KEY

TAKEAWAYS

- Combining basic forecasts with seasonality patterns affords a potent technique for figuring out tradable alternatives in particular sectors

- The Power (XLE), Utilities (XLU), and Supplies (XLB) sectors exhibit the strongest seasonal efficiency within the near-term

- Seasonality charts present useful insights, however checking total inventory market situations and technical buying and selling indicators additional confirms a excessive chance commerce

After we take into consideration sector rotation, we take into consideration fundamentally-based forecasts linked to the levels of the financial cycle (i.e. enterprise cycle). In distinction, once we consider seasonality forecasts, we consider a technically-based context outlined by common historic value efficiency, sometimes on a month-to-month foundation.

Combining each approaches may be an efficient solution to determine near-term buying and selling alternatives. Briefly, you would be on the lookout for sectors which analysts anticipate to carry out properly within the coming months, whereas drilling down on a sector’s seasonality patterns to anticipate traditionally sturdy months which can be tradable. Lastly, you’d verify these projections in opposition to the present value motion to see whether or not the technicals are favorable for buying and selling.

Sectors with the Strongest Close to-Time period Seasonal Efficiency

Utilizing the SPDR Choose Sector ETFs as sector proxies, the three sectors with the strongest seasonal efficiency within the close to time period are Power Choose Sector SPDR Fund (XLE), Utilities Choose Sector SPDR Fund (XLU), and Supplies Choose Sector SPDR Fund (XLB).

When it comes to fundamentals, all three are anticipated to see development in 2024. Power faces volatility pushed by geopolitical and renewable vitality transitions, whereas the utilities sector is seen as a extra secure funding, with a deal with renewables and infrastructure. The supplies sector may witness development, benefiting from favorable supply-demand dynamics, anticipated rate of interest adjustments, and engaging valuations.

Seasonal Efficiency vs. the S&P 500

Once you’re making investing or buying and selling selections primarily based on seasonality patterns, it is all the time a good suggestion to verify an asset’s seasonal efficiency in opposition to the broader market. Even when an asset (or, in our case, a sector) performs properly in a given month primarily based by itself historical past, that may not imply a lot if it underperforms the S&P 500. You are dealing with a chance price by which you may profit from buying and selling one other asset.

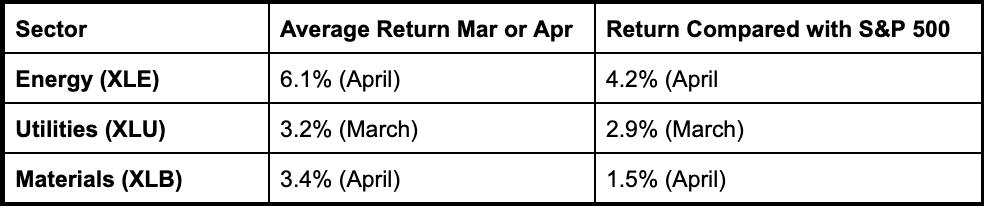

XLE, XLU, and XLB all have sturdy 10-year seasonal efficiency in April, which is developing quickly. Let’s take a broader have a look at their performances and evaluate it with the broader market (see desk under).

Wanting on the stats above, XLE is the strongest performer. Whereas XLB’s common return is greater than XLU, when put next with the S&P 500, XLB underperforms XLU. Let’s deal with the highest performer, XLE.

XLE’s Seasonality Profile

Utilizing StockCharts’ Seasonality Profile chart, let’s take a better have a look at XLE’s 10-year efficiency.

CHART 1. XLE’S 10-YEAR SEASONALITY PROFILE. Simply because a given month has the next shut share doesn’t suggest it is a favorable month to commerce. It’s important to have a look at its common return (backside of the bar) and evaluate each figures throughout all different months. Chart supply: StockCharts.com. For academic functions.

Whereas XLE has a higher-close fee of 67% in each March and April over a 10-year interval, its common return in April (6.1%) far exceeds the common unfavourable return (-1.2%) in March. April is XLE’s strongest seasonal month.

However what do these stats imply when put next with the S&P 500? Does it outperform or underperform the broader market?

CHART 2. XLE’S 10-YEAR SEASONAL PERFORMANCE COMPARED WITH THE S&P 500. Once you view seasonality utilizing relative efficiency, issues can typically change drastically. Within the case of XLE, March continues to be weak, April continues to be its strongest month, and the upper shut fee in April is identical in comparison with the S&P 500.Chart supply: StockCharts.com. For academic functions.

XLE’s relative seasonal efficiency in opposition to the broader market, you possibly can see that it outperforms the S&P 500 within the month of April (4.2%) whereas sustaining its 67% fee of upper closes.

Is XLE’s March Weak point a Setup for an April Surge?

a each day chart of XLE, you possibly can see that it has been buying and selling sideways because the center of October.

CHART 3. DAILY CHART OF XLE. All indicators on the chart serve a objective by way of assist and confluence: gauging momentum, shopping for stress, and figuring out a possible assist vary. Chart supply: StockCharts.com. For academic functions.

Whereas costs have surged, XLE additionally closed above the higher Bollinger Band® earlier within the week. A detailed above the band (2nd customary deviation) indicators a powerful potential for costs to say no, presumably towards the center band.

There’s additionally a bearish divergence within the Stochastic Oscillator (see blue dashed line), which has declined whereas nonetheless giving an overbought sign. Each indicators point out the chance that XLE could also be dipping quickly.

On the bullish facet, you can too see from the Chaikin Cash Circulation (CMF) that purchasing stress has ramped up and continues to be far above the zero line. In the meantime, an Ichimoku Cloud is plotted within the chart to offer some pattern context (which is barely bullish) and a doable vary for assist.

So, should you’re bullish on XLE and agree with the seasonal March weak spot and April energy thesis, you’d in all probability look forward to costs to fall between $83 and $84 within the coming month. Set a value alert at $85 to provide you with a warning to a possible commerce.

The $83 to $84 degree would coincide with the decrease or center Bollinger Band (if costs decline) and the cloud itself (the house between Senkou Span A and Senkou Span B). Ideally, you’d see a decline within the Stochastic Oscillator whereas the shopping for stress on the CMF maintains itself above the zero line. Subsequent, you’d search for an upward reversal on sturdy momentum earlier than deciding the place, precisely, to position your purchase cease (there are a lot of methods to find out this, and it relies on your buying and selling methodology).

The Backside Line: The Problem of Utilizing Seasonality Profiles

StockCharts’ Grayson Roze, in his video explaining learn how to use the corporate’s seasonality charts, makes it clear that seasonality is an efficient software for contextualization. Which means that you have already got a commerce thought, and you employ its seasonality profile to achieve extra info which will enable you to consider the chances of your buying and selling thesis.

Nevertheless, beginning with the seasonality chart to generate buying and selling concepts can show more difficult and problematic when the technicals do not recommend a right away buying and selling alternative. Nonetheless, if seasonal consistency takes place, you have probably unlocked a chance that different merchants won’t have anticipated.

Sectors rotate on a long-term foundation in relation to the enterprise cycle and on a short-term foundation in relation to the intra-year provide/demand state of affairs of the companies they comprise. So, there could also be an satisfactory cause to commerce sectors on a short-term foundation in response to their seasonal demand.

It might be tough to decipher at instances. Nonetheless, if a seasonality studying offers you an edge in anticipating a possible near-term transfer, it may be properly definitely worth the small effort it takes to investigate its seasonality profile.

The way to Entry the StockCharts Seasonality Software

There are alternative ways to entry the seasonality software in StockCharts.

- Click on the Charts & Instruments tab on the prime of the StockCharts web page, enter a logo within the Seasonality panel, and click on “Go.”

- Enter the image within the ChartBar on the prime of the web page and choose “Seasonality” from the dropdown menu on the left.

- From Your Dashboard, in Member Instruments, click on on Seasonality.

- Under the seasonality chart, you may discover hyperlinks to directions and fast ideas that give extra detailed directions.

Disclaimer: This weblog is for academic functions solely and shouldn’t be construed as monetary recommendation. The concepts and methods ought to by no means be used with out first assessing your individual private and monetary state of affairs, or with out consulting a monetary skilled.