Within the ever-evolving world of computerized buying and selling robotic, it’s essential to know the importance of constructing an optimization course of to keep away from the pitfall of over-fitting.

Over-fitting refers back to the phenomenon when a buying and selling technique is excessively tailor-made to suit historic information, leading to poor efficiency when utilized to unseen market circumstances. It’s a frequent pitfall that may erode the effectiveness and reliability of a buying and selling technique, resulting in potential monetary losses.

To counter this situation, it’s crucial to ascertain a sturdy optimization course of. This course of entails rigorously deciding on and testing varied parameters, indicators, and fashions to make sure that the buying and selling technique stays adaptable and efficient throughout completely different market circumstances.

This text delves into methods to constructing an optimization course of to mitigate the dangers related to over-fitting in buying and selling methods. It additionally introduces the Anti-Overfitting course of that I devised to optimize my buying and selling system.

It is strongly recommended to learn Half 1 first to be able to comprehend the indications and causes behind over-fitting.:

– Hyperlink 1: Avoiding Over-fitting in Buying and selling Technique (Half 1): Figuring out the Indicators and Causes

– Hyperlink 2: Monitoring the stay efficiency of the technique used for analysis right here

1. Optimization Course of Overview

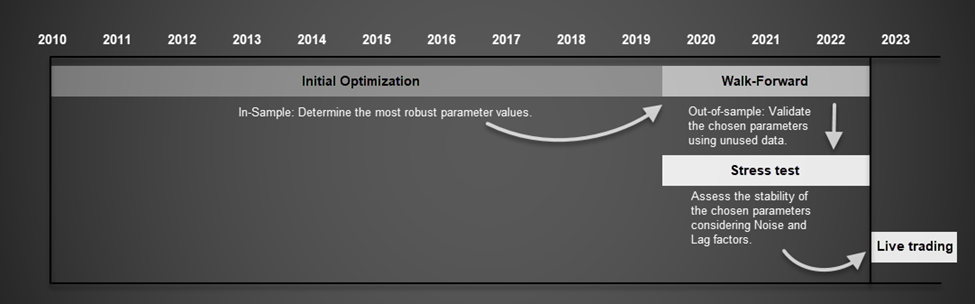

To make sure a sturdy optimization course of, two levels are concerned: the Preliminary Optimization section for figuring out optimum parameter values, and the Stroll-forward section for validating the chosen parameters utilizing new information. Every section requires completely different implementation strategies and has particular necessities. You will need to be aware that no historic information used within the Preliminary Optimization section is reused within the Stroll-forward section.

Determine 1. Optimization Course of timeline.

The diagram above illustrates the timeline association of those two levels:

– The Preliminary Optimization section begins with the earliest obtainable information.

– The Stroll-forward section concludes on the present date.

– The Stroll-forward section begins instantly after the Preliminary Optimization section ends.

To find out the allocation of historic information for the Preliminary Optimization section, two components want consideration: (1) the size of obtainable historic information, and (2) the variety of parameters to optimize.

To find out the allocation of historic information for the Preliminary Optimization section, two components want consideration: (1) the size of obtainable historic information, and (2) the variety of parameters to optimize. The ratio between the 2 phases relies on the variety of parameters being concurrently optimized. As mentioned in Half 1, the next levels of freedom necessitates a bigger pattern measurement throughout backtesting to attain statistical significance. Due to this fact, if a technique has extra parameters to optimize through the backtest, a bigger quantity of information is required for the Preliminary Optimization section. Within the Ahead take a look at section, which is designed to validate the parameters chosen from stage 1, the enter parameters stay unchanged, leading to zero levels of freedom.

Sometimes, the info ratio between the Preliminary Optimization section and Stroll-forward section is 2:1 when optimizing a single parameter, 3:1 when optimizing two parameters, and 4:1 when optimizing three parameters. If the variety of parameters exceeds this, it’s advisable to divide the technique into sub-strategies for optimization to keep away from the scenario that the buying and selling technique is excessively tailor-made to historic information, as mentioned in Half 1.

As soon as the Stroll-forward section is accomplished, Stress Testing is performed. This stage employs a simulation algorithm to introduce Noise and Lag variables to the entry and exit factors decided by the chosen parameters from the earlier two levels. The aim is to push the chosen parameters past their ”consolation zone” and assess system’s tolerance to random components comparable to lag and noise. This serves as the final word take a look at to find out if a technique is appropriate for precise buying and selling.

2. Implementing the Anti-overfitting Course of to Optimize the buying and selling technique

This part gives an in depth clarification of the steps concerned in every stage of the optimization course of. To facilitate understanding, I’ll present sensible examples of how I apply this course of to extract and validate parameter values for my buying and selling system – Boring Pips.

Buying and selling System Title: Boring Pips

Description of Buying and selling Technique: The technique depends on declining value momentum alerts at potential help and resistance zones to make buying and selling selections.

Optimization setting:

– Period: 12 years and 09 months (01.01.2010 – 31.09.2022)

– Variety of parameters optimized (variables) = 2:

- Momentum (open sign) (13) = 10,15,20,25,30,…65,70.

- Fibonaci degree (shut sign) (8) = 15,20,25,30,35,40,45,50.

Complete parameter combos: 104.

– Efficiency Metric: The effectiveness of the technique within the optimization course of is evaluated utilizing the CAGR/MDD (Compound Annual Progress Charge over Max Drawdown).

– Allocate previous information for optimization levels: Since there are 2 parameters within the backtest course of, the ratio between the Preliminary Optimization Section and the Stroll-forward Section is 3:1. Listed below are the desired time durations for every section:

- Preliminary Optimization Section: January 1, 2010 – Might 31, 2019.

- Stroll-forward Section: June 1, 2019 – September 31, 2022.

- Stress Testing: June 1, 2019 – September 31, 2022.

a. Preliminary Optimization Section

Preliminary Optimization is the primary stage of the optimization course of, which can be the stage that requires essentially the most historic information.

The targets of this section are as follows:

– Decide whether or not the technique has a buying and selling edge and if that edge is critical sufficient to use.

– Establish essentially the most sturdy parameter values.

Implementation Course of:

Step 1: Carry out a backtest utilizing the 104 units of enter mixture parameters with information from 01.01.2010 to 31.05.2019.

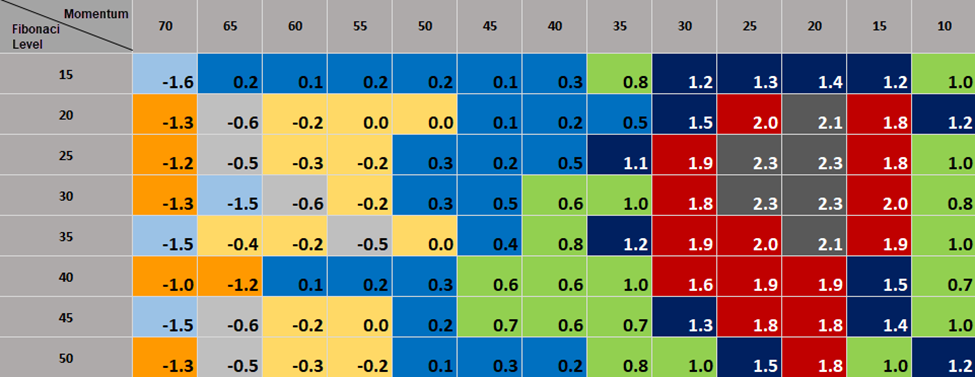

Step 2: Calculate the CAGR/MDD for every set of parameters based mostly on the backtest outcomes (Revenue and MDD). Mixture this information right into a desk.

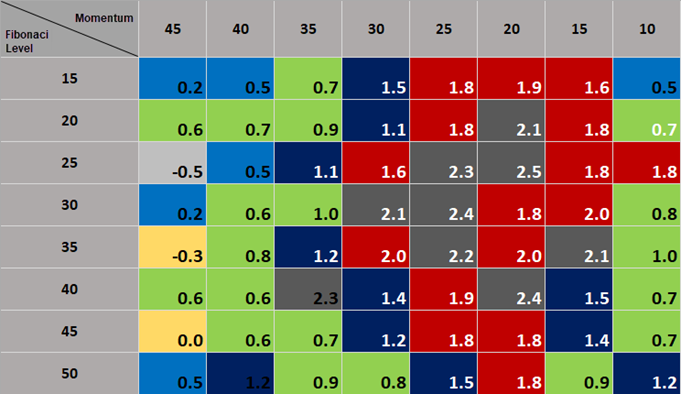

Desk 1. CAGR/MDD for every set of parameters based mostly on the backtest outcomes.

Be aware: CAGR is calculated utilizing the system:

The place:

- Remaining worth is the fairness on the finish of the backtest.

- Beginning worth is the fairness firstly of the backtest.

- N is the period of the backtest in years.

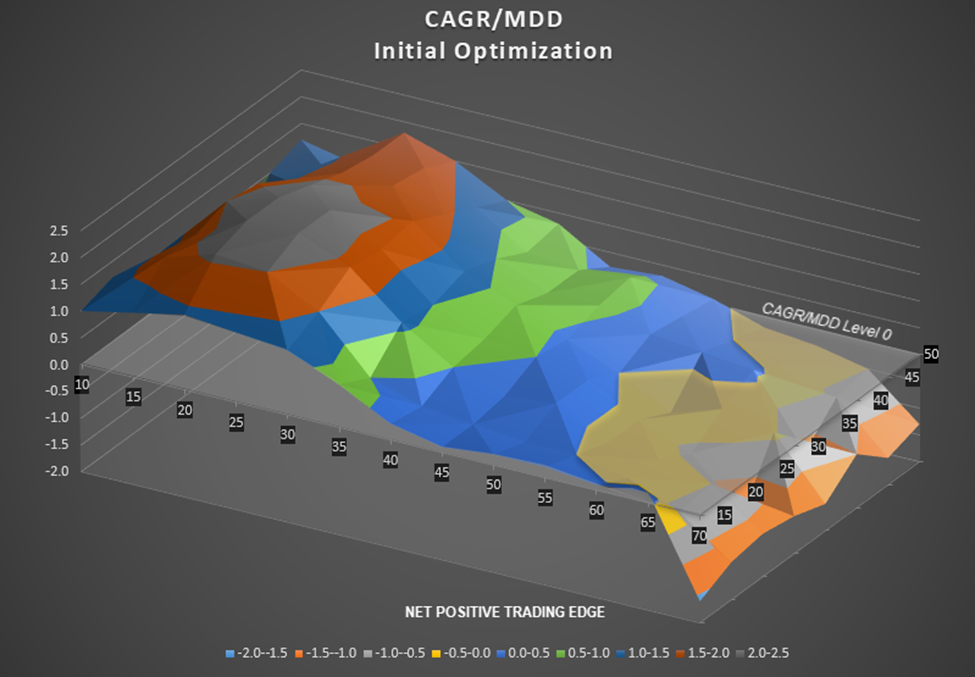

Step 3: Create a chart from tabular information for a visible and easy-to-analyze overview.

For the reason that optimization course of entails 2 enter parameters (Momentum and Fibonacci degree) and 1 output parameter (CAGR/MDD), a 3D chart is used as follows. The chart consists of:

- x-axis: Momentum (enter variable values).

- y-axis: Fibonacci degree (enter variable values).

- z-axis: CAGR/MDD (output variable worth).

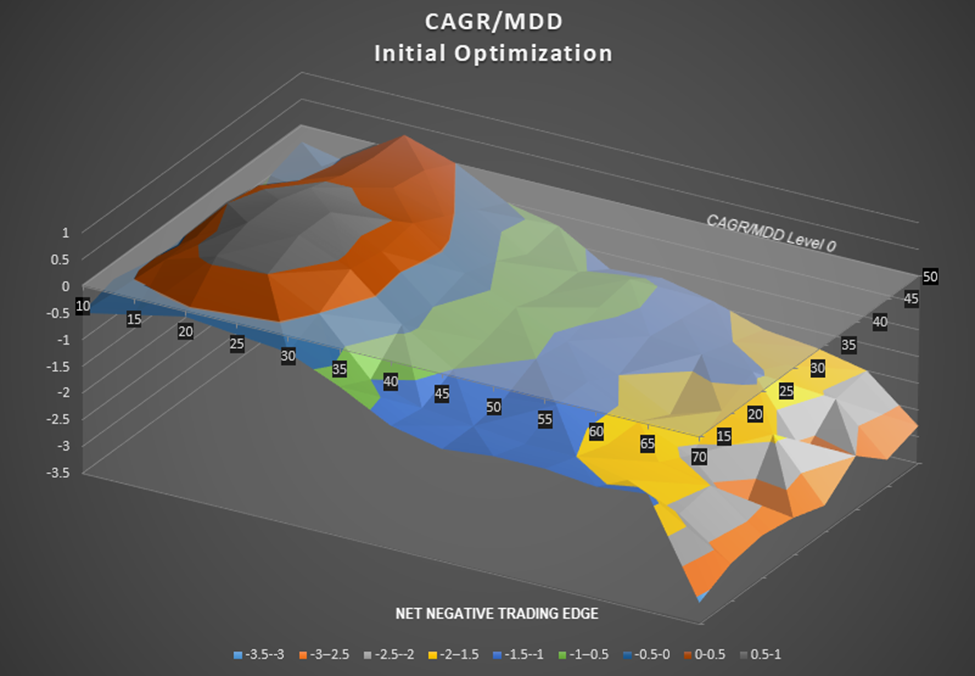

Determine 2. Internet Constructive Buying and selling Edge chart.

Let’s study this chart and draw just a few key observations:

- The profile outcomes appear to have significance, supporting our preliminary premise that coming into reversal orders at potential help/resistance zones during times of lowering value momentum results in improved buying and selling efficiency. Upon analyzing the chart, we will see that the CAGR/MDD ratio is highest when coming into at decrease Momentum ranges, particularly inside the vary of 20-25. Moreover, the Fibonacci zone of 25-35 gives the optimum exit sign, though exiting barely earlier or later nonetheless affords buying and selling edge, albeit not as substantial as inside this vary.

- Nearly all of the histograms present values above CAGR/MDD = 0, indicating a internet optimistic buying and selling edge.

- The chart reveals a transparent sample with none erratic nature, offering clear insights into essentially the most profitable parameter values.

Primarily based on these observations, we will conclude that when value momentum lower upon the potential help and resistance areas, coming into and exiting orders utilizing applicable fibonacci ranges can provide a buying and selling edge.

Under are 2 examples of chart forms of methods that wouldn’t have a buying and selling edge, or a buying and selling edge that isn’t important sufficient to use that we will come throughout when doing optimization.

Determine 3. Detrimental Buying and selling Edge Chart.

The sort of chart exhibits a relationship between momentum and CAGR/MDD, however many of the values fall under degree 0, indicating a internet destructive buying and selling edge. This edge just isn’t important sufficient to be exploited successfully.

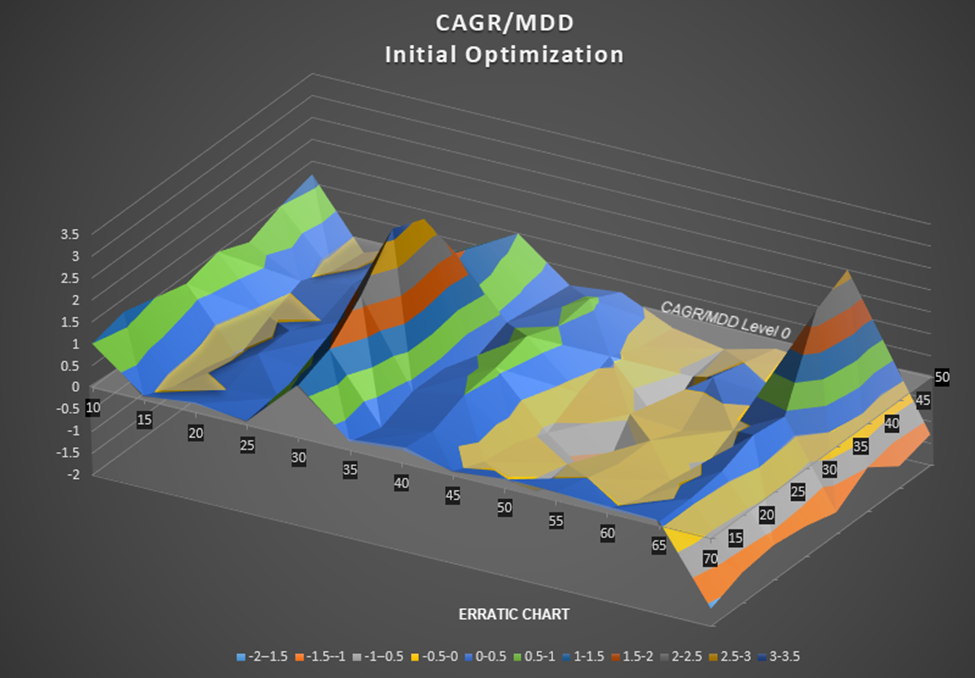

Determine 4. Erract Chart.

Though many of the histograms in this kind of chart present values above zero, there isn’t any discernible relationship between the enter variable, Momentum, and the output variable, CAGR/MDD. This reveals that the unique assumption used to construct the buying and selling technique is inaccurate. Buying and selling based mostly on such methods is dangerous as a result of there’s a advantageous line between attaining a CAGR/MDD of three.0 and -2.0.

After receiving the backtest outcomes from section 1, the parameter units that carried out nicely will endure a validation course of utilizing unseen information.

The targets of second section are as follows:

- Evaluating mannequin’s energy of prediction. To make sure accuracy, not one of the information used to construct the mannequin within the Preliminary Optimization section is reused on this section.

- Evaluating the compatibility of the buying and selling technique with present market circumstances. The market is consistently altering, and whereas first section covers a protracted historic interval to make sure a big pattern measurement, it might not mirror the current market section. In distinction, Stroll-forward section makes use of a smaller pattern measurement, consisting of information nearer to the present interval. If a technique performs nicely through the Stroll-forward section, it’s more likely to exhibit related efficiency in actual buying and selling.

Implementation Course of:

Step 1: Out of the 104 parameter units from stage 1, the highest 64 units might be chosen for backtesting in stage 2. These units embrace:

- 18 units for momentum (open sign) with values of 10, 15, 20, 25, 30, 35, 40, and 45.

- 8 units for Fibonacci ranges (shut sign) with values of 15, 20, 25, 30, 35, 40, 45, and 50.

Stroll-forward interval: 01.06.2019 – 31.09.2022.

Efficiency meter: utilizing the CAGR/MDD to keep up consistency with stage 1.

Step 2: The backtest outcomes might be aggregated right into a tabular format.

Desk 2. Stroll-forward Section backtest leads to tabular format.

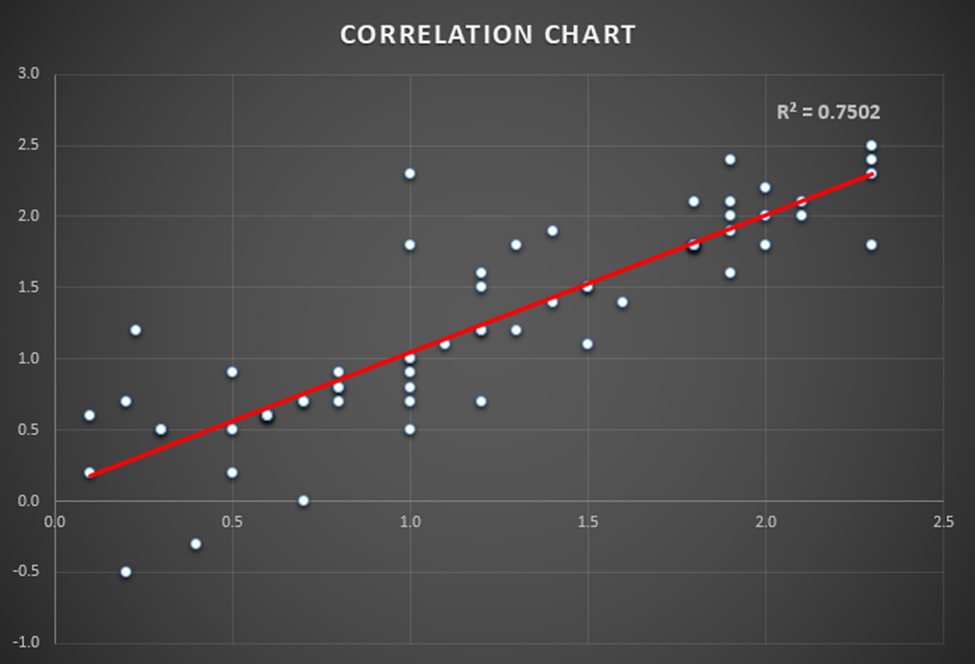

Step 3: A scatter chart might be generated utilizing the collected information to match the CAGR/MDD values for every parameter set between the Preliminary Optimization stage and Stroll-forward stage. This evaluation will assist decide the connection between the technique’s efficiency between the 2 phases of in-sample and out-of-sample information..

Determine 5. Correlation chart.

The x-axis represents the values from the Preliminary Optimization and the y-axis represents these values from the Stroll-forward section. Accordingly, when projected onto the x-axis, every white dot represents the CAGR/MDD worth of a parameter set throughout Preliminary Opitimization, if projected onto the y-axis, it represents the CAGR/MDD worth of the parameter set through the Stroll-forward take a look at..

From the chart, we will make a number of observations:

- Initially, many of the parameters present optimistic CAGR/MDD values through the Stroll-forward section (61/64), indicating that the buying and selling technique maintains its buying and selling edge within the present market circumstances.

- Generally, parameter units that carry out nicely through the Preliminary Optimization section additionally are inclined to carry out nicely within the Stroll-forward take a look at section, highlighting the predictive capacity of the mannequin. There are 2 units of parameters on the left aspect of the graph that exhibit destructive CAGR/MDD values through the Stroll-forward course of, these units of parameters even have low effectivity within the early levels. This might help keep away from poor efficiency parameter units throughout stay buying and selling.

To quantify this relationship, a trendline could be added with the corresponding R squared worth. An R squared worth of 0.75 for CAGR/MDD signifies a powerful correlation between the efficiency of a parameter set previously and its future efficiency. In different phrases, the constructing mannequin has predictive energy.

As soon as it has been established that the buying and selling system has an buying and selling edge and the optimum set of parameters has been recognized, the Stress testing section is performed to evaluate the tolerance of those parameter values to noise and lag components.

The unique system is modified by introducing noise and lag components. These components contain adjusting the entry and exit factors of unique trades from Stroll-forward section by including or subtracting a specified value vary or time interval. The aim is to judge the system’s stability beneath completely different market circumstances, the place:

- The Noise variable (N) is used to boost or lower the worth vary on the unique entry and exit factors. This helps assess how the system performs when these factors are adjusted by the worth of the noise variable.

- The Lag variable (L) is used so as to add or subtract a time interval to the unique entry and exit factors. This helps consider the system’s stability when orders are executed later or earlier by the worth of the lag variable.

By testing the system’s efficiency beneath random and unpredictable market circumstances, we will decide its sensitivity to modifications outdoors its regular working vary.

You will need to be aware that this testing course of requires fundamental programming expertise to implement. For instance, utilizing two-dimentional arrays within the MQL4/MQL5 language to retailer entry and exit factors, in addition to including simulator variables to the system.

Listed below are the steps to carry out stress testing utilizing an Professional Advisor constructed with the MQL5 language:

Step 1: Use the built-in perform OnTester() to avoid wasting the worth and time of all entry/shut factors through the Stroll-forward take a look at.

Step 2: Add the variables Noise (N) and Lag (L) to the unique system. Lag represents the time worth in minutes that might be added or subtracted from the preliminary entry and exit factors. The L variable additionally ranges from -30 to +30..

- Noise represents the worth vary in pips that might be added or subtracted from the preliminary entry and exit factors. The N variable ranges from -30 to +30.

- Lag represents the time worth (in minutes) that might be added or subtracted from the preliminary entry and exit factors. The L variable carries the worth from – 30 to + 30.

Step 3: Conduct backtests for every chosen parameter set with the buying and selling system that features the extra noise and delay variables.

Assuming the variable values to be backtested are:

- N (6): -30,-20,-10,10,20,30.

- L (6): -30,-20,-10,10,20,30.

(Be aware: the mix of N = 0 and L = 0 corresponds to the unique backtest end result within the Stroll-forward course of).

And we select 9 units of parameters have finest CAGR/MDD rating from second section to check, then the sum of the person backtest outcomes to be carried out is 9*60 = 540.

This section requires processing a considerable amount of information, so it ought to solely be utilized with the very best efficiency parameter units discovered within the earlier Stroll-forward section.

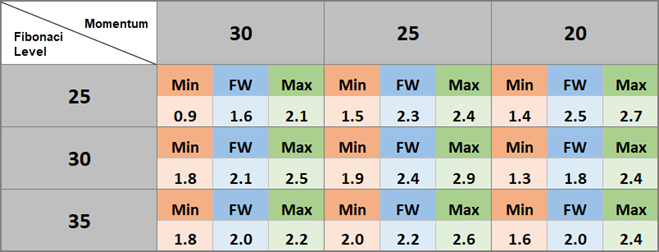

Step 4: Document the leads to a desk format. For every parameter set, establish the utmost and minimal efficiency values after making use of the noise and lag variables.

Desk 3. Maximum and minimal efficiency values after making use of the noise and lag variables.

Step 5: Interpret the outcomes utilizing graphs and evaluation to achieve insights into the system’s efficiency beneath the Stress testing.

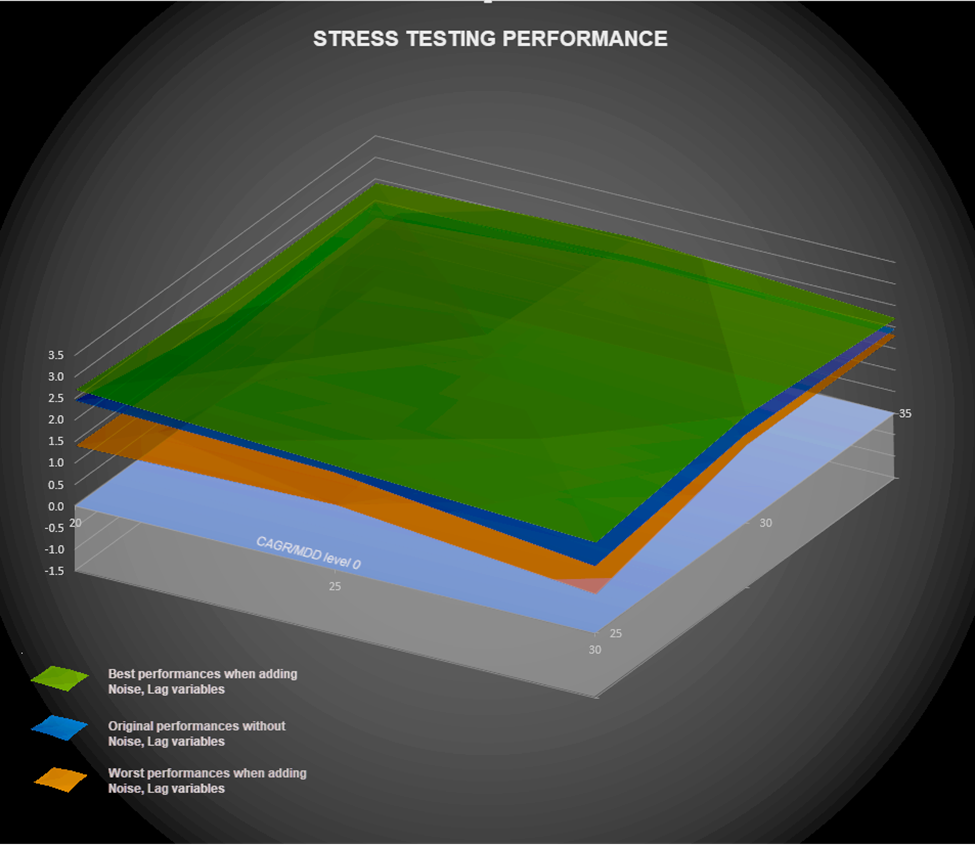

Determine 6. Stress Testing efficiency.

The outcomes obtained from the Stress testing section reveal just a few key factors:

- When setting the very best and lowest efficiency ranges of the parameters beneath the affect of noise and lag components on the identical chart and evaluating them with the preliminary efficiency of the Stroll-forward section, the noticeable level is that these three layers of charts all exhibit steady shapes and present no random fluctuations (excessive/low spikes). This means that the parameter units carry out nicely beneath noise and lag circumstances.

- Moreover, the proximity of the three chart layers suggests the soundness of the chosen parameter units. Regardless of the affect of lag and noise on the entry/exit factors of the unique positions, the general efficiency of the technique just isn’t considerably affected.

- Even the bottom efficiency degree affected by delay and noise (proven within the orange layer on the backside) stays above CAGR/MDD = 0, indicating the system’s security. In excessive market circumstances, optimistic efficiency can nonetheless be anticipated.

Remaining Conclusion

The optimization course of described above is designed to eradicate the danger of over-fitting and make sure the generalizability of the buying and selling technique. Every stage of this course of performs an important function in optimizing the technique: Preliminary Optimization and Stroll-forward section establish the existence of a buying and selling edge based mostly on preliminary premises and extract essentially the most sturdy parameter values, whereas Stress testing section exams the system’s stability in opposition to market noise and lag components.

After present process a radical and complete optimization course of, the Boring Pips system has been confirmed to own a real exploitable buying and selling edge whereas demonstrating stability in varied market circumstances, together with excessive occasions. Primarily based on these conclusions, the optimum set of parameters, Momentum (25) and Fibonacci degree (30), has been utilized in precise buying and selling since 10.10.2022. You could find extra details about the precise buying and selling efficiency of the BoringPips technique on the following hyperlink:

Hyperlinks: Monitoring the stay efficiency of the technique used for analysis right here