It is simple to disregard dangerous information when the S&P 500 (SPY) is making new highs and our web price is on the rise. Sadly it’s usually at these heights that the primary indicators of bother seem…however are exhausting to see at first. That’s the reason you could learn the most recent insights from veteran investor, Steve Reitmeister, as he factors to a disconnect between the basics and present inventory worth motion. Learn on under for extra.

The higher than anticipated PCE inflation report on Thursday led to a different rally pushing the S&P 500 (SPY) again in the direction of the highs at 5,100. This represents a hearty 5% return in February. Even higher, market breadth improved with smaller shares coming alongside for the journey within the remaining days of the month.

I hate to be the bearer of dangerous information…however sadly the basics are usually not completely supporting this rampant bullishness. Particularly as a result of I do not imagine issues get that a lot better even after the Fed does lastly begin decreasing charges.

Why is that?

And what does that imply for shares within the weeks forward?

Get the solutions under with my up to date outlook and buying and selling plan.

Market Commentary

In my commentary earlier this week I shared the next perception:

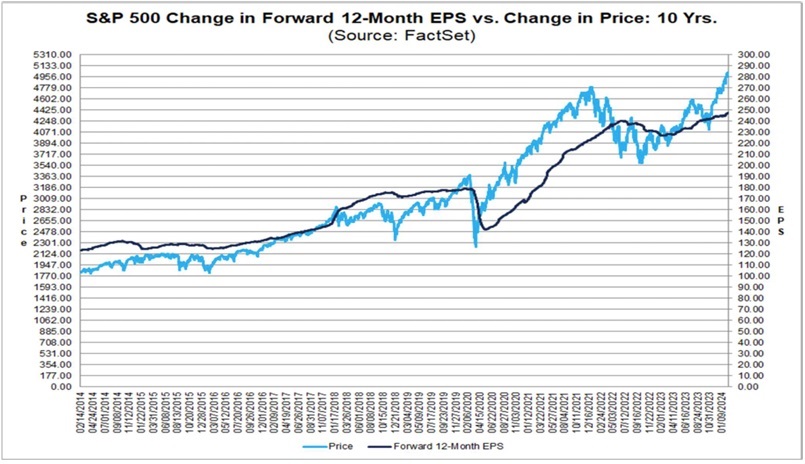

We have to begin the dialog with this provocative chart from FactSet evaluating the motion of the ahead S&P 500 EPS estimates versus the inventory index:

You’ll uncover that for a lot of the previous 10 years the darkish line for earnings is above the value motion. Which means the advance within the earnings outlook propelled shares larger. But every time we discover the inventory index climbing above the EPS outlook it comes again right down to measurement prefer it did in 2022.

If the teachings of historical past maintain true, then it factors to 2 potential outcomes.

First, can be a correction for inventory costs to be extra consistent with the true state of the earnings outlook. One thing within the vary of 10% ought to do the trick with a few of the extra inflated shares enduring a stiffer 20%+ penalty.

Then again, shares may degree out for some time patiently ready for charges to be lowered. This act is a well-known catalyst for higher financial progress that ought to lastly push earnings larger getting issues again in equilibrium with the index worth.

Sure, there’s a 3rd case the place shares simply maintain rallying as a result of buyers are usually not wholly rationale. Sadly, these durations of irrational exuberance led to far more painful corrections additional down the street. So, let’s hope that won’t be the case right here.

(Finish of earlier commentary)

Nevertheless, here’s what I ignored of that dialog that must be added now. Even when the Fed lastly begins decreasing charges, it might not be as nice of a catalyst for earnings progress and share worth appreciation as buyers at the moment imagine.

Simply think about what is going on now. GDP is buzzing alongside round regular ranges and but earnings progress is sub-par to non-existent 12 months over 12 months….why is that?

As a result of tough instances, like a recession, results in extra stringent price reducing on the a part of firm administration. This decrease price base = improved revenue margins and better progress when the financial system expands as soon as once more. And sure, that’s the prime catalyst for inventory worth advances.

However notice…we did not have a recession. And unemployment stays robust. And thus, there was by no means the foremost price reducing part which ushers within the subsequent cycle of spectacular earnings progress which propels inventory costs larger.

Or to place it one other method, even when the Fed lowers charges…it might have a really modest affect on improved earnings progress due to what I simply famous above. And this equates to much less purpose for shares to ascend additional.

No…this doesn’t equate to the forming of one other bear market. As famous earlier, maybe a correction is within the offing. Or extra possible that the general market stays round present ranges with a rotation out of progress shares in the direction of worth shares.

That is the place we get to press our benefit with the POWR Scores.

Sure, it evaluations 118 elements in all for every inventory discovering these with probably the most upside potential. 31 of these elements are within the Worth camp (the remainder being unfold throughout Development, Momentum, High quality, Security and Sentiment).

This worth bias helps the POWR Scores out yearly resulting in it is common annual return of +28.56% a 12 months going again to 1999. This 12 months we’d be capable to press our benefit much more as progress prospects dim and the seek for worth takes middle stage.

Learn on within the subsequent part for my favourite POWR Scores worth shares so as to add to your portfolio presently…

What To Do Subsequent?

Uncover my present portfolio of 12 shares packed to the brim with the outperforming advantages present in our unique POWR Scores mannequin. (Almost 4X higher than the S&P 500 going again to 1999)

This consists of 5 underneath the radar small caps not too long ago added with large upside potential.

Plus I’ve 1 particular ETF that’s extremely effectively positioned to outpace the market within the weeks and months forward.

That is all based mostly on my 43 years of investing expertise seeing bull markets…bear markets…and all the things between.

If you’re curious to study extra, and need to see these fortunate 13 hand chosen trades, then please click on the hyperlink under to get began now.

Steve Reitmeister’s Buying and selling Plan & Prime Picks >

Wishing you a world of funding success!

Steve Reitmeister…however everybody calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Whole Return

SPY shares have been buying and selling at $512.85 per share on Friday afternoon, up $4.77 (+0.94%). Yr-to-date, SPY has gained 7.90%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

In regards to the Creator: Steve Reitmeister

Steve is healthier identified to the StockNews viewers as “Reity”. Not solely is he the CEO of the agency, however he additionally shares his 40 years of funding expertise within the Reitmeister Whole Return portfolio. Be taught extra about Reity’s background, together with hyperlinks to his most up-to-date articles and inventory picks.

The put up Inventory Traders: Why Are You So Bullish??? appeared first on StockNews.com