The markets continued to commerce on anticipated strains. The buying and selling week was quick as Friday was a buying and selling vacation on account of Mahashivratri. Within the 4 buying and selling classes, the markets stayed uneven and didn’t make any particular and convincing strikes whereas they continued to modestly advance on a weekly foundation. The buying and selling vary additionally stayed slim; the Index oscillated in an outlined 301.30-point buying and selling vary whereas staying devoid of directional bias on most events. The volatility additionally dipped; the India VIX declined by 10.65% to 13.61. By and huge, whereas not displaying any significant upsides, the headline index closed with a internet weekly achieve of 154.80 factors (+0.69%).

As we head right into a contemporary week, the markets stay liable to consolidation at larger ranges. The Choices knowledge proceed to point out a buildup of resistance simply above the present ranges. There are sturdy prospects that the markets could present incremental advances, however on the identical time, additionally keep liable to profit-taking bouts at larger ranges. A sustained upmove is unlikely and that might occur provided that Nifty is ready to take out 22600 ranges and better. This warrants a powerful vigil at larger ranges; it could be necessary to not solely establish alternatives with sturdy relative power but additionally hold defending earnings at larger ranges.

Chasing the development ought to be carried out very mindfully and with strict protecting stops in place. The approaching week is prone to as soon as once more see a quiet begin to the commerce. The degrees of 22600 and 22750 are prone to act as resistance ranges; helps are available in decrease at 22230 and 22050 ranges.

The weekly RSI stands at 74.52; it stays in a mildly overbought zone. It additionally stays impartial and doesn’t present any divergence towards the value. The weekly MACD stays bullish and stays above the sign line.

A candle with a small actual physique emerged; this denotes the shortage of conviction and indecisiveness of the market individuals at present ranges.

The sample evaluation of the weekly charts exhibits that the Nifty continues effectively whereas advancing the breakout that it achieved because it crossed above 20800 ranges. Following a breakout from the rising channel, the Index has continued to advance whereas forming incremental highs. The bands have gotten wider; there are prospects that this bulge could kill the development and push the markets underneath some consolidation.

There aren’t any indicators although on the charts that recommend any corrective transfer to occur. Nevertheless, that being stated, the technical construction of the charts makes it evident that the markets are on the level of taking a breather. The present uptrend could keep intact or could not instantly reverse, however the Nifty actually appears to be like liable to some consolidation at larger ranges. Whereas we hold following the development and search for shares that present improved or sturdy relative power, equal significance ought to be laid on the safety of earnings at larger ranges. It’s strongly beneficial that whereas one could proceed to comply with the development, successfully trailed stops could also be adopted whereas maintaining general leveraged positions at modest ranges. A cautious outlook is suggested for the week.

Sector Evaluation for the approaching week

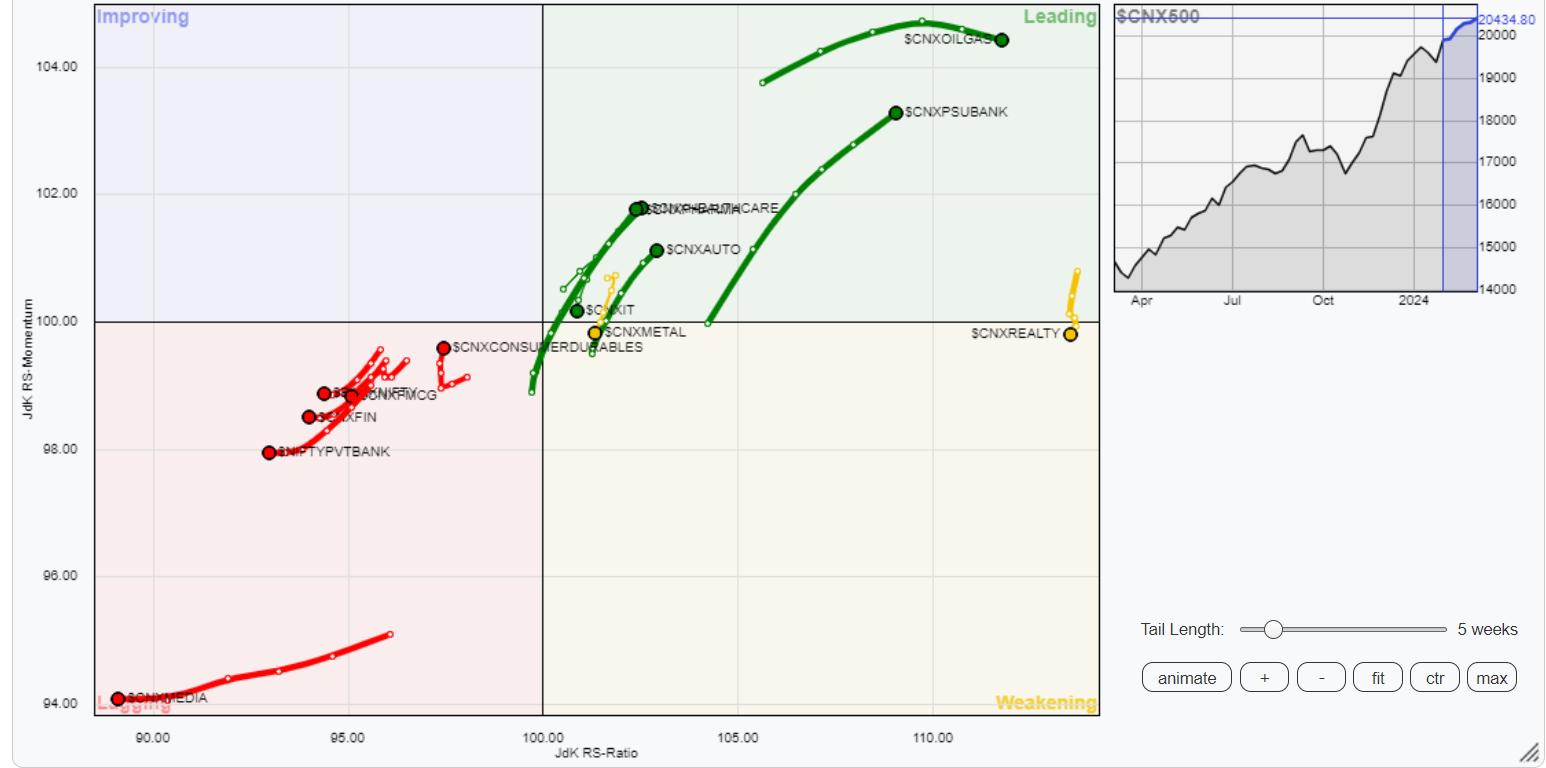

In our have a look at Relative Rotation Graphs®, we in contrast varied sectors towards CNX500 (NIFTY 500 Index), which represents over 95% of the free float market cap of all of the shares listed.

Relative Rotation Graphs (RRG) present that whereas staying contained in the main quadrant, Nifty IT, Commodities, and the PSE teams are displaying a slowdown of their relative momentum towards the broader markets. Apart from this, PSU Banks, Pharma, Infrastructure, and Auto indices are contained in the main quadrant and will proceed to comparatively outperform the broader markets.

The Realty Index is again contained in the weakening quadrant and so is the Metallic Index. These two sectors together with the Nifty Midcap 100 index which can be within the weakening quadrant may even see their relative efficiency slowing down whereas they might proceed to carry out on a person foundation.

Nifty FMCG, Monetary Companies, Service Sector Index, Banknifty, and Media proceed to languish contained in the lagging quadrant. The Consumption Index can be contained in the lagging quadrant however seems to be enhancing on its relative momentum.

No sectors are current contained in the enhancing quadrant.

Essential Be aware: RRG™ charts present the relative power and momentum of a bunch of shares. Within the above Chart, they present relative efficiency towards NIFTY500 Index (Broader Markets) and shouldn’t be used instantly as purchase or promote indicators.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

www.EquityResearch.asia | www.ChartWizard.ae

Milan Vaishnav, CMT, MSTA is a capital market skilled with expertise spanning near twenty years. His space of experience contains consulting in Portfolio/Funds Administration and Advisory Companies. Milan is the founding father of ChartWizard FZE (UAE) and Gemstone Fairness Analysis & Advisory Companies. As a Consulting Technical Analysis Analyst and along with his expertise within the Indian Capital Markets of over 15 years, he has been delivering premium India-focused Impartial Technical Analysis to the Purchasers. He presently contributes each day to ET Markets and The Financial Occasions of India. He additionally authors one of many India’s most correct “Every day / Weekly Market Outlook” — A Every day / Weekly E-newsletter, at present in its 18th 12 months of publication.