Fast Take

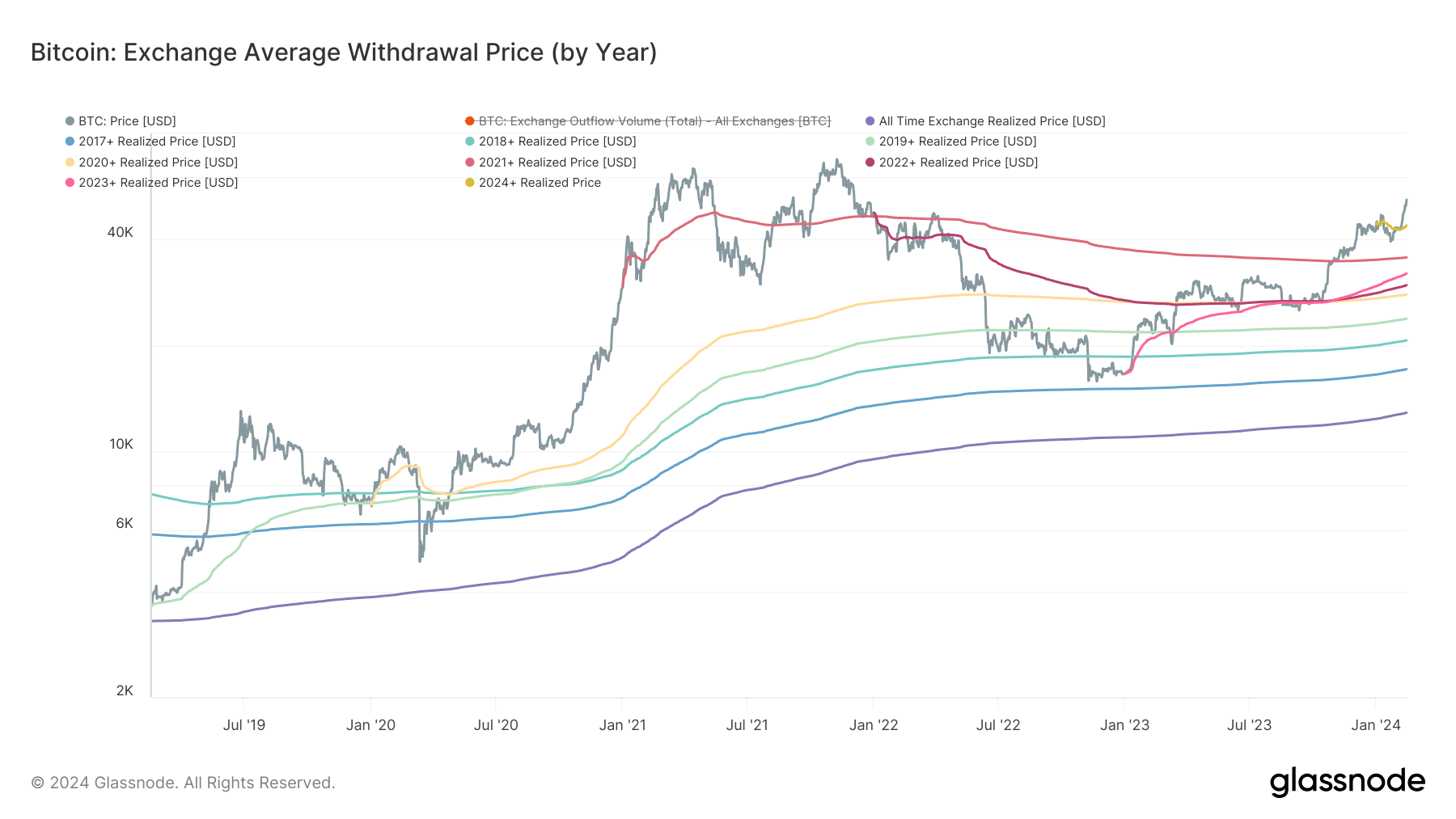

Monitoring the common withdrawal costs from digital asset exchanges supplies a viable technique to estimate a market-wide price foundation.

A deep-dive into the cohorts’ efficiency reveals an fascinating narrative. Essentially the most notable cohort is 2021, which had an preliminary realized worth of roughly $47,000 again in 2021. Since then, steady purchases have introduced their price foundation right down to $35,553, marking their entry right into a worthwhile part in November 2023 when Bitcoin exceeded the $40,000 mark.

| 12 months | Worth ($) |

|---|---|

| 2017+ | 17,115 |

| 2018+ | 20,658 |

| 2019+ | 23,800 |

| 2020+ | 27,897 |

| 2021+ | 35,553 |

| 2022+ | 29,646 |

| 2023+ | 32,007 |

| 2024+ | 43,780 |

Contrastingly, the 2024 cohort, with a realized worth of $43,780, skilled a quick interval of loss in January following the ETF’s launch, as Bitcoin retraced 20%. Nevertheless, they shortly bounced again to a positive revenue place, aligning with the general optimistic development of all cohorts.

For the primary time since November 2021, all cohorts are experiencing profitability as a result of Bitcoin’s rise above the $50,000 mark. The all-time change price foundation stays regular, averaging round $12,800.

Intriguingly, a latest development is rising throughout all cohorts. Their price foundation has been on an upswing previously few weeks, indicating that they’re buying Bitcoin at a worth greater than their present price foundation.

The submit Historic change withdrawal costs in revenue for BTC as upward price foundation development begins appeared first on CryptoSlate.