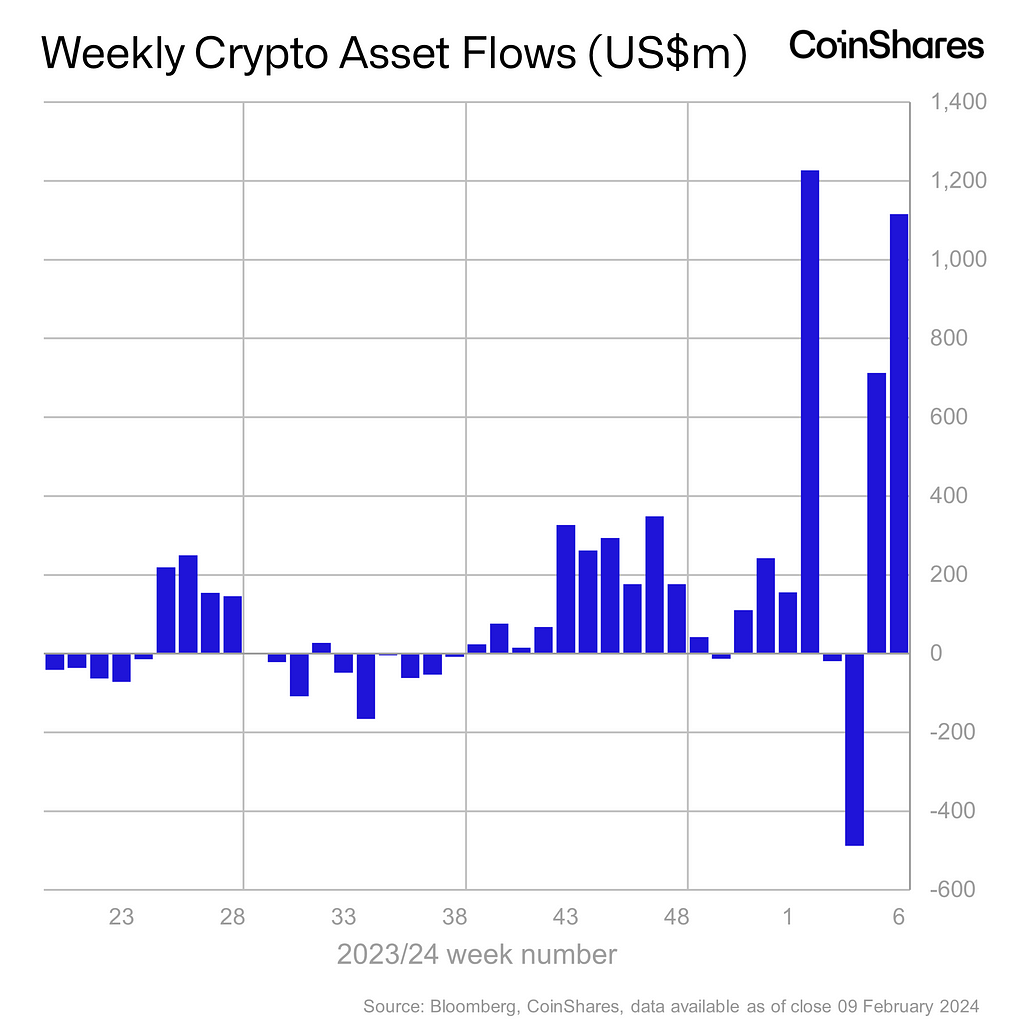

The inflow of investments into cryptocurrencies amounted to +$1.1 billion, bringing the full influx because the starting of the 12 months to +$2.7 billion:

Flows of funds into cryptocurrencies

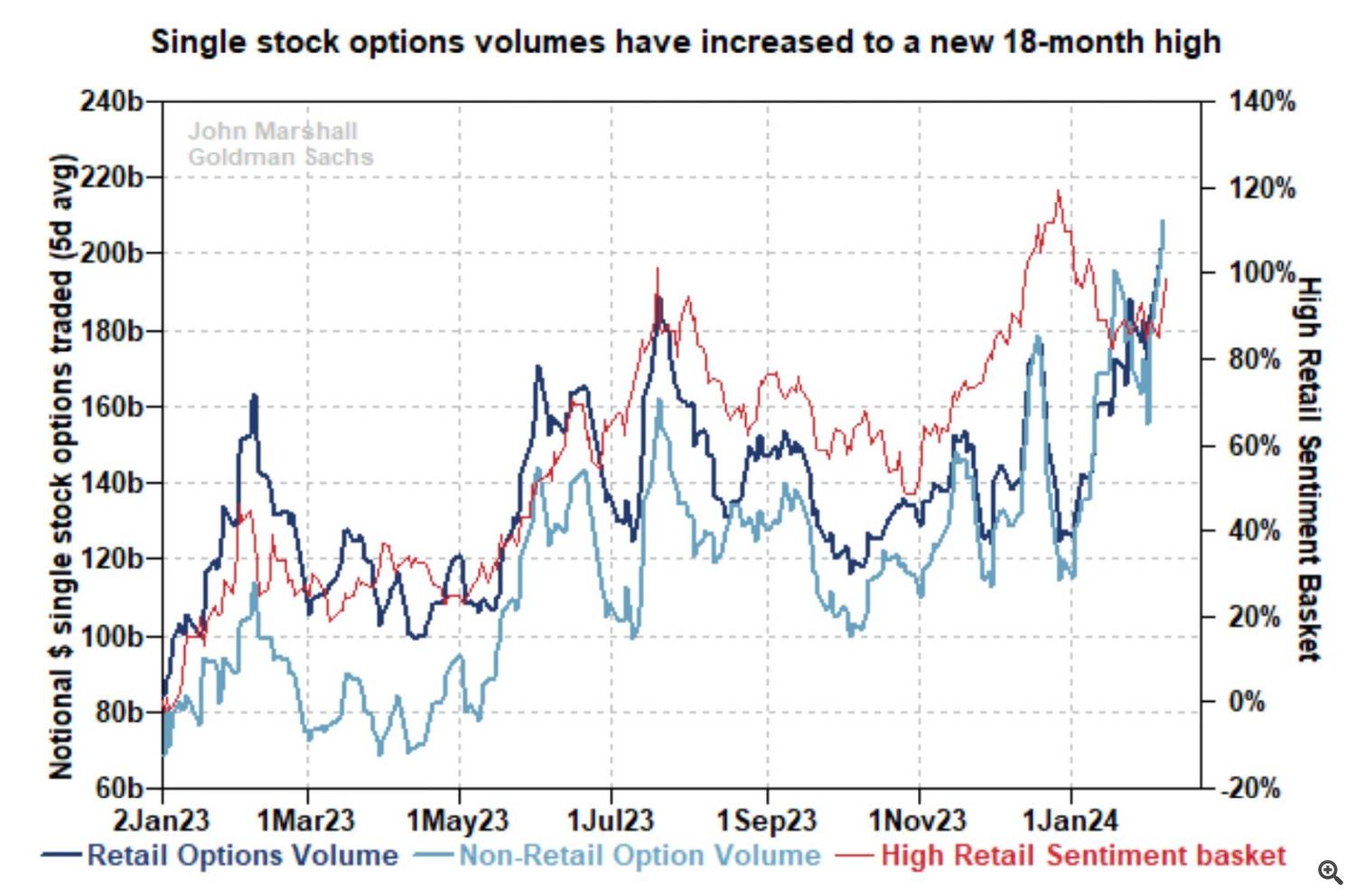

Choices quantity on particular person shares has risen considerably over the previous week and is now at a brand new 18-month excessive, suggesting traders are set for continued positive aspects:

Quantity of particular person inventory choices

Institutional traders

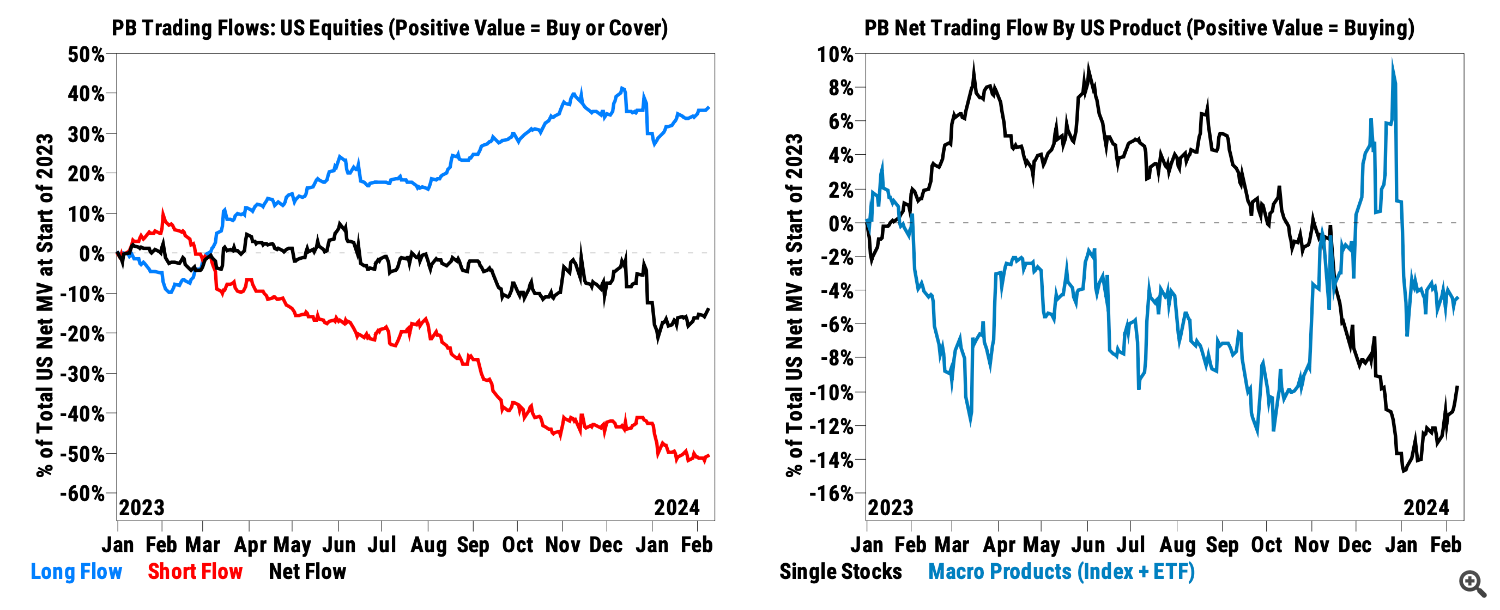

Hedge funds purchased US shares (principally particular person shares fairly than funds) for the third week in a row on the quickest tempo since March 2023:

Hedge fund flows into US equities

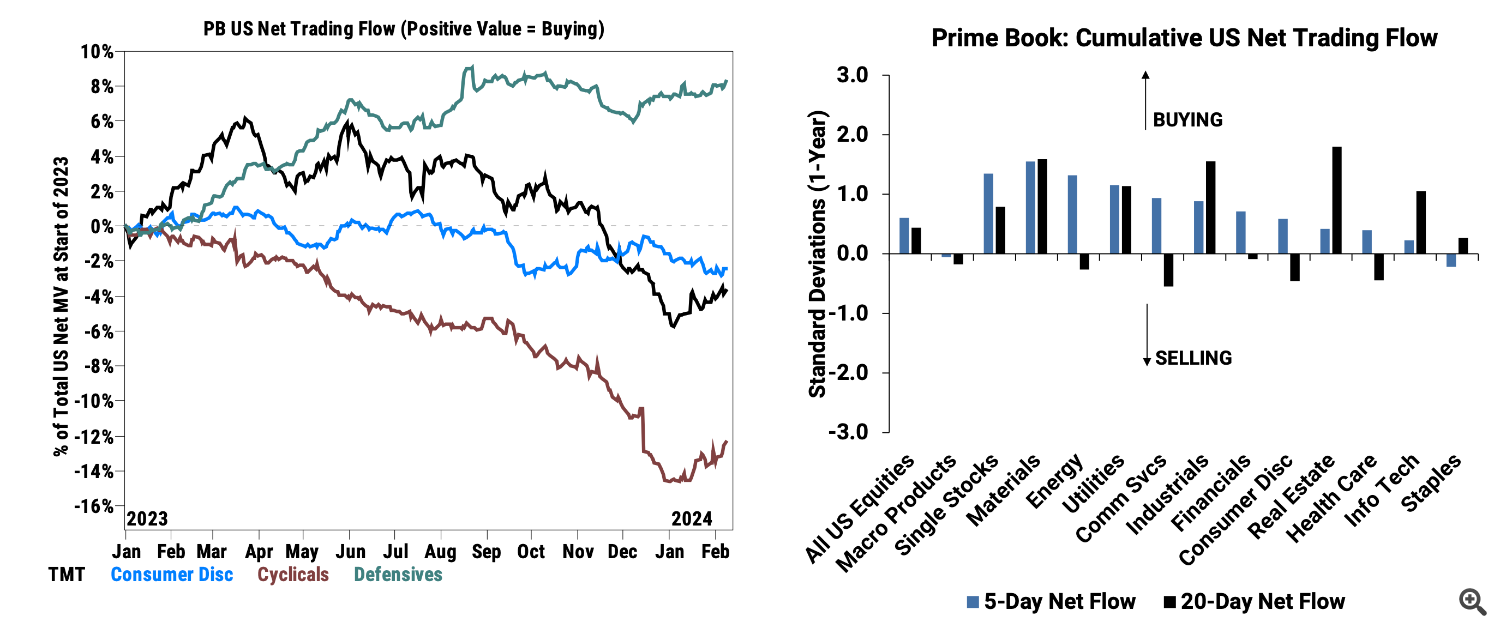

Hedge funds made their greatest purchases of cyclical shares since September 2021. Industrials shares have been purchased for the sixth week in a row, and this was the most important web buy of the 12 months:

Hedge fund flows into US equities by sector

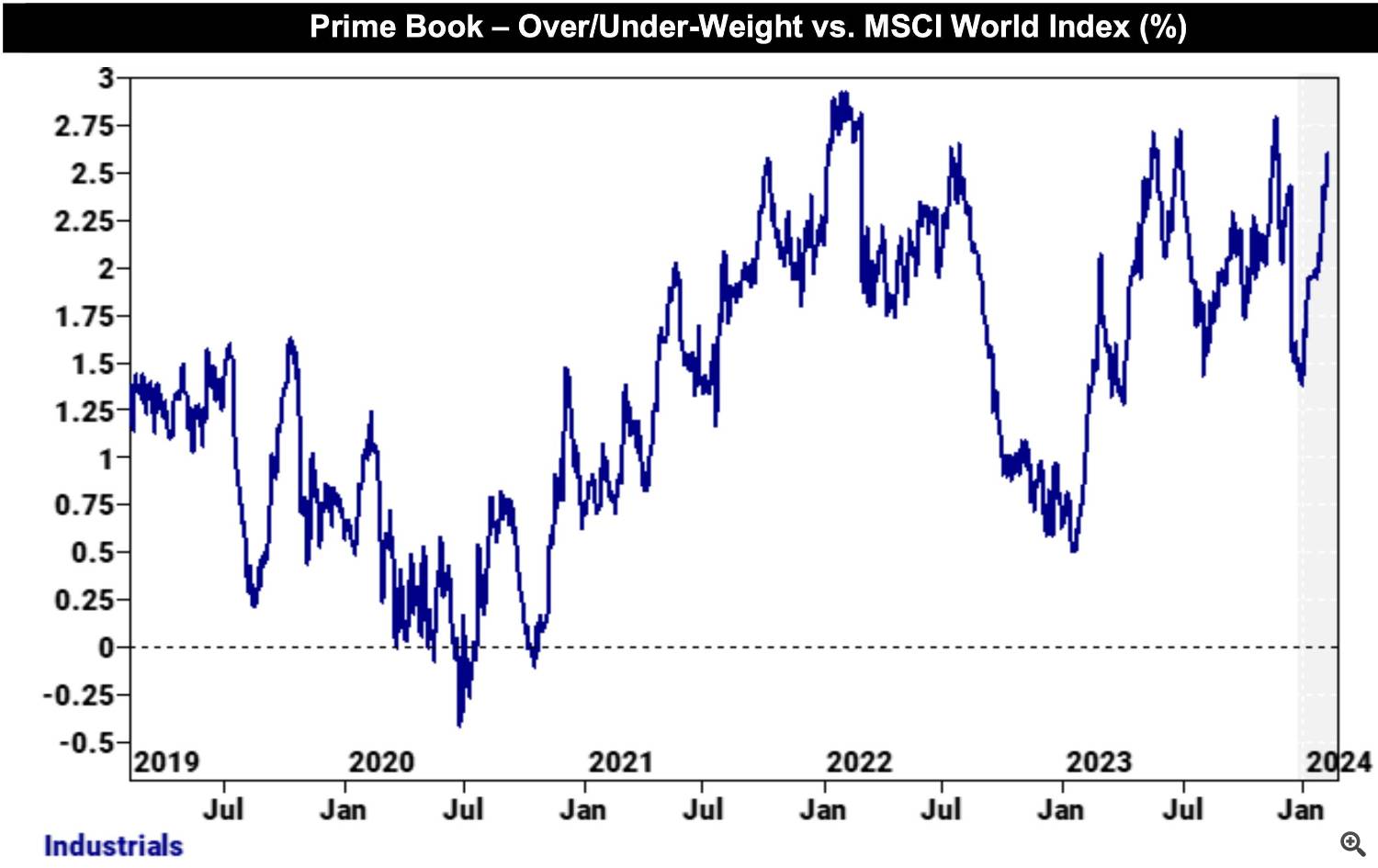

Weight of Industrials in Hedge Fund Portfolios vs. Weight of Industrials within the MSCI World Index

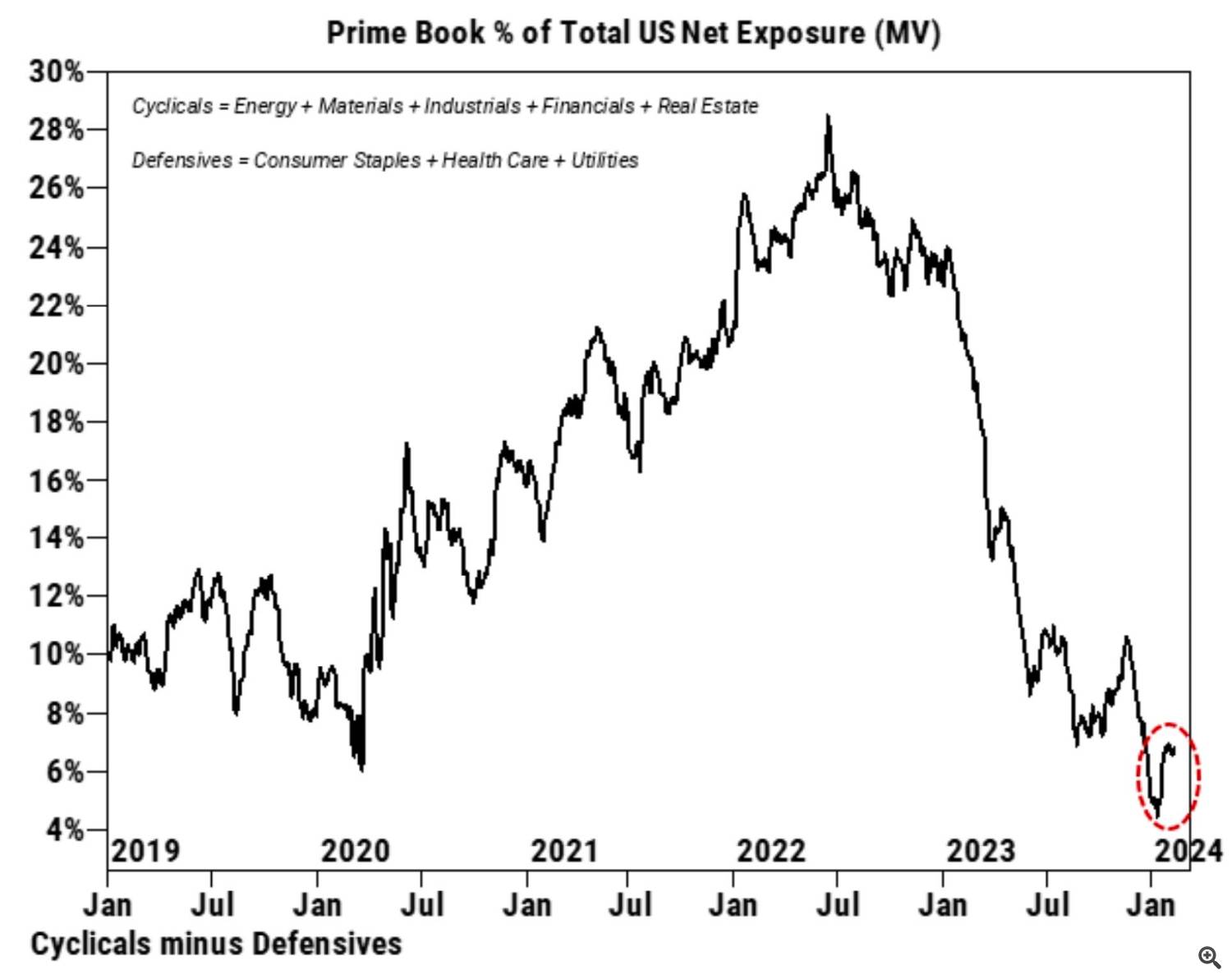

Regardless of current purchases of cyclical shares, their share in hedge fund portfolios relative to defensive sectors nonetheless stays at 4-year lows:

Share of cyclical shares in hedge fund portfolios relative to defensive sectors

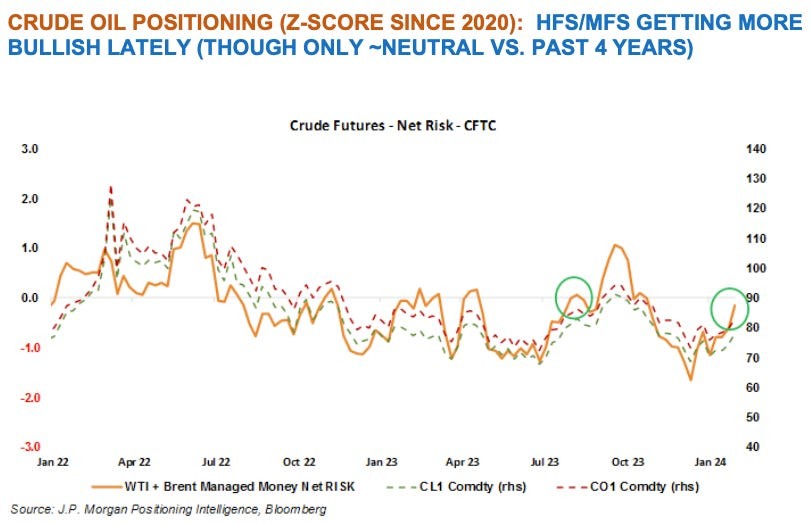

The funds’ web positions in oil futures have been rising because the finish of final 12 months and reached their highest stage since 3Q 2023:

Funds’ web positions in oil futures

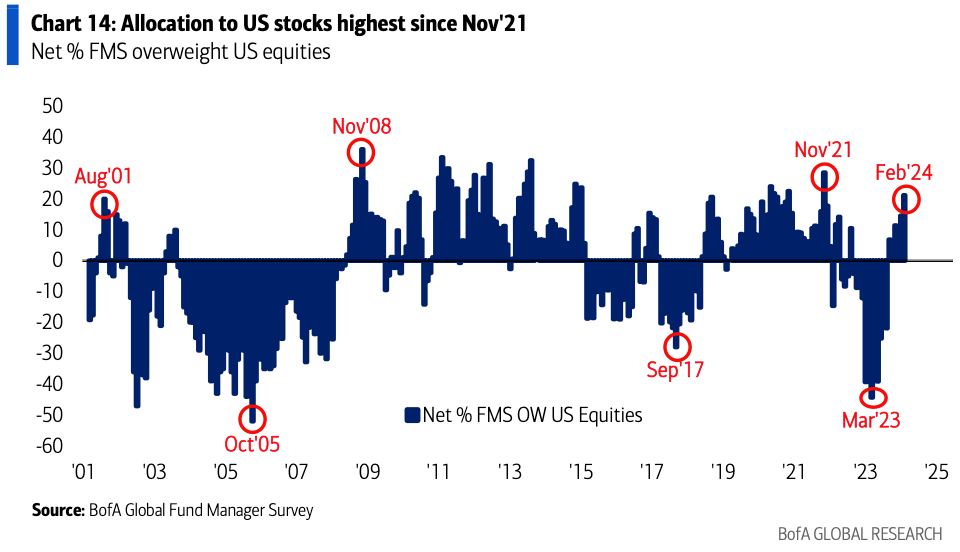

The share of US shares in fund managers’ portfolios elevated by 7 share factors. m/m to a web achieve of 21%, the very best since November 2021, with the sector with the most important achieve being expertise:

Overweight of US shares in fund managers’ portfolios

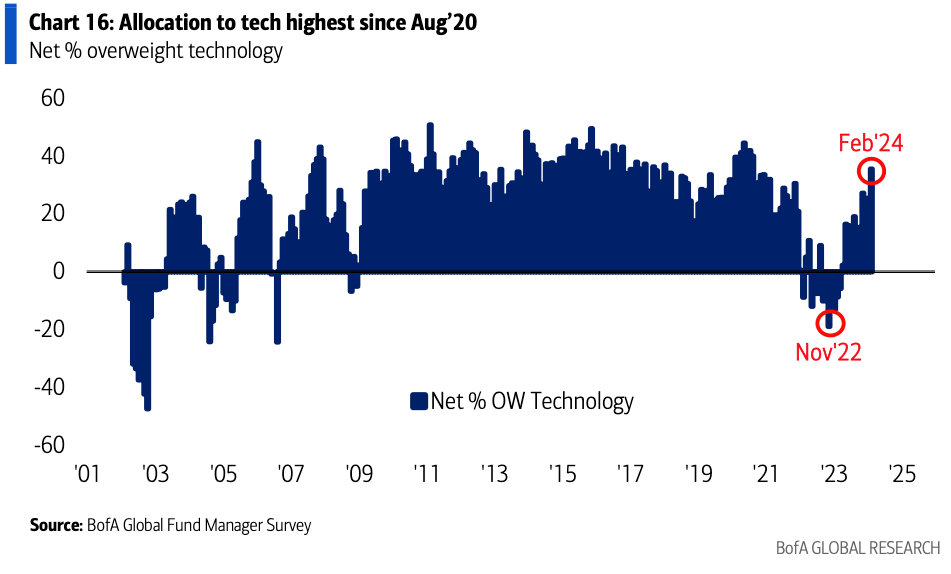

Overweight of US expertise shares in fund managers’ portfolios

Housing market

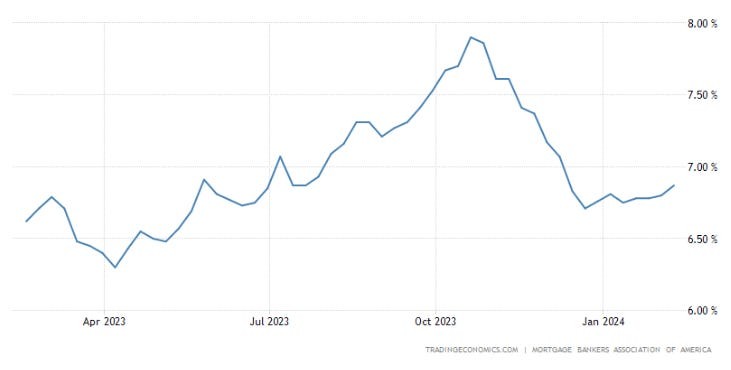

The fastened fee on 30-year mortgages elevated by 7 bps. over the past week to six.87%, the very best within the final 2 months:

Common fastened fee for 30-year mortgages

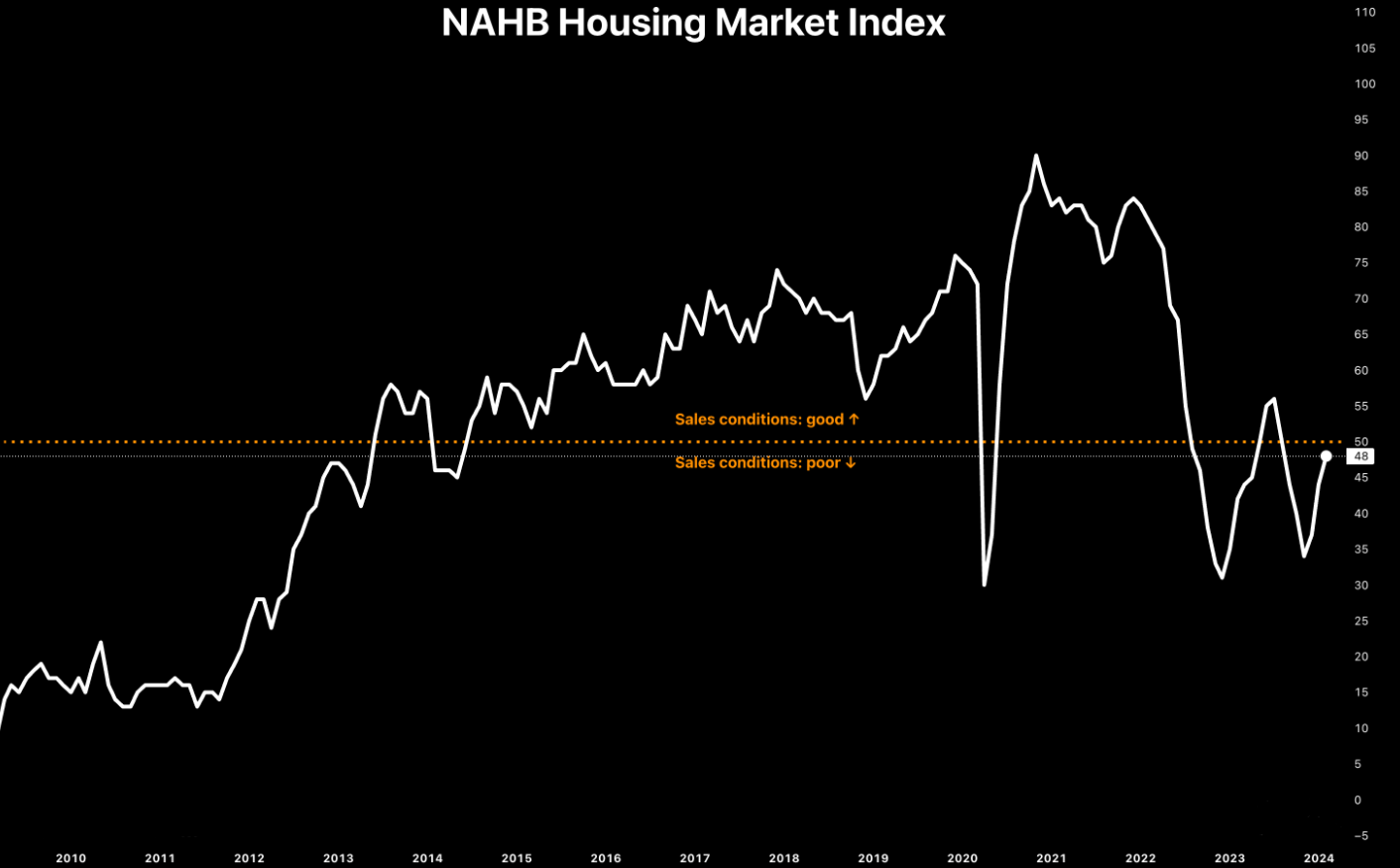

The NAHB Housing Market Index, which measures homebuilder sentiment, rose to 48 (consensus 46, 44 beforehand) and hit a 6-month excessive in February:

NAHB Housing Market Index

Retail

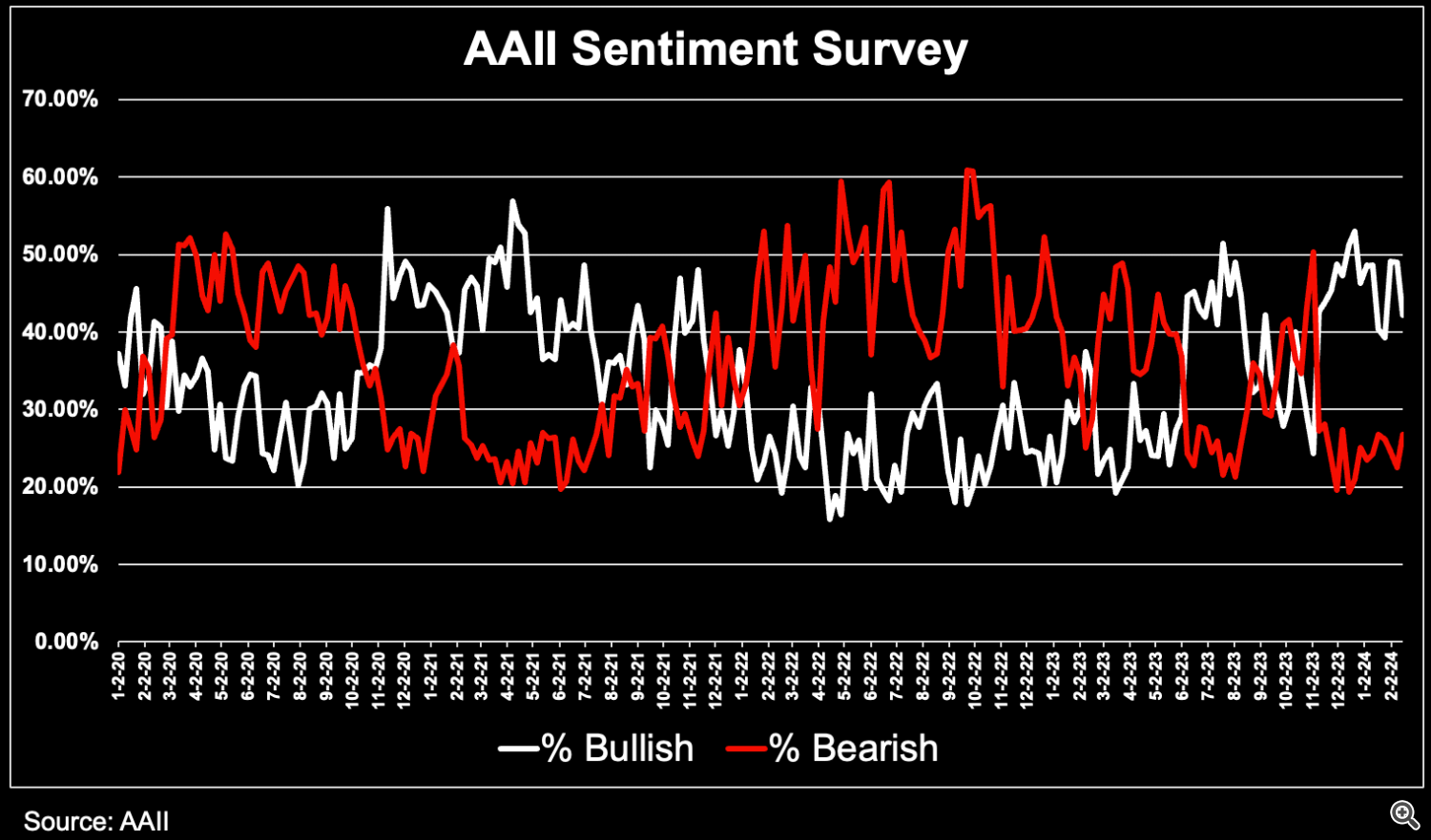

The share of “bullish” sentiment amongst retail traders, in accordance with the AAII survey, decreased from 49% to 42.2% over the previous week. Bearish sentiment elevated from 22.6% to 26.8%:

AAII Retail Investor Sentiment Survey