Observe to the reader: That is the eighth in a sequence of articles I am publishing right here taken from my e-book, “Investing with the Pattern.” Hopefully, you’ll discover this content material helpful. Market myths are usually perpetuated by repetition, deceptive symbolic connections, and the entire ignorance of info. The world of finance is filled with such tendencies, and right here, you may see some examples. Please remember the fact that not all of those examples are completely deceptive — they’re typically legitimate — however have too many holes in them to be worthwhile as funding ideas. And never all are straight associated to investing and finance. Take pleasure in! – Greg

Actual Time vs. Historical past

In regard to monetary crises, market meltdowns, and so forth, whenever you really dwell by way of one, it’s at all times amplified to the purpose you assume it’s the absolute worst ever. After issues have pale into historical past, it by no means appears as dangerous. I have been by way of a bunch of goofy markets, however 2008 appears near the worst, regardless that I ‘m certain it is not. Being human has some actual points in the case of the markets. There’s an previous aviation saying, “It’s higher to be on the bottom wishing you had been within the air than being within the air wishing you had been on the bottom.”

One other loopy human trait is to want the markets to be truthful, however then search, usually at nice expense, for a technique to get an edge and win. Opposing that’s whenever you imagine the market is unfair, but you test your portfolio 3 times a day (see the part “Cognitive Dissonance” on this chapter).

Behavioral Investing

The time period heuristic refers to experience-based strategies for downside fixing, studying, and discovery. The place an exhaustive search is impractical, heuristic strategies are used to hurry up the method of discovering a passable answer. Examples of this technique embody utilizing a rule of thumb, an informed guess, an intuitive judgment, or frequent sense. Heuristics are methods utilizing readily accessible, although loosely relevant, info to regulate problem-solving in human beings and machines. Heuristics is derived from the identical Greek root phrase from which we derive eureka.

By the way, the phrase “rule of thumb” has many origins; I am going to decide the one the place a person would use his thumb to make varied measurements. (When you test the Web, you will discover many different feedback concerning the origin of “rule of thumb.”)

There are some nice authors that I significantly like in the case of studying and understanding behavioral finance and investing. Right here is my brief checklist of favorites:

- James Montier

- Tim Richards

- Hersh Shefrin

- Thomas Gilovich

- Martin Sewell

A lot of the following materials got here from their books (bibliography) or web sites. If you have not learn Montier’s Little Ebook of Behavioral Investing, you might want to, after which learn it once more every year. I’m usually requested for recommendation from younger merchants and traders, and probably the most constant and most-stressed factor I inform them is to study your self. Understanding behavioral biases will assist accomplish that.

As a result of the environment friendly market speculation is extensively criticized, the sphere of habits finance/investing has surfaced prior to now couple of many years in its place. The true benefit of understanding these heuristics is that one can study oneself, and hopefully alter his or her resolution making in the case of investing.

Behavioral Biases

Listed here are the biases that I feel are necessary for traders to contemplate (alphabetically listed):

Ambiguity Aversion

• “We do not thoughts threat, however we hate uncertainty.” Tim Richards

• “Folks favor the acquainted to the unfamiliar.” Hersh Shefrin

Anchoring

• Anchoring is a cognitive heuristic through which choices are made primarily based on an preliminary “anchor.”

• Displays the diploma to which the preliminary judgment about an occasion or state of affairs prohibits one from deviating from that place, no matter new info on the contrary.

• Psychologists have documented that when individuals make quantitative estimates, their estimates could also be closely influenced by earlier values of the merchandise. For instance, it’s not an accident that used-car salespeople at all times begin negotiating with a excessive worth after which work down. The salespeople try to get the buyer anchored on the excessive worth in order that, once they supply a cheaper price, the buyer will estimate that the cheaper price represents a great worth.

• Anchoring may cause traders to underreact to new info.

• “Our behavior of specializing in one salient level and ignoring all others, equivalent to the value at which we purchase a inventory.” Tim Richards

• “Within the absence of any strong info, previous costs are more likely to act as anchors for immediately’s costs.” “The inventory market tends to underreact to basic info— be it dividend omission, initiation or an earnings report.” James Montier

Availability

• It is completely different this time!

• Availability is a cognitive heuristic through which a choice maker depends on information that’s available somewhat than inspecting different alternate options or procedures. Th is results in arguments like, “smoking is just not harmful since my mom smoked two packs a day and lived to 90.”

• “There are conditions through which individuals assess the frequency of a category or the prob.capability of an occasion by the convenience with which situations or occurrences will be delivered to thoughts. For instance, one might assess the chance of coronary heart assault amongst middle-aged individuals by recalling such occurrences amongst one’s acquaintances. Equally, one might consider the likelihood {that a} given enterprise enterprise will fail by imagining vari.ous difficulties it might encounter. This judgmental heuristic is named availability. Availability is a helpful clue for assessing frequency or likelihood, as a result of situations of huge courses are often reached higher and quicker than situations of much less frequent courses. Nonetheless, availability is affected by elements aside from frequency and prob.capability. Consequently, the reliance on availability leads predictable biases.” Amos Tversky and Daniel Kahneman

Calendar Results

• Calendar results (typically much less precisely described as seasonal results) are cyclical anomalies in returns, the place the cycle relies on the calendar. The commonest calendar anomalies are the January impact and the weekend impact.

Cognitive Dissonance

• “Cognitive dissonance is the psychological battle that individuals expertise when they’re introduced with proof that their beliefs or assumptions are mistaken.” James Montier

• “The impact of concurrently attempting to imagine two incompatible issues on the similar time.” Tim Richards

Communal Reinforcement

• Communal reinforcement is a social building through which a robust perception is shaped when a declare is repeatedly asserted by members of a neighborhood, somewhat than as a result of existence of empirical proof for the validity of the declare.

• Affirmation bias is a cognitive bias whereby one tends to note and search for info that confirms one’s current beliefs, whereas ignoring something that con.tradicts these beliefs. It’s a kind of selective pondering. This can be a heuristic frequent with publication writers. One thing has brought about them to imagine the market will do such and such, after which they seek for conditions and information that help that perception.

• “Affirmation bias is the technical identify for individuals’s need to seek out info that agrees with their current view.” James Montier

Disposition Impact

• “The disposition impact will be defined by arguing that traders are predisposed to holding losers too lengthy and promoting winners too early.” Hersh Shefrin

• “Shefrin and Statman predicted that as a result of individuals dislike incurring losses far more than they take pleasure in making beneficial properties, and individuals are keen to gamble within the area of losses, traders will maintain onto shares which have misplaced worth (relative to the reference level of their buy) and will probably be wanting to promote shares which have risen in worth. They known as this the ‘disposition impact.'” James Montier

Endowment Impact

• “This sample—the truth that individuals usually demand far more to surrender an object than they’d be keen to pay to amass it—is named the endowment impact.” Richard Thaler

• “The endowment impact is a speculation that individuals worth a great extra as soon as their property proper to it has been established. In different phrases, individuals place a better worth on objects they personal relative to things they don’t. In a single experiment, individuals demanded a better worth for a espresso mug that had been given to them however put a cheaper price on one they didn’t but personal.” Martin Sewell

• “Each the established order bias and the endowment impact are a part of a extra normal concern referred to as loss aversion.” James Montier

• “Merely put, the endowment impact says that when you personal one thing you begin to place a better worth on it than others would.” James Montier

Halo Impact

• Consultants add little worth. Pedigree trumps proof.

• “The halo impact is a straightforward, pervasive and highly effective psychological bias which sees us anchor onto a single optimistic function of an individual after which indiscriminately apply it to all of their different traits. So if we understand somebody as bodily fascinating we’re more likely to assume that they are engaging in all different methods as effectively. That is extremely lucky for these stunning however dangerous tempered, foul mouthed and cerebrally challenged personalities who generally grace our multimedia world.” Tim Richards

• Corporations will usually try to make use of the halo impact by getting superstar endorse.ments from fully unrelated however well-liked celebrities. Nonetheless, buying and selling on such a easy psychological trait could be unlikely to idiot savvy traders, you’d assume.

Herding

• “Herding habits or ‘following the development’ has steadily been noticed within the housing market, within the inventory market crash of 1987 (see Shiller) and within the overseas trade market.” Frankel and Froot, Allen and Taylor

• [“The behavior, although individually rational, produces group behavior that is, in a well-defined sense, irrational. This herd-like behavior is said to arise from an information cascade.” Robert Shiller

• “We review theory and evidence relating to herd behavior, payoff and reputational interactions, social learning, and informational cascades in capital markets. We off er a simple taxonomy of effects, and evaluate how alternative theories may help explain evidence on the behavior of investors, firms, and analysts. We consider both incentives for parties to engage in herding or cascading, and the incentives for parties to protect against or take advantage of herding or cascading by others.” Hirshleifer and Teoh

Hindsight Bias

• “The reason for overconfidence may also have to do with hindsight bias, a tendency to think that one would have known actual events were coming before they happened, had one been present then or had reason to pay attention. Hindsight bias encourages a view of the world as more predictable than it really is.” Robert Shiller

• “Hindsight bias: a.k.a Monday morning quarterback.” Nassim Taleb

• This is a common heuristic among investors, especially technical analysts, who see situations in the past and actually think they are making a determination that will affect the future—they quite honestly don’t realize they are doing it.

Loss Aversion/Risk Aversion

• Lose sight of the big picture. Focus on short-term losses. Anchor against most recent values. Underweight more aggressive investments.

• “In prospect theory, loss aversion refers to the tendency for people to strongly prefer avoiding losses than acquiring gains. Some studies suggest that losses are as much as twice as psychologically powerful as gains. Loss aversion was first convincingly demonstrated by Amos Tversky and Daniel Kahneman.”

• “The central assumption of the theory is that losses and disadvantages have greater impact on preferences than gains and advantages.” Amos Tversky and Daniel Kahneman

• “Numerous studies have shown that people feel losses more deeply than gains of the same value.” Amos Tversky and Daniel Kahneman.

• Everyone believes they are above average. An often quoted test is to ask a group of 50 people to raise their hands if they think they are above average drivers. Most times, considerably more than half of them will raise their hands. People also have a tendency to cling to their assertions about things. With investing, overconfidence can lead to underdiversification. James Montier says this is one of the most common biases.

Overreaction

• “[I]nvestors overreact to unfavourable information.” Hersh Shefrin

• “De Bondt and Thaler argued that traders overreact to each dangerous information and excellent news. Subsequently, overreaction leads previous losers to grow to be underpriced and previous win.ners to grow to be overpriced.” Hersh Shefrin

• “Slightly, what we discover is obvious Underneath-reaction at brief horizons and obvious overreaction at lengthy horizons.” Hersh Shefrin

• “What we appear to have is overreaction at very brief horizons, say lower than one month momentum probably attributable to Underneath-reaction for horizons between three and twelve months (Jegadeesh and Titman) and overreaction for intervals longer than one yr (De Bondt and Thaler).” Hersh Shefrin

• “The overreaction proof exhibits that over longer horizons of maybe three to fi ve years, safety costs overreact to constant patterns of stories pointing in the identical route.” Shleifer

Prospect Idea

• Features are much less intense than losses. Folks maintain onto losses too lengthy. Folks promote winners too quickly.

• “Prospect concept was developed by Kahneman and Tversky. In its authentic kind, it’s involved with habits of resolution makers who face a alternative between two alternate options. Th e definition within the authentic textual content is: ‘Determination making below threat will be considered as a alternative between prospects or gambles.’ Choices topic to threat are deemed to indicate a alternative between different actions, that are related to specific chances (prospects) or gambles. The mannequin was later elaborated and modified.” Goldberg and von Nitzsch

• “Prospect concept has most likely finished extra to deliver psychology into the center of financial evaluation than every other method. Many economists nonetheless attain for the anticipated util.ity concept paradigm when coping with issues, nevertheless, prospect concept has gained a lot floor in recent times, and now actually occupies second place on the analysis agenda for even some mainstream economists. In contrast to a lot psychology, prospect concept has a strong mathematical foundation—making it comfy for economists to play with. Nonetheless, in contrast to anticipated utility concept which issues itself with how choices below uncertainty must be made (a prescriptive method), prospect concept issues itself with how choices are literally made (a descriptive method).” James Montier

• “[G]et-evenitis is central to prospect concept,” Hersh Shefrin.

• “[P]rospect concept offers with the way in which we body choices, the other ways we label—or code—outcomes; and the way they have an effect on our angle towards threat.” Belsky and Thomas Gilovich

Recency

• “You overfocus on the newest occasions you have skilled and neglect to fret about older info. We do not a lot combine new info with the previous as use it to overwrite our reminiscences,” Tim Richards

Representativeness

• Nice firms are nice investments. Folks depend on guidelines of thumb. Folks see issues the way in which they should be.

• “Lots of the probabilistic questions with which individuals are involved belong to one of many following varieties: What’s the likelihood that object A belongs to class B? What’s the likelihood that occasion A originate from course of B? What’s the likelihood that course of B will generate occasion A? In answering such questions, individuals usually depend on the rep.resentativeness heuristic, through which chances are evaluated by the diploma to which A is consultant of B, that’s, by the diploma to which A resembles B. For instance, when A is extremely consultant of B, the likelihood that A originates from B is judged to be excessive. However, if A is just not much like B, the likelihood that A originates from B is judged to be low.” Amos Tversky and Daniel Kahneman

• “One of the best clarification thus far of the misperception of random sequences is obtainable by psychologists Daniel Kahneman and Amos Tversky, who attribute it to individuals’s ten.dency to be overly influenced by judgments of ‘representativeness.’ Representativeness will be regarded as the reflexive tendency to evaluate the similarity of outcomes, situations, and classes on comparatively salient and even superficial options, after which to make use of these assessments of similarity as a foundation of judgment. Folks assume that ‘like goes with like’: Issues that go collectively ought to look as if they go collectively. We count on situations to appear like the classes of which they’re members; thus, we count on somebody who’s a librarian to resemble the prototypical librarian. We count on results to appear like their causes; thus we usually tend to attribute a case of heartburn to spicy somewhat than bland meals, and we’re extra inclined to see jagged handwriting as an indication of a tense somewhat than a relaxed character.” Thomas Gilovich

Selective Considering

• Selective pondering is the method by which one focuses on favorable proof with a purpose to justify a perception, ignoring unfavorable proof.

Self-Attribution

• “Self-attribution bias happens when individuals attribute profitable outcomes to their very own talent however blame unsuccessful outcomes on dangerous luck.” Hersh Shefrin

• Self-deception is the method of deceptive ourselves to simply accept as true or legitimate that which is fake or invalid.

Standing Quo Bias

• The established order bias is a cognitive bias for the established order; in different phrases, individuals are usually biased towards doing nothing or sustaining their present or earlier resolution.

• “The instance additionally illustrates what Samuelson and Zeckhauser (1988) name a establishment bias, a desire for the present state that biases the economist in opposition to each shopping for and promoting his wine.” Richard Thaler

• “One implication of loss aversion is that people have a robust tendency to stay at the established order, as a result of the disadvantages of leaving it loom bigger than the benefits. Samuelson and Zeckhauser have demonstrated this impact, which they time period the established order bias.” Richard Thaler

• “Each the established order bias and the endowment impact are a part of a extra normal concern referred to as loss aversion.” James Montier

Underreaction

• “In predicting the longer term, individuals are likely to get anchored by salient previous occasions. Consequently, they underreact.” Hersh Shefrin

• The underreaction proof exhibits that safety costs underreact to information equivalent to earnings bulletins. If the information is sweet, costs hold trending up after the preliminary optimistic response; if the information is dangerous, costs hold trending down after the preliminary unfavourable response.

Bias Tracks for Traders

The next is my try to tie a few of these behavioral biases collectively and see how they circulate from one to a different and finally into technical evaluation strategies (italicized).

1. Communal Reinforcement causes Selective Considering, which causes Affirmation Bias, which may trigger Self-Deception, which results in both Self-Fulfilling or Self-Harmful. If Self-Fulfilling, it could result in utilizing Value, which may result in utilizing Help and Resistance. If Self-Harmful, it could result in utilizing Time, which may result in utilizing Calendar Results equivalent to Weekend Impact, January Barometer, January Impact, and so forth.

2. Standing Quo Bias can result in Anchoring, which may result in Help and Resistance. It will probably additionally result in Loss/Threat Aversion, which may result in Underreaction, which is often related to the brief time period.

3. Self-Deception can result in Self-Attribution and Overconfidence. Overconfidence can result in Hindsight Bias and Representativeness. Representativeness can result in Overreaction, which is often related to the long run.

4. Since anchoring is usually related to framing, right here is a straightforward instance of how framing can work. I ask individuals how you can pronounce the capitol of Kentucky, is it Lewisville, or Loueyville? I simply framed the query. I hear a fair quantity of each from the viewers. The proper reply is Frankfurt. That is significantly attention-grabbing once I’m doing this whereas in Kentucky.

5. Herding, disposition, affirmation bias, and representativeness can present justification for Pattern following. Data is just not dispersed evenly throughout the investor universe, particularly for illiquid property or if the data has a lot uncertainty, which results in underreaction. If traders are reluctant to take small losses, then momentum is improved by the disposition impact.

6. Herding results in Pattern evaluation. And eventually, Overconfidence can result in spoil.

Backside line: You’ll be able to enter any of those tracks at nearly any level and the outcomes will probably be related.

Investor Feelings

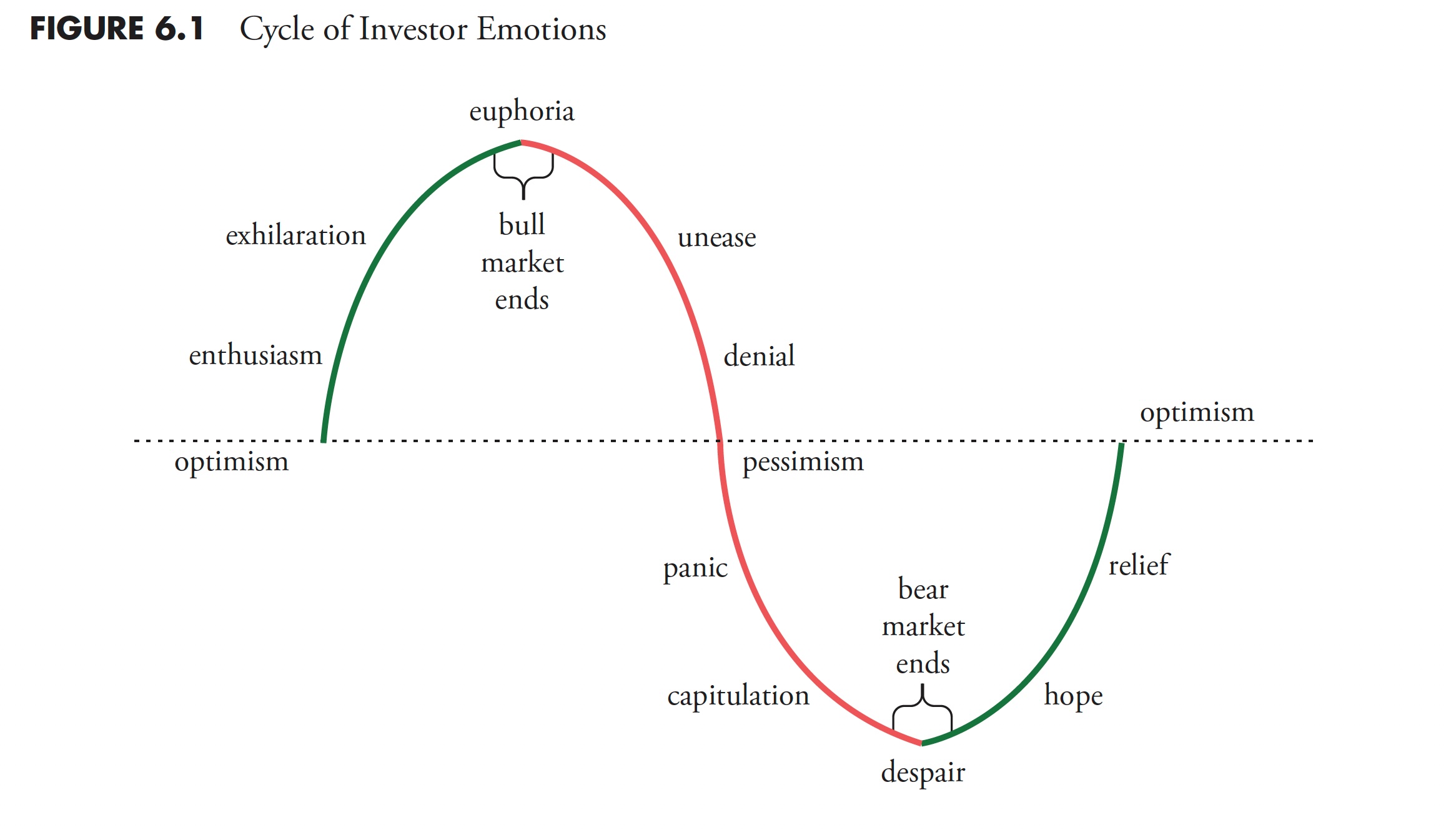

I’d think about that everybody has skilled the emotional cycle of investing with no plan. We purchase a inventory for no matter cause, primarily as a result of we’re optimistic about its future. When it does rise in worth, it creates pleasure, and because it retains rising, a state of euphoria is dominating the investor’s thoughts. I can bear in mind 30+ years in the past enthusiastic about quitting my day job throughout such a interval. If the value then drops a bit, it instantly causes anxiousness; if it drops extra, then downright concern units in. Even additional worth erosion results in panic driving the investor, with absolutely the despair being the final part of investor disappointment, often coinciding with lastly promoting the inventory. Nonetheless, if one remains to be frozen with despair and panic when the value then rises, hope is instilled. Rising costs slowly deliver on optimism, and the emotional cycle of unplanned, random, guesswork like investor begins once more. Determine 6.1 exhibits this emotional cycle.

Determine 6.1

Determine 6.1

Traders as a Complete Do Poorly

Knowledge has proven that traders as an entire proceed to purchase and promote at precisely the mistaken time. Though we can’t probably know the precise causes, a shallow understanding of the human psyche will supply some solutions. They react to information with out doing any evaluation, and it does not matter whether it is thought of excellent news or dangerous. Traders grow to be mesmerized by long-running bull markets and completely unnerved by bear markets. They, as an entire, attempt to match the funding acumen of their kinfolk, neighbors, pals, enterprise associates, and even full strangers, if they’ve claimed, even casually, that they’ve finished effectively out there.

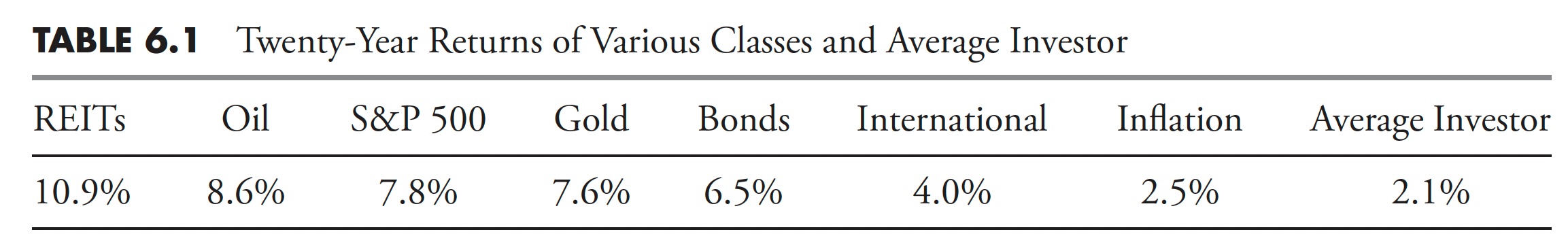

Desk 6.1

Desk 6.1

There’s a examine put out yearly by Dalbar, which exhibits that traders as an entire underperform the markets in plenty of other ways. In reality, they’ve constantly underperformed the S&P 500 wherever from 4 % to 10 % per yr for the previous 27 years as of 2012 (Dalbar started their service in 1984). The proportion might sound small at first look, however, over time, it turns into important. Vital on this instance can imply that one might not get well from it. Desk 6.1, utilizing information from JP Morgan, exhibits the 20-year annualized returns for varied asset courses and the typical investor primarily based on the Dalbar information.

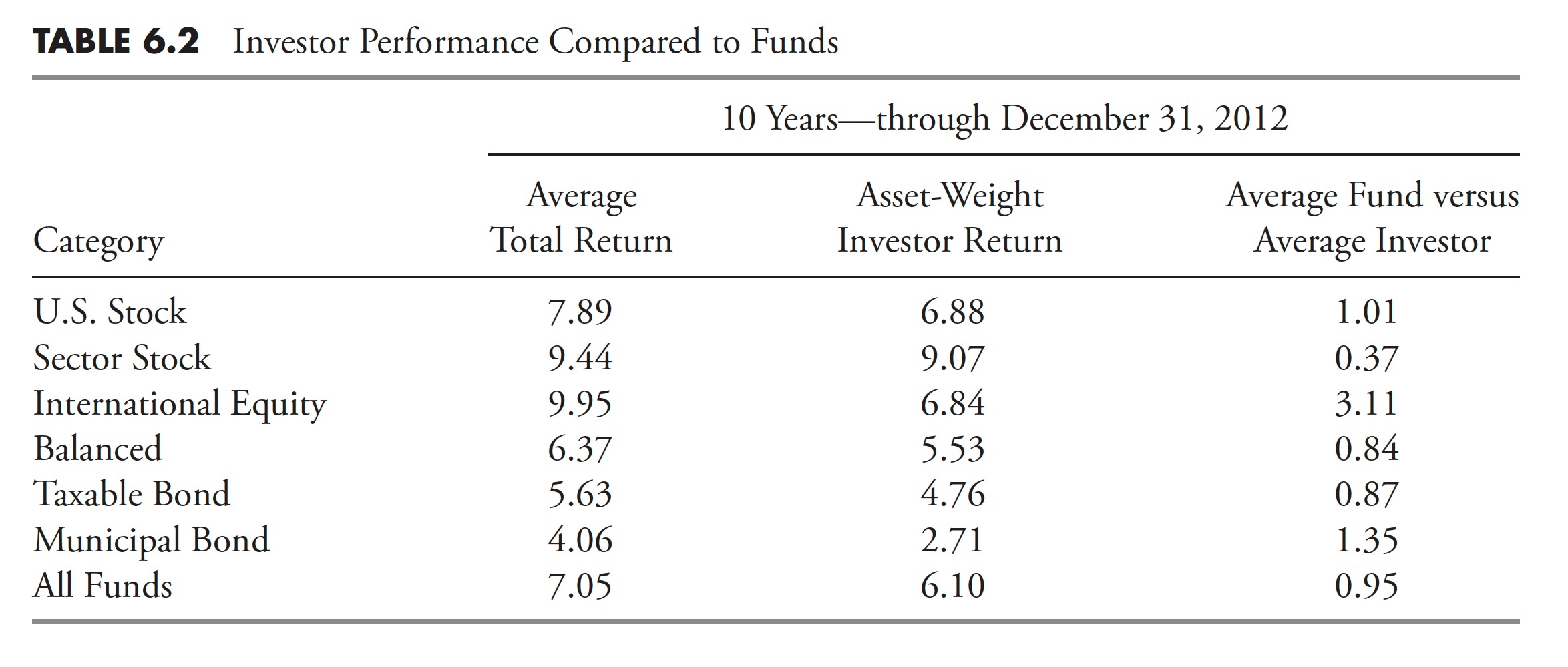

One other examine put out by Morningstar’s Russell Kinnel, on 2/4/2013, exhibits the identical downside; traders as an entire do fairly poorly in comparison with indices. (See Desk 6.2.) Primarily based on all funds, the typical investor lagged the typical fund by 0.95 % annualized over the previous 10 years.

Desk 6.2

Desk 6.2

Shopping for and promoting on the mistaken time will be defined by the truth that most traders react to information, whether or not it’s optimistic or unfavourable, with none detailed evaluation. They’re mesmerized by seemingly endless uptrends out there and demoralized by persevering with new lows. The underside line is that they fail to have the self-discipline to comply with a scientific method that can help them on detaching their feelings from their choices.

Here’s a checklist of investor faults in the case of investing. Books are stuffed with far more and with far more element, I simply wished to incorporate those that I’ve skilled, with the Lack of Self-discipline being the one that may trigger probably the most ache.

- Lack of self-discipline

- Impatience

- Greed

- Refusal to simply accept the reality

- No objectivity

- Impulse habits

- Keep away from false parallels

Your human mind will play tips on you. When you take an escalator or transferring sidewalk when going to work and achieve this steadily, you’ll perceive. Your mind will trigger an computerized (involuntary) motion to help you as you step onto the escalator or transferring sidewalk. You won’t even notice it. Nonetheless, if sooner or later the escalator is stopped, and also you discover that it’s stopped, you’ll virtually stumble as you step onto it, as a result of your mind is programmed to help, and this time that help is just not useful, regardless that you knew it was not transferring previous to stepping on it.

Many who are usually not good at math use heuristics or, worse but, guessing to resolve issues. I am going to simply use a number of of the mathematics points that James Montier has used over time as examples.

Instance A: You might be advised {that a} baseball and bat price a complete of $1.10, and that the bat price $1 greater than the ball. What’s the price of every? The answer includes a very easy eighth grade algebra downside, however most will simply guess and their preliminary guess will most likely be that the bat prices a $1 and the ball prices $0.10. As a result of these numbers simply virtually come out at you from the data given. Sadly, they forgot the a part of the issue that stated the bat prices $1 greater than the ball. Their regular reply has the distinction being $0.90.

Let the ball = X, then we all know that the bat is X+100 (utilizing cents right here), so the equation is:

X (ball) + (X + 100) (bat) = 110.

Simplifying, it turns into 2X + 100 = 110,

once more, 2X = 110 – 100,

once more, 2X= 10, or X = 5 = $0.05. Subsequently the bat prices $1.05.

Instance B: You might be advised {that a} swimming pool that measures 100 toes by 100 toes has a lily pad plant put into it. The plant doubles in dimension daily. If it fully covers the pool in 24 days, how lengthy did it take to cowl half of the pool? Most will shortly say 12 days, because the phrase double and 24 simply appear to yearn for that. In fact, some will probably be actually hesitant attempting to invoke the scale of the pool since that was given—it has completely nothing to do with the issue. The proper reply is 23 days. Give it some thought.

Instance C: Your espresso store is providing two offers on espresso: the primary is 33 % extra espresso, and the second takes 33 % off the value. Which might you select? Most would declare they’re primarily equal. A reduction of 33 % is similar as getting a 50 % enhance within the quantity of espresso. Backside line: Getting one thing further without spending a dime feels higher than getting the identical for much less. However, is it?

Most view these choices as primarily the identical proposition, however they are not. The low cost is by far the higher deal as a result of most do not understand {that a} “50 % enhance in amount is similar as a 33 % low cost in worth.” However let’s do the mathematics. The preliminary worth is $10 for 10 ounces of espresso. Hopefully, it is apparent that the unit worth is due to this fact $1 per ounce. An additional 33 % extra “free” espresso would deliver the whole as much as 13.3 ounces for $10. That $10 divided by 13.3 ounce provides us a unit worth of $0.75 per ounce. With a 33 % low cost off the preliminary supply, although, the proposition turns into $6.67 for 10 ounces, for a unit worth of $0.67 per ounce. After studying this, you’ll most likely pay something for a cup of espresso.

Now that I hopefully have captured your consideration within the first six chapters, let’s concentrate on some info concerning the market. The following chapter focuses on bull and bear markets, each cyclical and secular, together with many convincing statistics about them.

Thanks for studying this far. I intend to publish one article on this sequence each week. Cannot wait? The e-book is on the market right here.