Prototype: The last word buying and selling template.

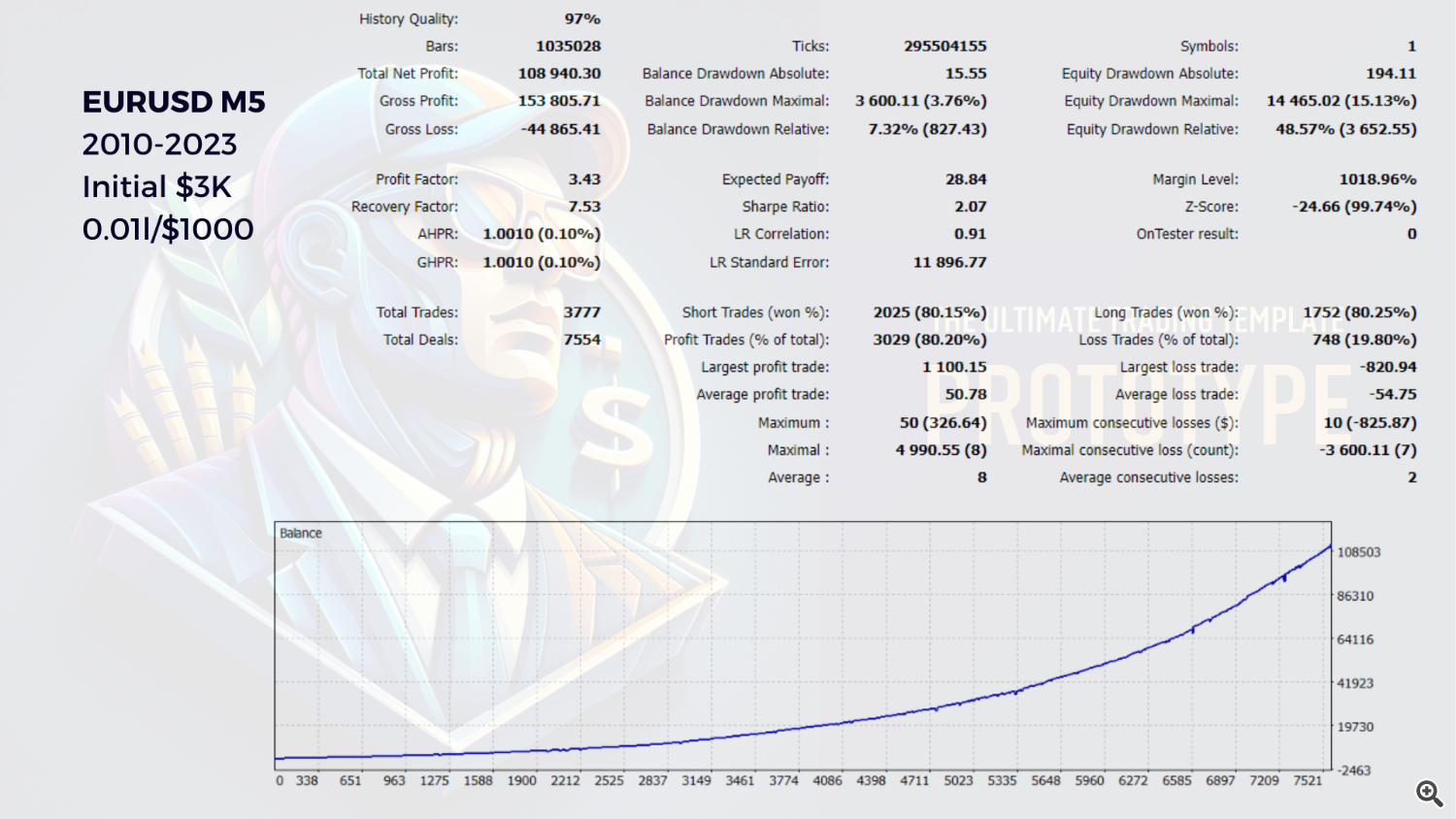

The Prototype isn’t just a buying and selling advisor, efficiently backtested on quotes since 2010, however a common device for creating virtually any buying and selling methods.

Prototype supply code might be obtainable to the shoppers inside 7-10 days after fee verification is accomplished.

Customers will even get entry to a non-public Telegram group created to assist Prototype.

In case you are in search of a flexible and highly effective device to commerce on the foreign exchange market with any buying and selling technique you need, you may wish to try Prototype. Prototype is a buying and selling answer that can be utilized as a common template for making use of completely different buying and selling methods. You’ll be able to customise Prototype in line with your wants, danger urge for food, and market scenario.

Prototype is designed that can assist you commerce extra successfully and effectively, by offering you with a versatile and customizable device that may match any buying and selling type and technique. You should utilize Prototype to check and optimize your buying and selling concepts, or to automate your buying and selling choices. Prototype is suitable with any foreign money pair and any timeframe. You may also use it with different indicators and professional advisors.

To make use of Prototype, you could have minimal information of the mql language so as to add the mandatory indicators and circumstances to the code of the professional advisor. Prototype has all the mandatory checks for verifying the code within the MQL market. Yow will discover extra details about Prototype and its parameters on the MQL market web site.

Listed here are a few of the fundamental advantages of utilizing Prototype:

- It permits you to commerce with any buying and selling technique you need, through the use of a common template that may be custom-made in line with your preferences and danger tolerance.

- It permits you to set the buying and selling ranges primarily based on fastened or relative strategies, relying in your buying and selling targets and market circumstances.

- It permits you to select the order measurement primarily based on fastened, balance-based, or risk-based strategies, and to make use of arithmetic or geometric development to calculate the order measurement for a number of orders.

- It permits you to use market or pending orders to enter and exit the market at the most effective costs, and to keep away from getting into the market throughout excessive volatility.

- It permits you to handle every order individually or management the entire basket of orders as a single entity, and to make use of bodily or digital ranges for cease loss and take revenue.

- It permits you to set the steadiness management to restrict the utmost drawdown or the utmost variety of orders, and to customise the degrees for every order and/or the whole basket, reminiscent of take revenue, cease loss, breakeven, and trailing cease.

- It permits you to partially shut orders to lock in income or scale back losses, and to entry a dialog window that reveals the statistics of your buying and selling efficiency and the buttons to shut all orders or solely the worthwhile or the shedding ones.

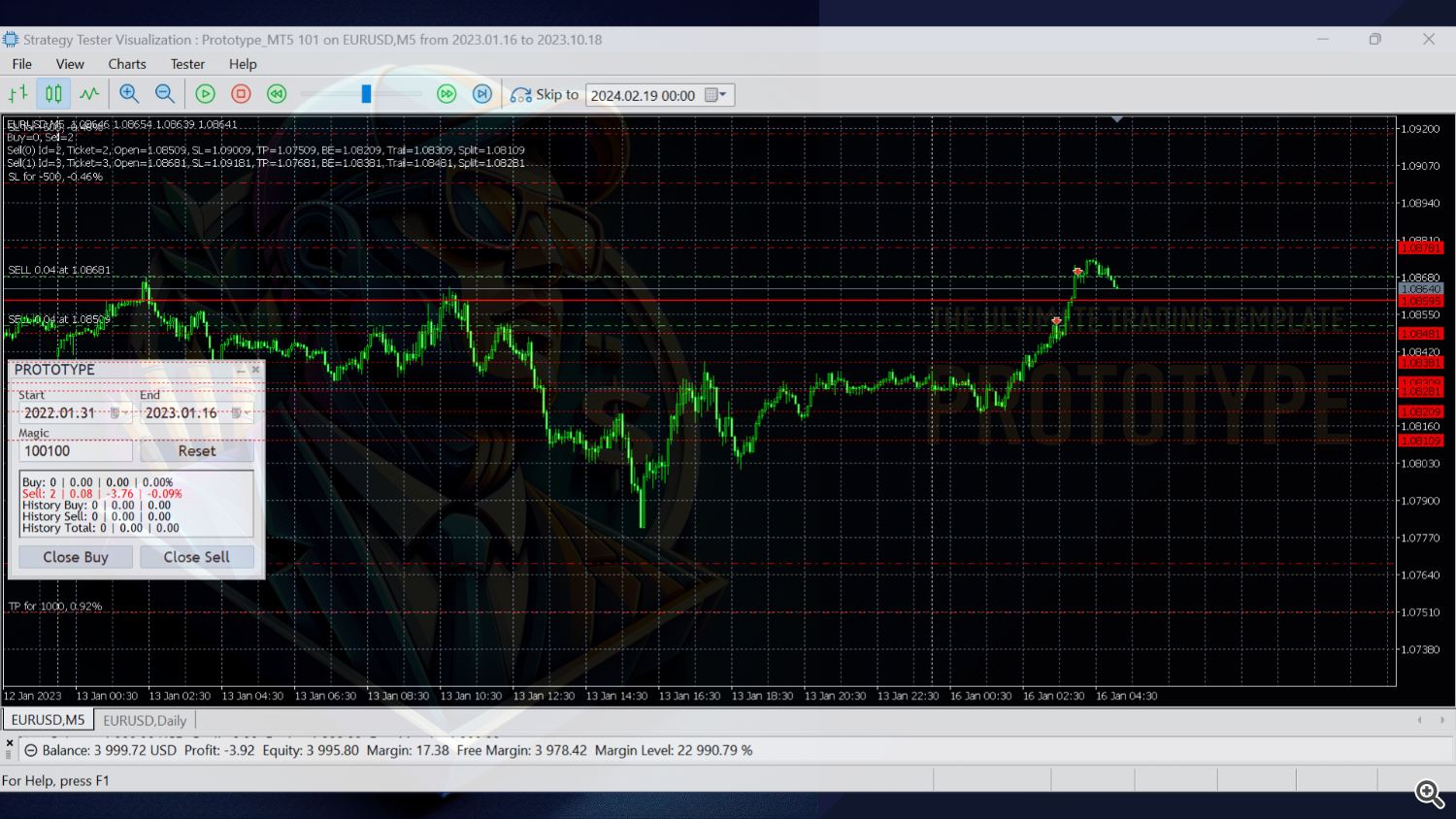

- It permits you to visualize your trades and buying and selling ranges on the chart with arrows and features that point out the entry and exit factors, the order measurement, and the revenue or loss.

- It permits you to check and optimize your buying and selling concepts, or to automate your buying and selling choices, through the use of a versatile and customizable device that may swimsuit any buying and selling type and technique.

- It’s suitable with any foreign money pair and any timeframe, and can be utilized with different indicators and professional advisors.

- It has all the mandatory checks for verifying the code within the MQL market.

One of many key options of Prototype is the flexibility to set the buying and selling ranges. You should utilize fastened or relative ranges. Mounted ranges are set in factors from the present worth. Relative ranges are set in share from the present worth. You should utilize fastened or relative ranges to set the entry, exit, and cease ranges to your orders.

One other characteristic of Prototype is the flexibility to decide on the order measurement. You should utilize fastened, balance-based, or risk-based strategies. The fastened technique permits you to set a relentless order measurement in heaps, whatever the market motion. The balance-based technique calculates the order measurement primarily based on the share of the steadiness you wish to use per commerce. The danger-based technique determines the order measurement primarily based on the share of the steadiness you might be able to danger per commerce.

You may also select the tactic of calculating the order measurement for a number of orders. You should utilize arithmetic or geometric development. Arithmetic development provides a relentless worth to the order measurement for every subsequent order. Geometric development multiplies the order measurement by a relentless issue for every subsequent order. You should utilize arithmetic or geometric development to extend or lower the order measurement for a number of orders.

You may also select find out how to enter and exit the market. You should utilize market or pending orders. Market orders are executed immediately on the present market worth. Pending orders are positioned at a specified worth and are executed when the market reaches that worth. You should utilize pending orders to enter the market at a extra advantageous worth or to keep away from getting into the market throughout excessive volatility.

You may also select find out how to handle your orders. You’ll be able to handle every order individually or management the entire basket of orders as a single entity. You should utilize bodily or digital ranges for cease loss and take revenue. Bodily ranges are positioned on the server and are seen to the dealer. Digital ranges are saved on the native pc and are invisible to the dealer. You should utilize bodily or digital ranges to guard your orders from slippage or manipulation.

You may also set the steadiness management to restrict the utmost drawdown or the utmost variety of orders. You may also customise the degrees for every order and/or the whole basket, reminiscent of take revenue, cease loss, breakeven, and trailing cease. These ranges could be modified manually or robotically primarily based available on the market circumstances.

You may also select find out how to shut your orders. You’ll be able to partially shut orders to safe income or scale back losses. You’ll be able to entry a dialog window that reveals the statistics of your buying and selling efficiency and the buttons to shut all orders or solely the worthwhile or the shedding ones. You may also visualize your trades and buying and selling ranges on the chart with arrows and features that point out the entry and exit factors, the order measurement, and the revenue or loss.

Prototype is a must have for any foreign exchange dealer who needs to have extra management and adaptability over their buying and selling actions. With Prototype, you possibly can commerce with confidence and comfort, and obtain your buying and selling targets.

Magic – magic quantity

Remark – remark

Positions Whole Max, pos – most whole variety of opened positions

Positions Course Max, pos – most variety of open positions in a single course

Quantity Whole Max, lot – most whole quantity of all open positions

Quantity Place Max, lot – most quantity of every place

Unfold Max, level – most unfold worth for buying and selling actions

Course – place course

DIR_LONG – solely lengthy

DIR_SHORT – solely brief

DIR_LONGSHORT – lengthy and brief

Timeframe In – place opening timeframe

Motion Kind – commerce motion sort

ACT_TYPE_TICK – on a brand new tick

ACT_TYPE_BAR – on a brand new bar

Timeframe Motion – commerce motion timeframe (excluding the opening)

Order Kind – order sort

ORD_TYPE_MARKET – market orders

ORD_TYPE_PENDING – pending orders

Management Mode (Separate/Basket) – open place management mode

CTRL_MODE_SEPARATE – separate processing of every merchandise

CTRL_MODE_BASKET – complete basket processing

— Time —

Hour On – preliminary hour for opening new positions (solely first place in CTRL_MODE_BASKET)

Minute On – preliminary minute for opening new positions (solely first place in CTRL_MODE_BASKET)

Hour Off – preliminary hour for opening new positions (solely first place in CTRL_MODE_BASKET)

Minute Off – preliminary minute for opening new positions (solely first place in CTRL_MODE_BASKET)

— Quantity —

Kind – quantity calculation sort

VOL_TYPE_FIXED – fastened quantity = Inititial Worth

VOL_TYPE_RELATIVE – steadiness primarily based quantity

VOL_TYPE_RISK – danger primarily based quantity (loss as a share of steadiness sheet)

Inititial Worth – preliminary quantity worth (VOL_TYPE_FIXED: fixed worth/VOL_TYPE_RELATIVE: base worth/VOL_TYPE_RISK: danger worth)

Relative Worth – a part of steadiness: quantity=Steadiness/RelativeValue*InitialValue (applies to sort VOL_TYPE_RELATIVE)

Development Kind – development sort for quantity calculation

PRG_TYPE_ARITH – ariyhmetic development: quantity=final quantity + ProgressionValue

PRG_TYPE_GEO – geometric development: quantity=final quantity * ProgressionValue

Development Worth – development issue (0 – development isn’t used)

— Ranges —

Kind – commerce lavels (stoploss, takeprofit, cut up, trailing) sort

LEV_TYPE_FIXED – fastened ranges, factors

LEV_TYPE_RELATIVE – common bar measurement primarily based ranges, % of common bar measurement

Avrg Interval – averaging interval (for LEV_TYPE_RELATIVE)

Digital Stoploss – stoploss worth is managed by EA and isn’t set on the server (0-unused), LEV_TYPE_FIXED: level/LEV_TYPE_RELATIVE: %

Digital Takeprofit – takeprofit worth is managed by EA and is notset on the server (0-unused), LEV_TYPE_FIXED: level/LEV_TYPE_RELATIVE: %

Place Stoploss – stoploss worth is ready on the server (0-unused), LEV_TYPE_FIXED: level/LEV_TYPE_RELATIVE: %

Place Takeprofit – takeprofit worth is ready on the server (0-unused), LEV_TYPE_FIXED: level/LEV_TYPE_RELATIVE: %

Grid Again – distance between positions towards course (0-unused), LEV_TYPE_FIXED: level/LEV_TYPE_RELATIVE: %

Grid Ahead – distance between positions within the course (0-unused), LEV_TYPE_FIXED: level/LEV_TYPE_RELATIVE: %

Shift – degree offset in mode ORD_TYPE_PENDING (0-unused), LEV_TYPE_FIXED: level/LEV_TYPE_RELATIVE: %

— Person code begin —

— Sample —

RSI Interval

RSI Stage

ATR Interval

ATR Avrg Interval

ATR/Atr Avrg Ratio

— Person code finish —

— Exit —

Exit on/off – enabling/disabling further circumstances for closing/deleting positions

— Trailing —

Breakeven Begin – degree of setting to breakeven (0-unused), LEV_TYPE_FIXED: level/LEV_TYPE_RELATIVE: %

Trailing Begin – trailing cease activation degree (0-unused), LEV_TYPE_FIXED: level/LEV_TYPE_RELATIVE: %

Trailing Distance – trailing cease distance, LEV_TYPE_FIXED: level/LEV_TYPE_RELATIVE: %

— Break up —

Break up Begin – cut up activation degree (0-unused), LEV_TYPE_FIXED: level/LEV_TYPE_RELATIVE: %

Break up Step – cut up distance, LEV_TYPE_FIXED: level/LEV_TYPE_RELATIVE: %

Break up Lot – cut up worth, % of remaining quantity

— Steadiness Cease —

Kind – steadiness cease sort

FIXED – fastened worth, $

RELATIVE – relative worth, % of steadiness

Worth – steadiness cease worth (0 – unused,>0 – revenue management, <0 – loss management)

— Show —

Colour Purchase – purchase ranges/positions shade (clrNone-unused)

Colour Promote – promote ranges/positions shade (clrNone-unused)

Trades – offers/ranges show sort

DISP_NONE – no show

DISP_MT – by terminal

DISP_EA – by EA

Buying and selling Ranges – allow/disable show of commerce ranges

Dialog – allow/disable dialog window

Dialog Hystory Interval – interval of commerce historical past, D1 timeframe

Remark Trades – allow/disable feedback

Hyperlinks