As earnings season winds down we’re getting some robust numbers from main fintech corporations. In the present day, it was MoneyLion’s flip as they reported their earnings earlier than the markets opened this morning.

Listed here are among the key takeaways from their report.

Product Enlargement and Buyer Base Progress

MoneyLion reported including an astounding 7.5 million whole prospects in FY 2023 bringing their whole to 14 million, greater than doubling the variety of prospects from Dec 2022. This progress is partially attributed to the enlargement of its product choices, aiming to raised match prospects with appropriate monetary merchandise. The initiative seems to contribute to each attracting new customers and rising engagement amongst present ones, inside their framework of constructing a extra complete monetary companies ecosystem.

Concentrate on Efficiency Indicators

The earnings presentation (PDF hyperlink) highlighted the corporate’s reliance on year-over-year (Y/Y) key efficiency indicators (KPIs) to drive its progress and profitability, aiming in direction of reaching the “Rule of 40.” This business benchmark signifies that an organization’s progress fee and revenue margin mixed ought to exceed 40%, a metric usually related to sustainable progress. The emphasis on these KPIs is indicative of the corporate’s strategic planning and operational focus.

Membership Fashions and Partnerships

A shift in direction of a premium membership mannequin was famous as a method to extend the overall addressable market (TAM) and safe extra constant income streams. The mannequin goals to supply further worth to customers whereas establishing a extra predictable income base in a aggressive business.

The corporate additionally highlighted its community of over 1,100 enterprise companions, which drives round 205 million annual buyer inquiries. This in depth partnership community, enhanced by a strategic alliance with EY, goals to increase the corporate’s attain and distribution capabilities.

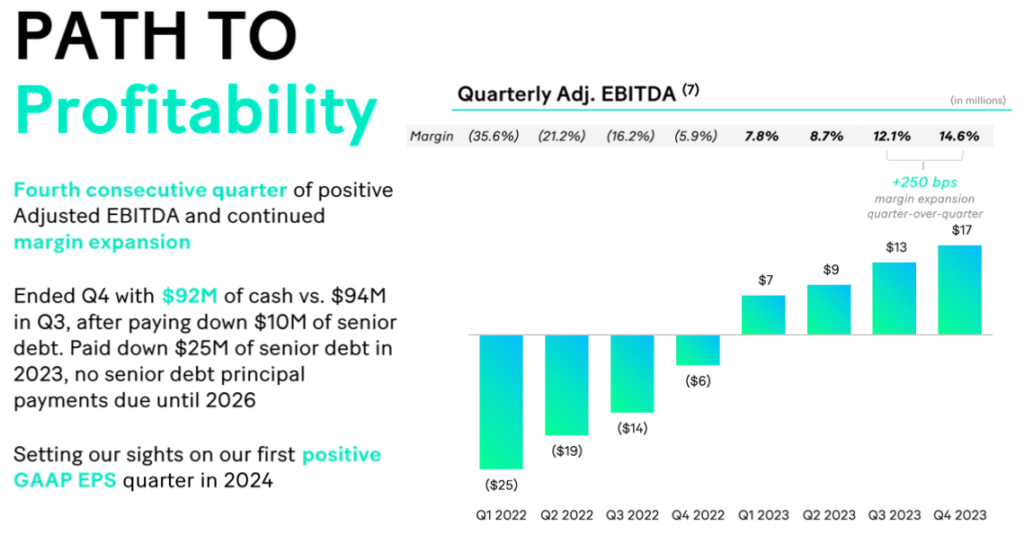

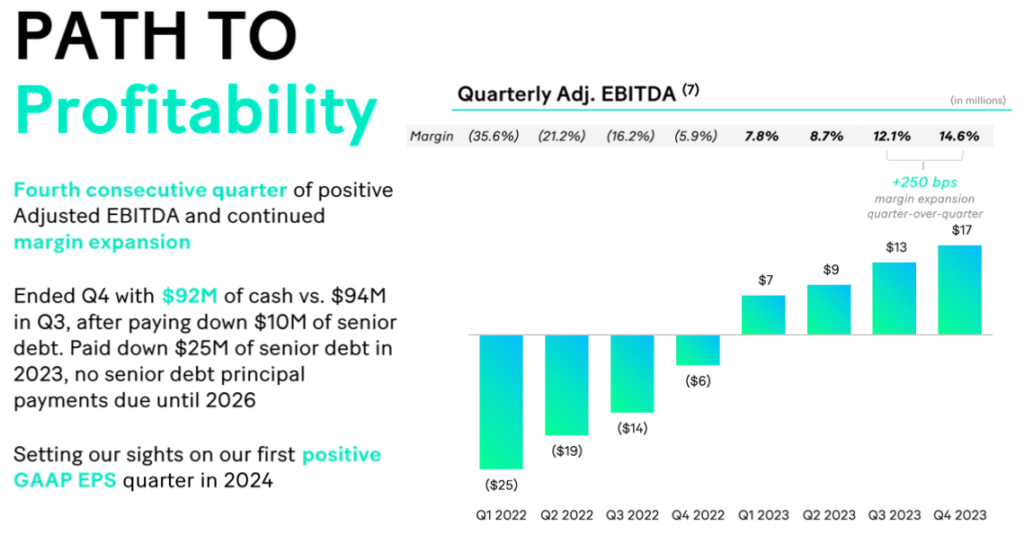

Monetary Highlights and Future Projections

The earnings presentation reported a yr of report income and a rise in gross revenue margins, pointing to the corporate’s operational efficiencies and profitable income technology methods. The presentation additionally detailed the lifetime efficiency of client and enterprise cohorts, suggesting vital recurring income streams.

A comparability of the FY 2023 steering towards precise outcomes was supplied, demonstrating the corporate’s forecasting accuracy and operational efficiency. Trying forward, the Q1 2024 steering displays an anticipation of continued progress and profitability, underscored by strategic buyer acquisition and lifecycle administration initiatives.

The Q&A With Analysts

The Q&A with analysts centered on a lot of key areas:

- EY Partnership: A major focus was positioned on the just lately introduced strategic alliance with EY, aimed toward co-building digital options for mid-sized monetary establishments to boost their digital capabilities, significantly in fraud detection, KYC, and onboarding processes. This partnership, leveraging MoneyLion’s consumer-facing applied sciences and EY’s banking sector experience, is anticipated to considerably contribute to MoneyLion’s progress, significantly in distributing market expertise to banks.

- Credit score Card Vertical Entry: The introduction into the bank card vertical is positioned as a strategic transfer to diversify MoneyLion’s market choices. The latest CFPB rules on bank card charges had been mentioned, with MoneyLion’s market mannequin considered as well-suited to navigate and probably profit from these regulatory modifications by providing a broad vary of economic merchandise to shoppers.

- MoneyLion WOW Membership: The subscription mannequin, MoneyLion WOW, was highlighted for its potential to deepen buyer engagement and enhance lifetime worth. This mannequin gives a variety of advantages, together with money again on merchandise and unique options, aimed toward consolidating prospects’ monetary actions inside the MoneyLion ecosystem. Preliminary client demand for the WOW membership has been sturdy, contributing to the corporate’s technique to develop its whole addressable market and improve recurring income streams.

- Progress Technique: MoneyLion’s progress technique for 2024 contains specializing in funnel optimization, increasing product verticals past lending (e.g., insurance coverage, bank cards, mortgages), and enhancing distribution by strategic partnerships. The corporate goals to leverage these methods alongside its market expertise to handle the evolving wants of economic companies shoppers and enterprise companions.

A Optimistic Market Response

Traders welcomed this robust earnings report from MoneyLion because the inventory completed up 28% as we speak.