Hiya, After very long time I got here with a brand new instructional weblog the place I will likely be instructing some common strategies to detect a pattern change. I’m not going to debate fundamental strategies corresponding to transferring common as I’m a wave / fibo / worth motion sort of dealer and I don’t use any indicator corresponding to Shifting common to detect pattern change.

1. X’s Breakout : On this technique we contemplate backside as A, and the earlier swing excessive as X. If worth breaks X by shut, the pattern change chance exists on this case.

2. Development Breakout: On this we contemplate A as backside and search for current xy trendline, there could be many trendlines making xy as decrease low however we solely choose current one. We don’t contemplate greater than 2 touches on trendline, that’s the reason I name it xy trendline. When a breakout happens, the chance of pattern reversal exists.

3. Methodology of completion : Its a way which can give late entry. On this technique we detect any sample completion, it may very well be any harmonics, chart sample or any sort of sample which isn’t pending

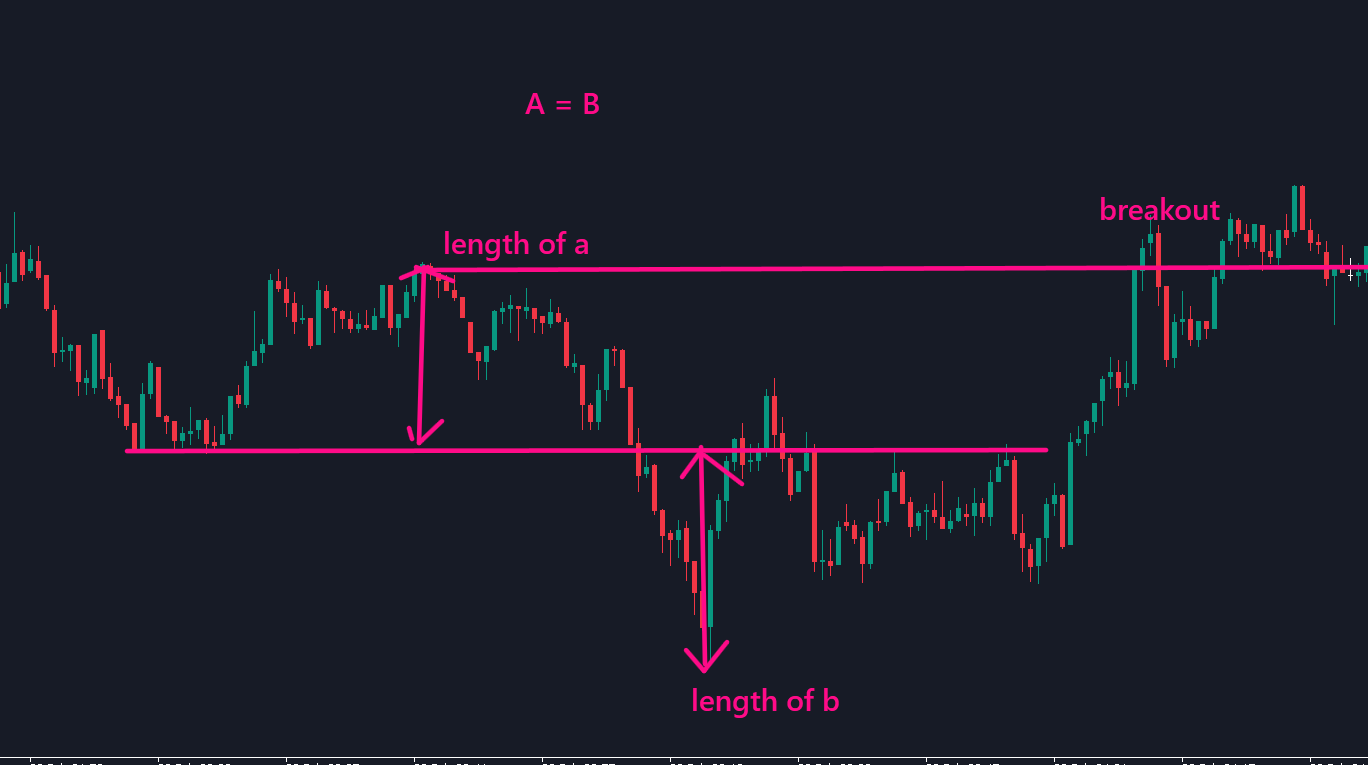

on this instance we see there was Ab = Cd sample accomplished, as you possibly can see the lef of A is the same as leg of B

So now we look forward to the breakout of A and the pattern reversal chance exists on this case

These are 3 fundamental strategies which could be higher than watching indicators e.g. Shifting common and others for pattern reversal.