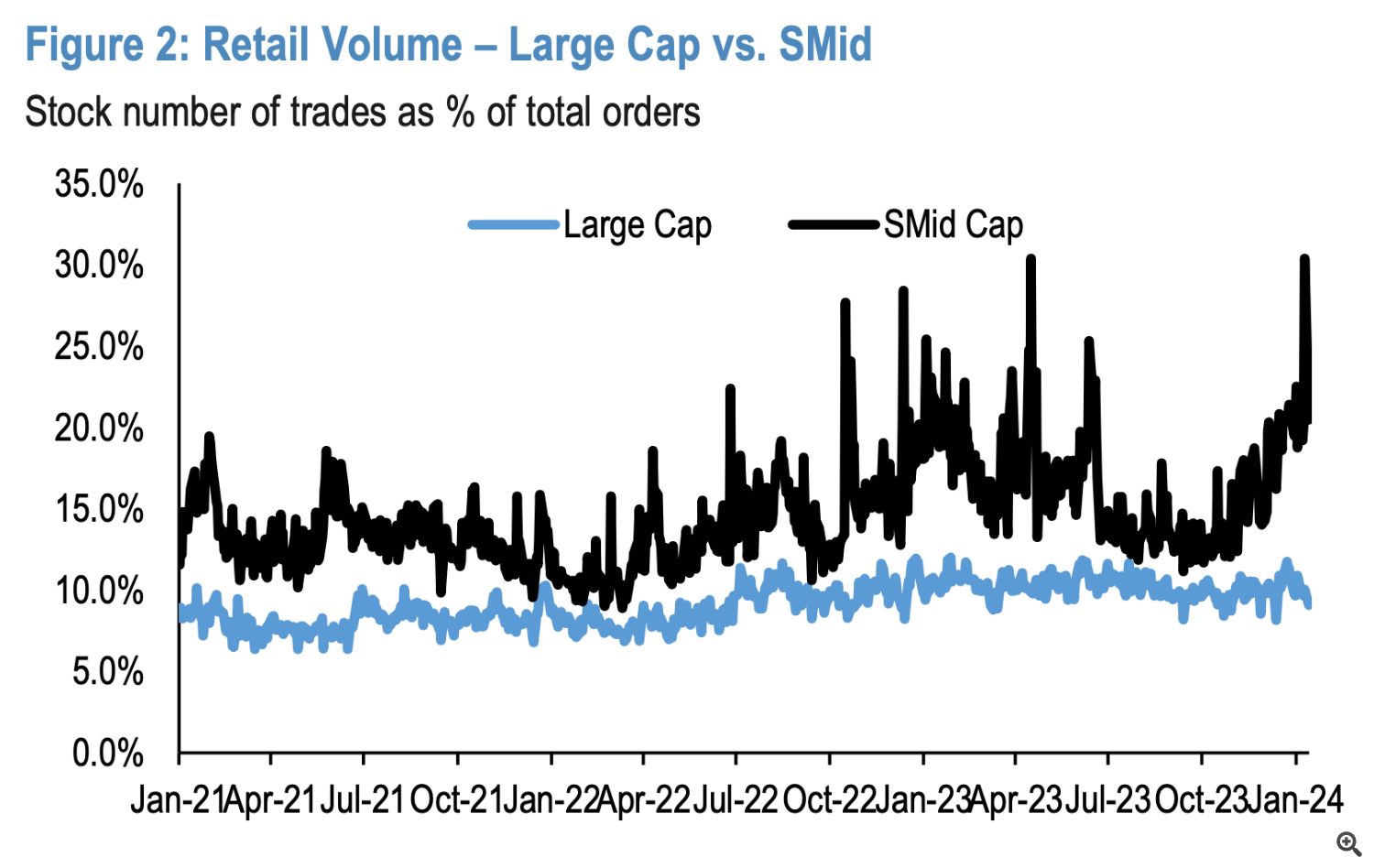

In current months, retail merchants’ buying and selling volumes have shifted closely in the direction of small and mid-cap shares:

Share of shares from all transactions of retail merchants by capitalization