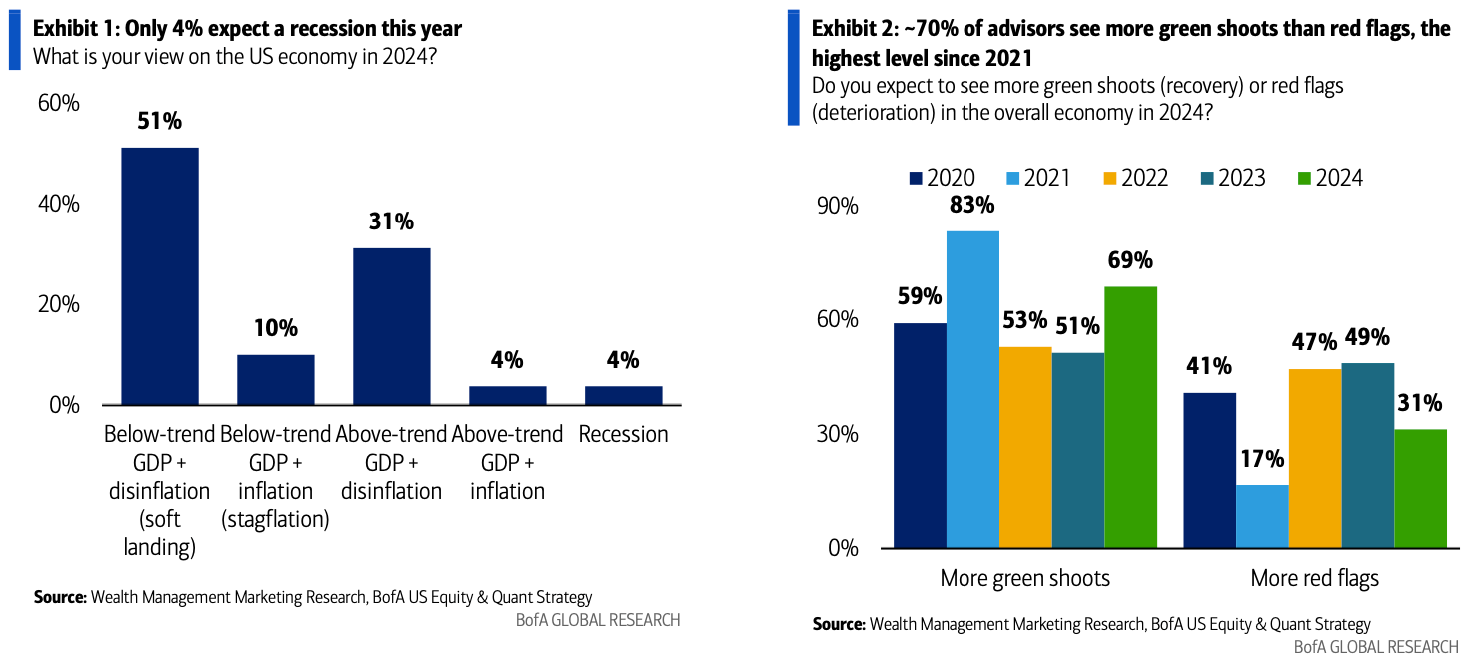

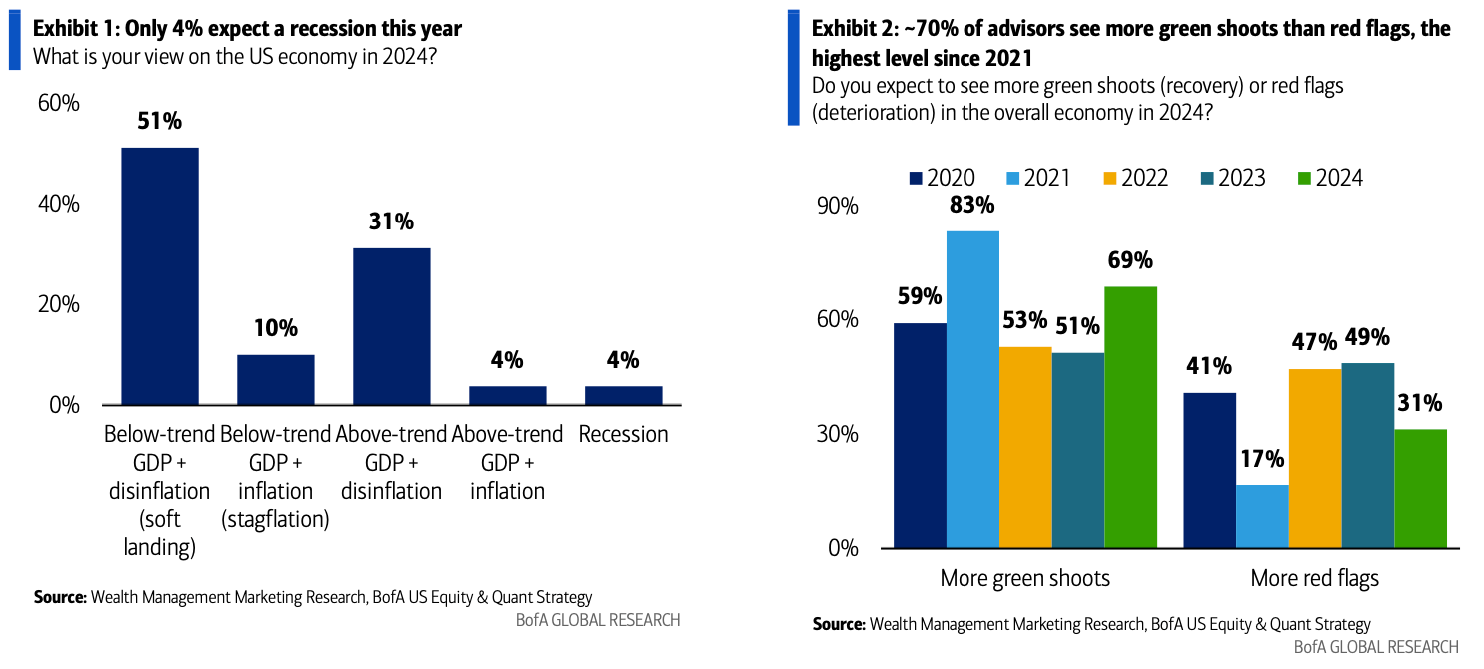

Simply 4% of economic advisors anticipate a recession this yr, down from 85% final yr. In addition they anticipate extra restoration than contraction figures within the information:

Financial Expectations of Monetary Advisors, Financial institution of America Survey

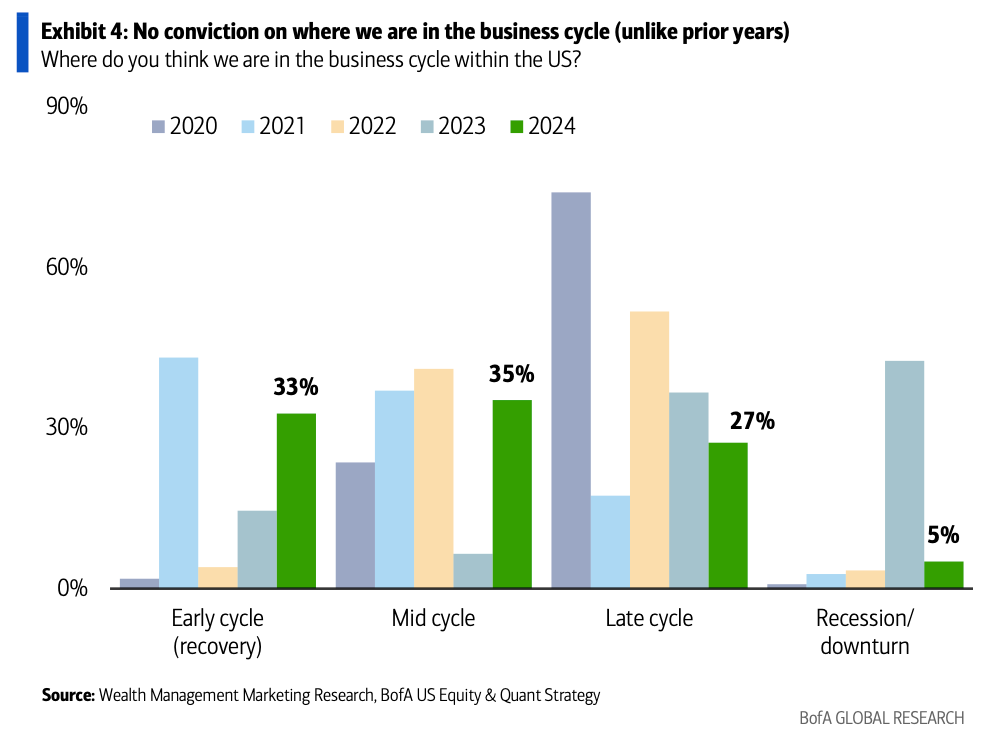

Monetary advisors, based on a Financial institution of America survey, do not need a transparent opinion about what stage of the enterprise cycle the financial system is at:

Monetary advisors’ views on the present stage of the enterprise cycle, Financial institution of America survey

The Chicago CFSEC financial exercise index fell from +7 in January to -14 in February, indicating that financial development was beneath development:

Chicago CFSEC Financial Exercise Index

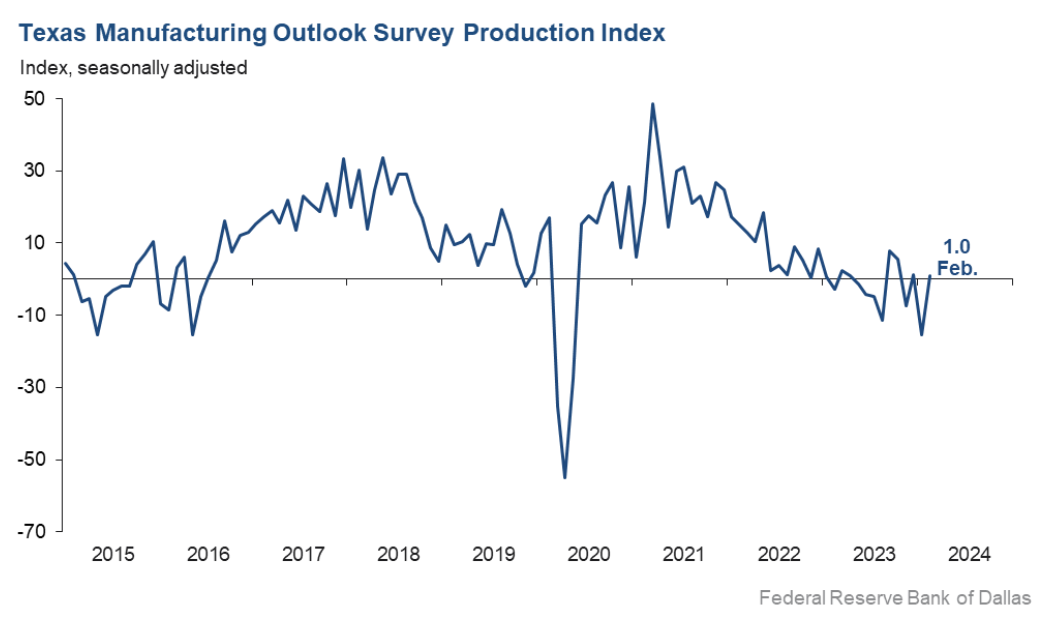

The Dallas Fed’s headline Texas manufacturing PMI rose to -11.3 in February 2024 from an eight-month low of -27.4 the earlier month (consensus -8). The brand new orders element, a key indicator of demand, rose 18 factors to five.2 in February, the primary optimistic studying since Could 2022. The anticipated future enterprise exercise element rose 17 factors to six.2, returning to optimistic territory after six months of damaging readings:

Texas Fed General Manufacturing PMI

Simply 4% of economic advisors anticipate a recession this yr, down from 85% final yr. In addition they anticipate extra restoration than contraction figures within the information:

Financial Expectations of Monetary Advisors, Financial institution of America Survey

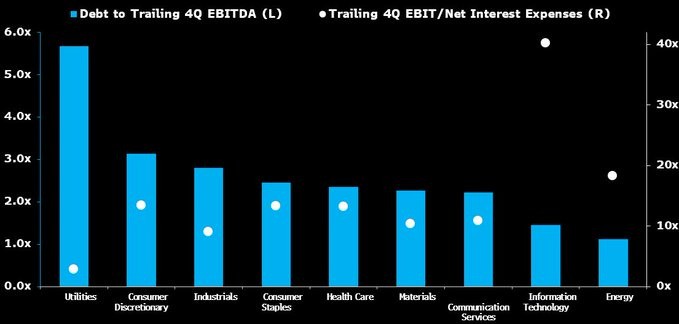

Larger Fed charges over the long run could also be much less of an issue for tech shares than generally thought. The S&P 500 Expertise sector has above-average money circulate turnover in comparison with the remainder of the market, however it has comparatively little debt and a better curiosity protection ratio:

This autumn 2023 Debt to EBITDA and This autumn 2023 EBIT to Curiosity Protection Ratio by Sector

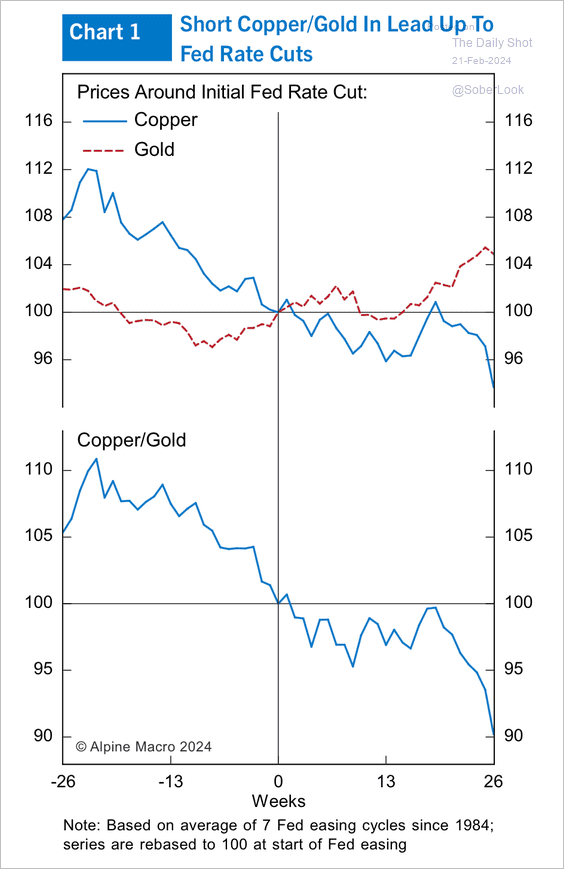

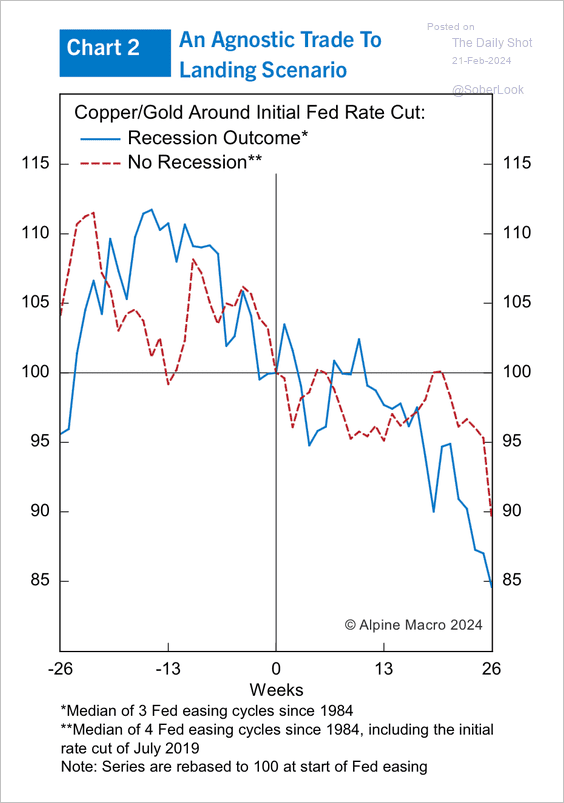

The copper-to-gold ratio usually declines after the Fed’s first price minimize, no matter whether or not there’s a recession:

Copper, gold costs and their ratios earlier than the primary Fed price minimize

Copper, gold costs and their ratios earlier than the primary Fed price minimize, which did and didn’t result in a recession

The DXY Greenback Index has a detailed relationship with the Industrial Buying Managers Index and outperforms it by roughly 126 buying and selling days. Judging by the motion of the DXY, we will anticipate a powerful upturn in enterprise exercise within the coming months:

DXY Greenback Index and ISM Industrial PMI

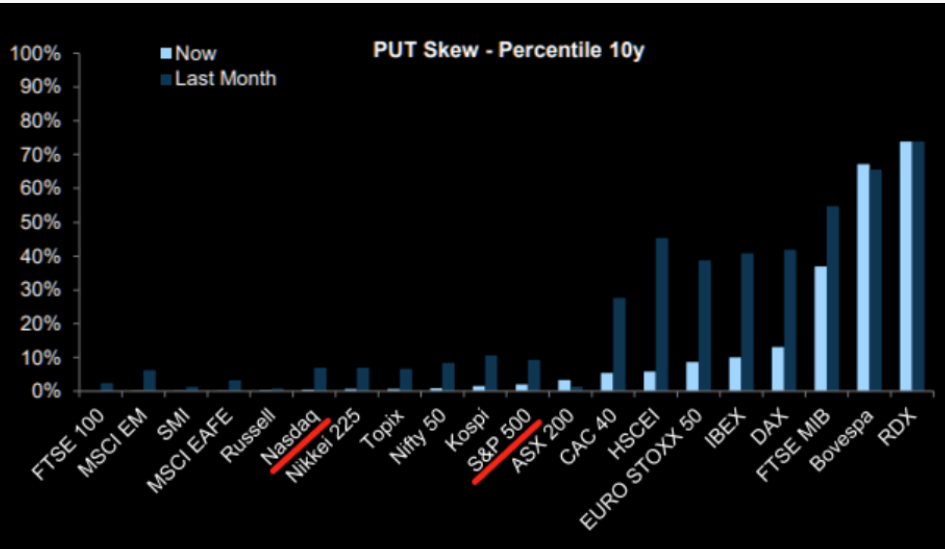

The price of put choices on dangerous belongings was comparatively low-cost even a month in the past. At the moment, the price of put choices on main inventory indices all over the world is at its lowest ranges:

The worth of put choices on main inventory indices at the moment versus the worth a month in the past

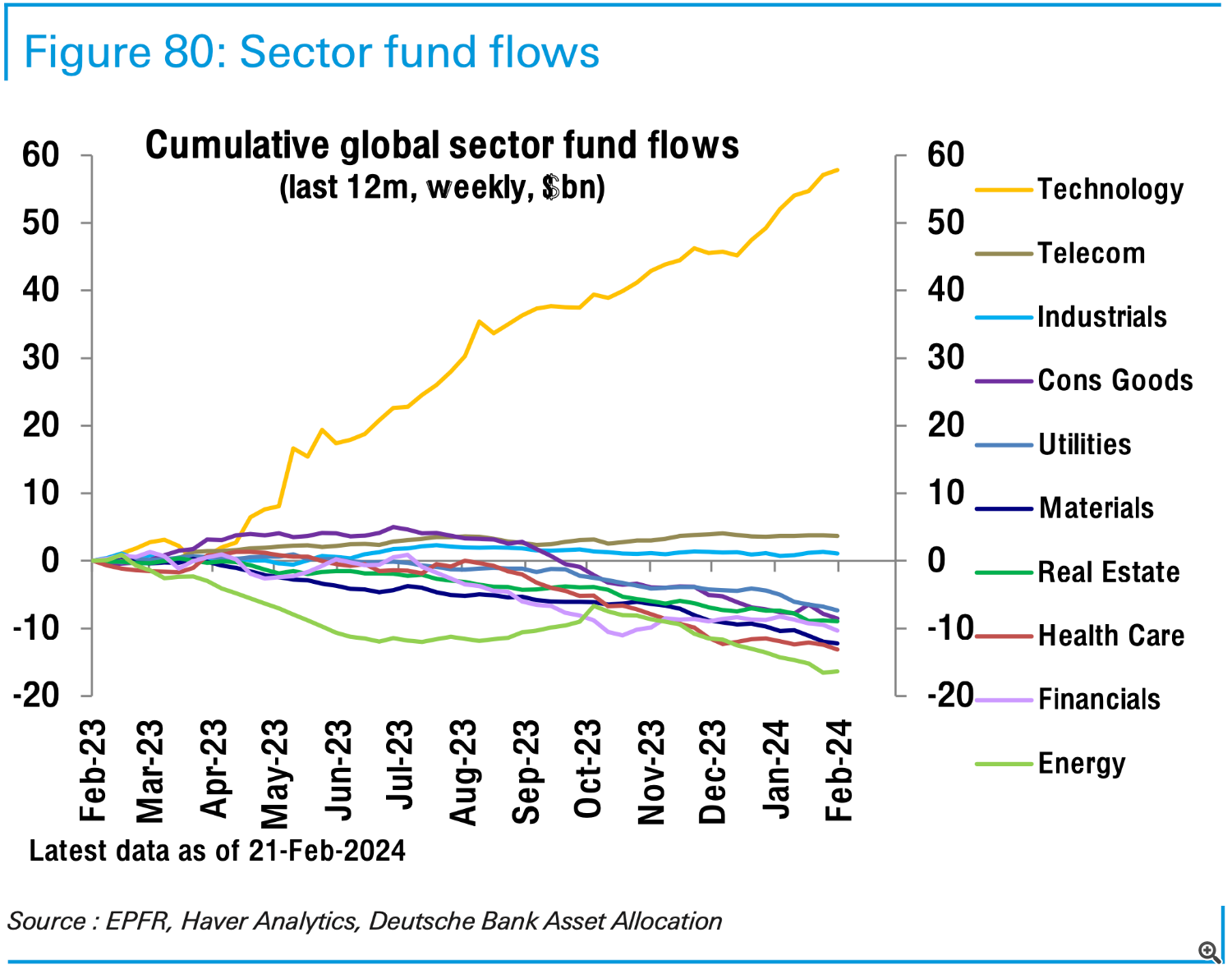

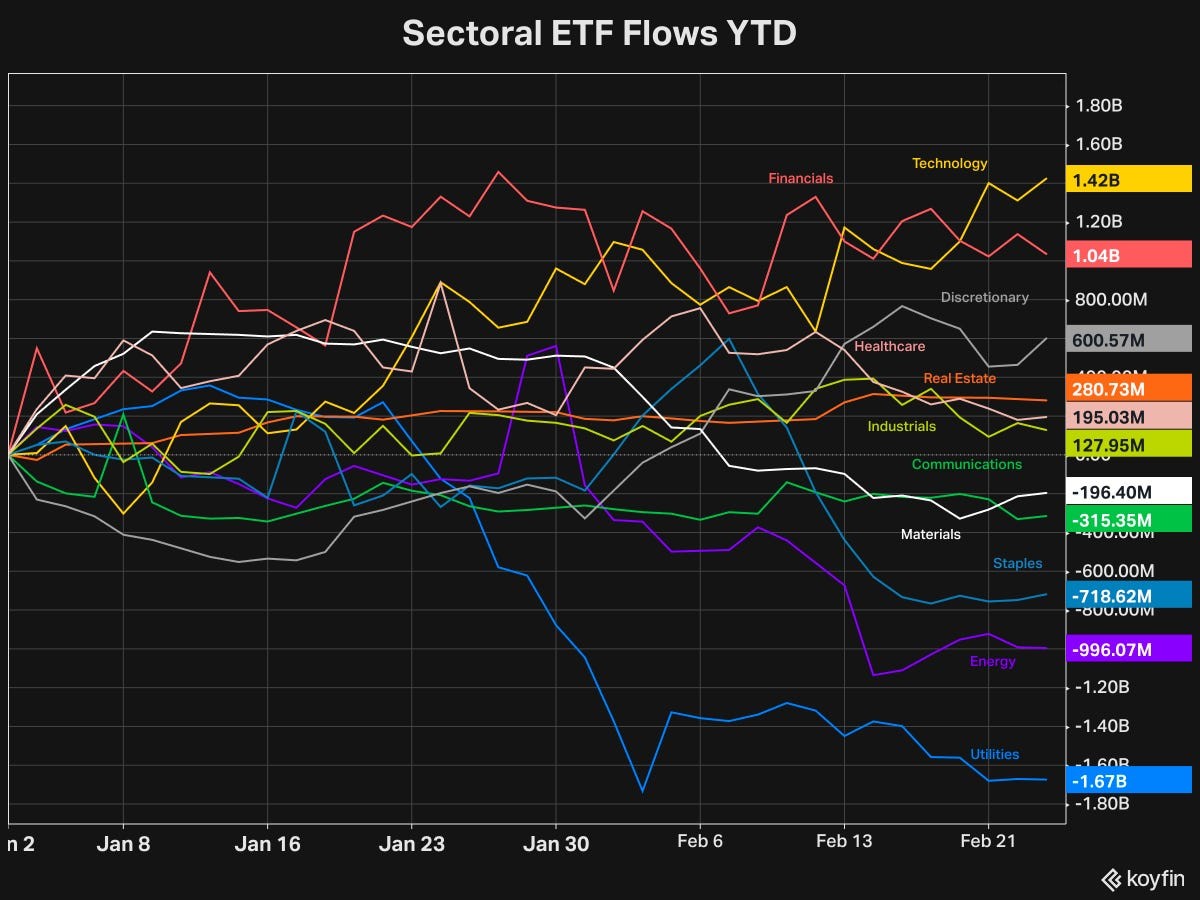

Inflows into the tech sector (+$0.7 billion) slowed, whereas the monetary sector (-$0.8 billion) skilled outflows for the 4th week in a row:

Flows into US equities by sector

Flows into US ETFs since early 2024 present outflows from the utilities, vitality, FMCG, supplies and communications sectors. The biggest inflows had been noticed within the know-how, finance and sturdy items sectors:

Flows into US ETFs since early 2024 by sector

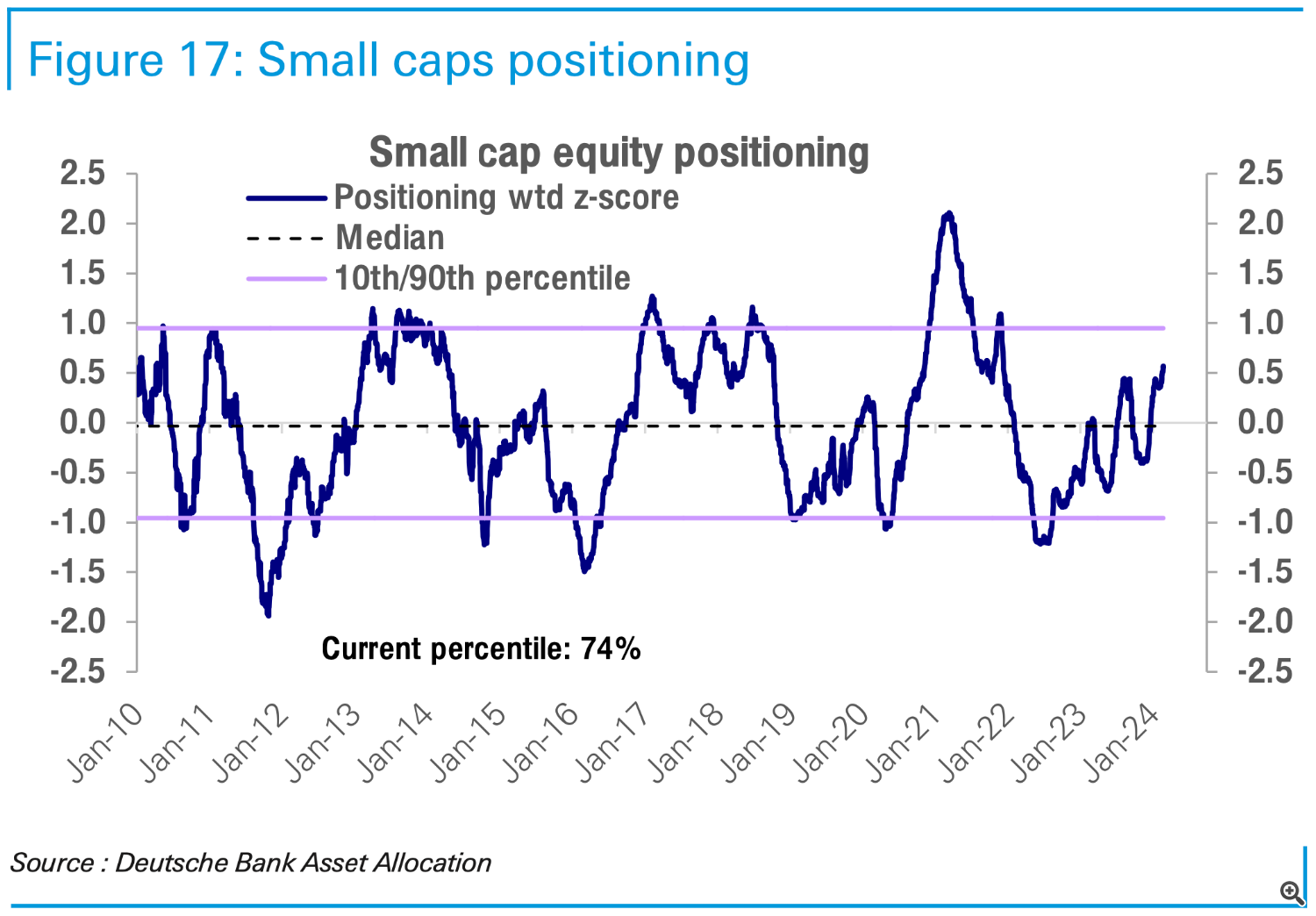

Positioning in small-cap shares rises to 26-month excessive:

Positioning in small cap shares

Institutional traders

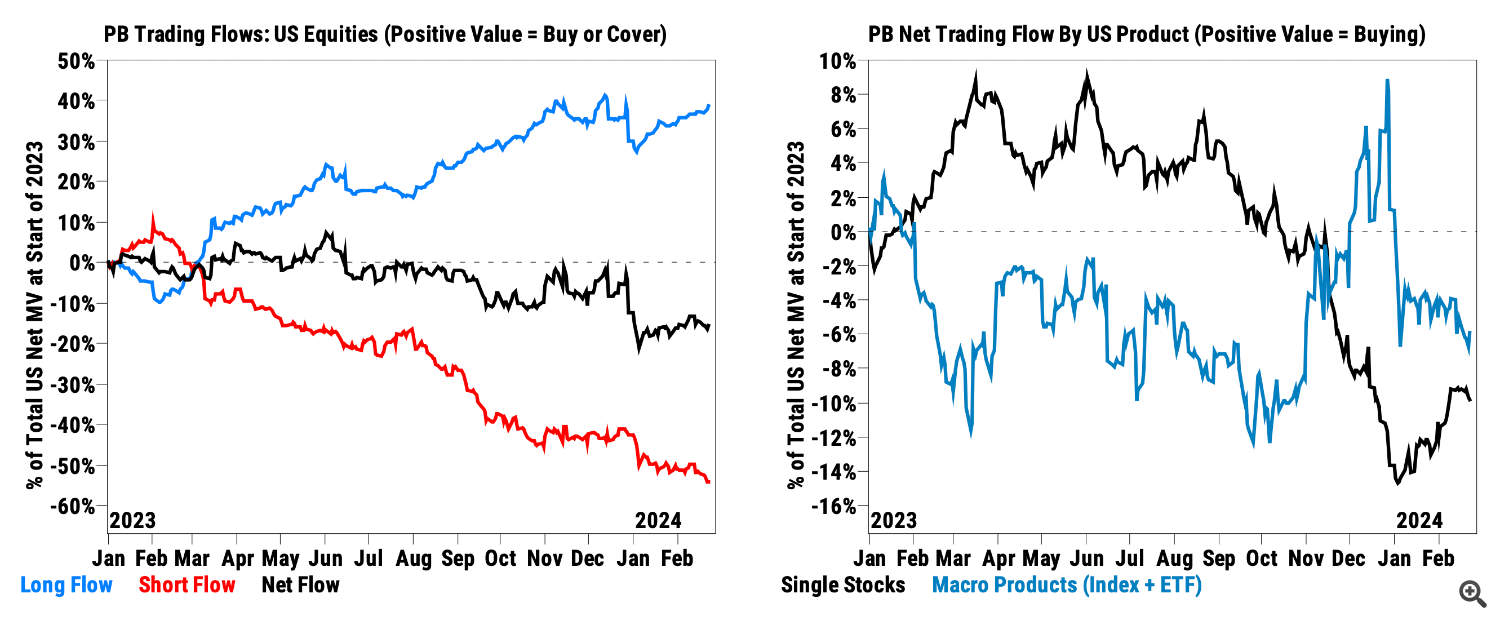

The previous 5 weeks have seen massive web promoting of US equities by hedge funds, with final week’s largest quick place in particular person US equities since September 2023:

Hedge fund flows into US equities

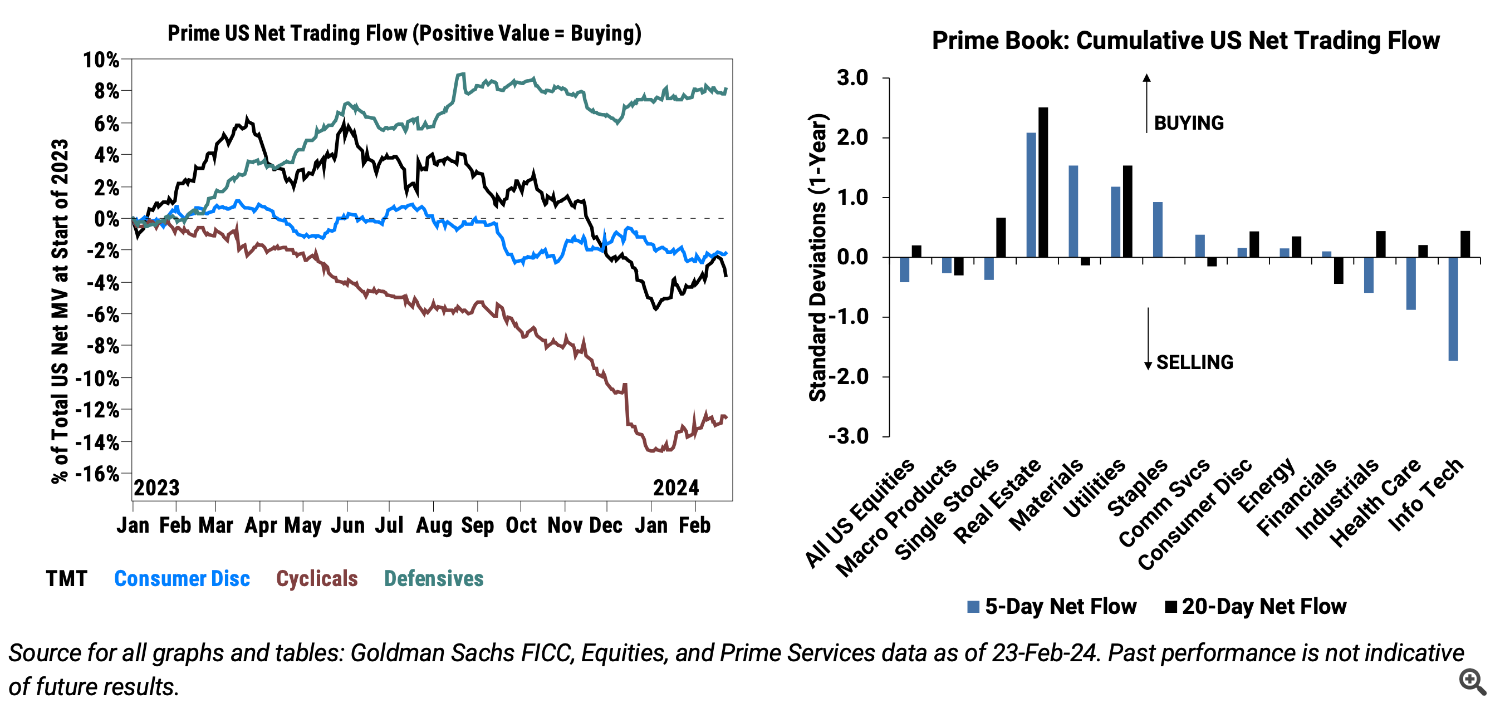

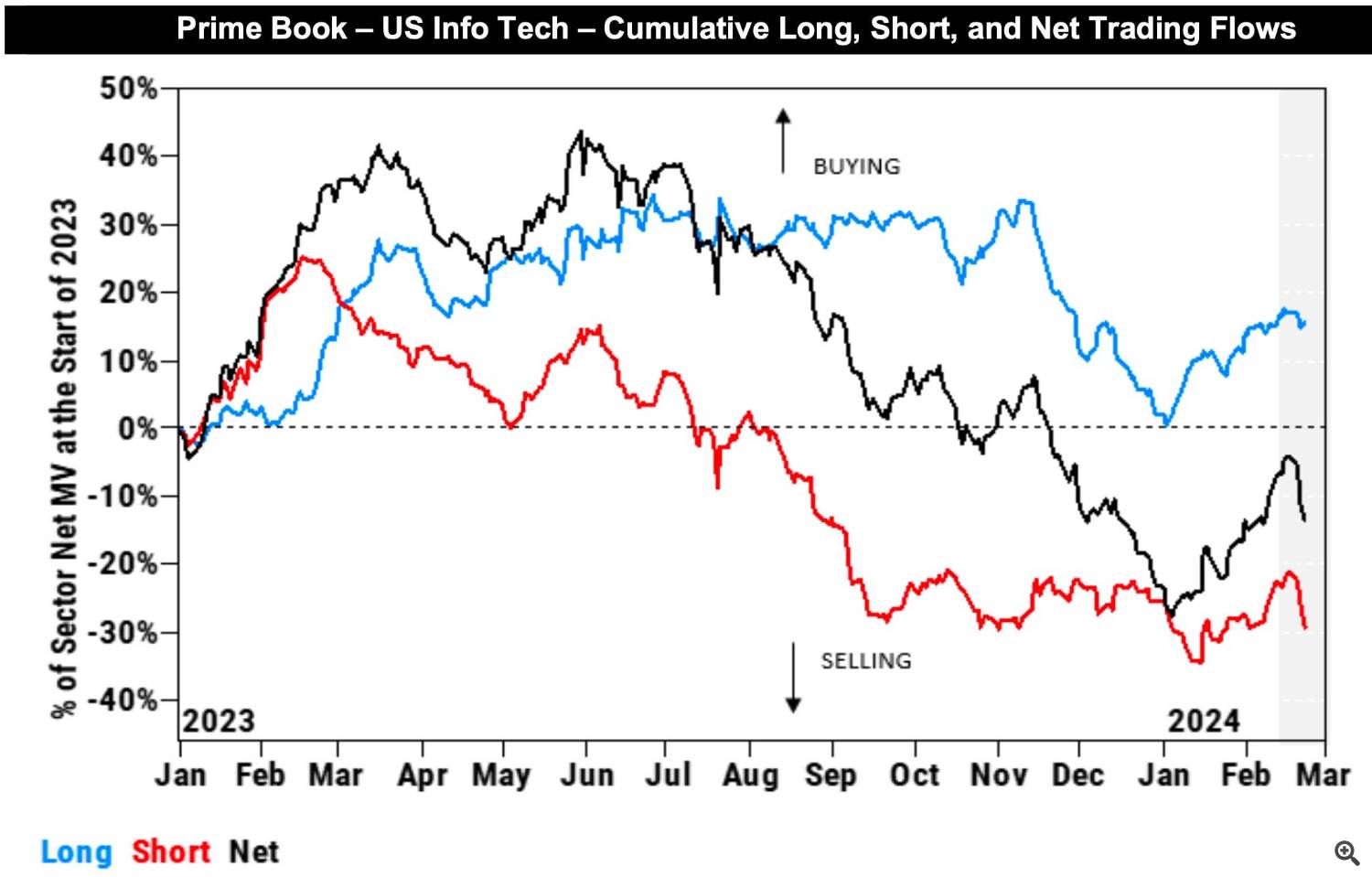

Hedge fund flows into particular person shares point out a rotation out of the know-how, healthcare and industrial sectors. Web gross sales of know-how shares final week had been the biggest since July:

Hedge fund flows into US equities by sector

Hedge fund flows into US know-how shares