Fast Take

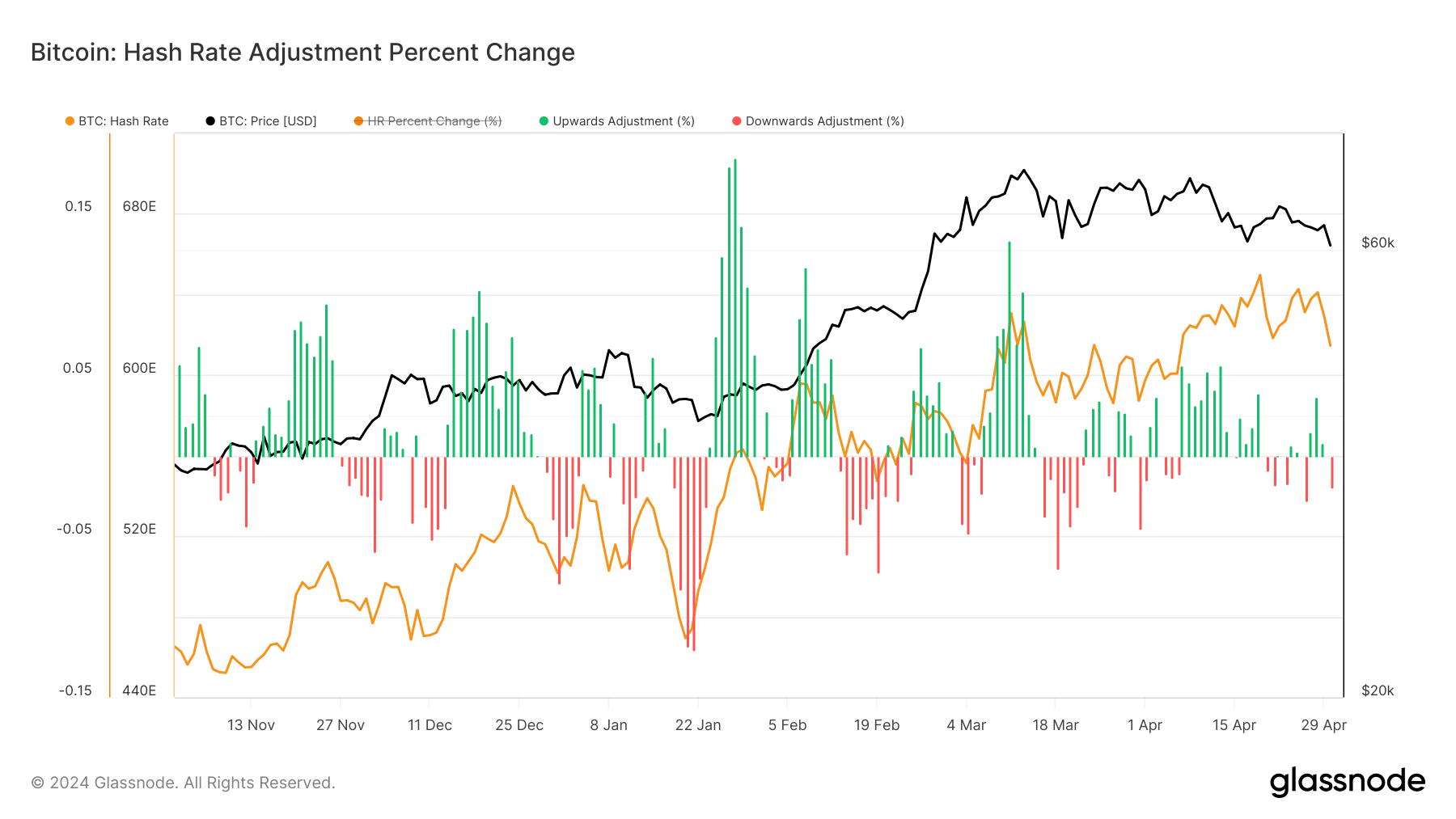

CryptoSlate’s evaluation sheds mild on the anticipated hash fee adjustment, with historic developments indicating a possible 20% lower post-halving. Previous cycles replicate important hash fee corrections: 39% in 2012, 11% in 2016, and 26% in 2020. As of 2024, we’ve noticed a 6% decline to date, taking the hash fee from 649 eh/s to 619 eh/s.

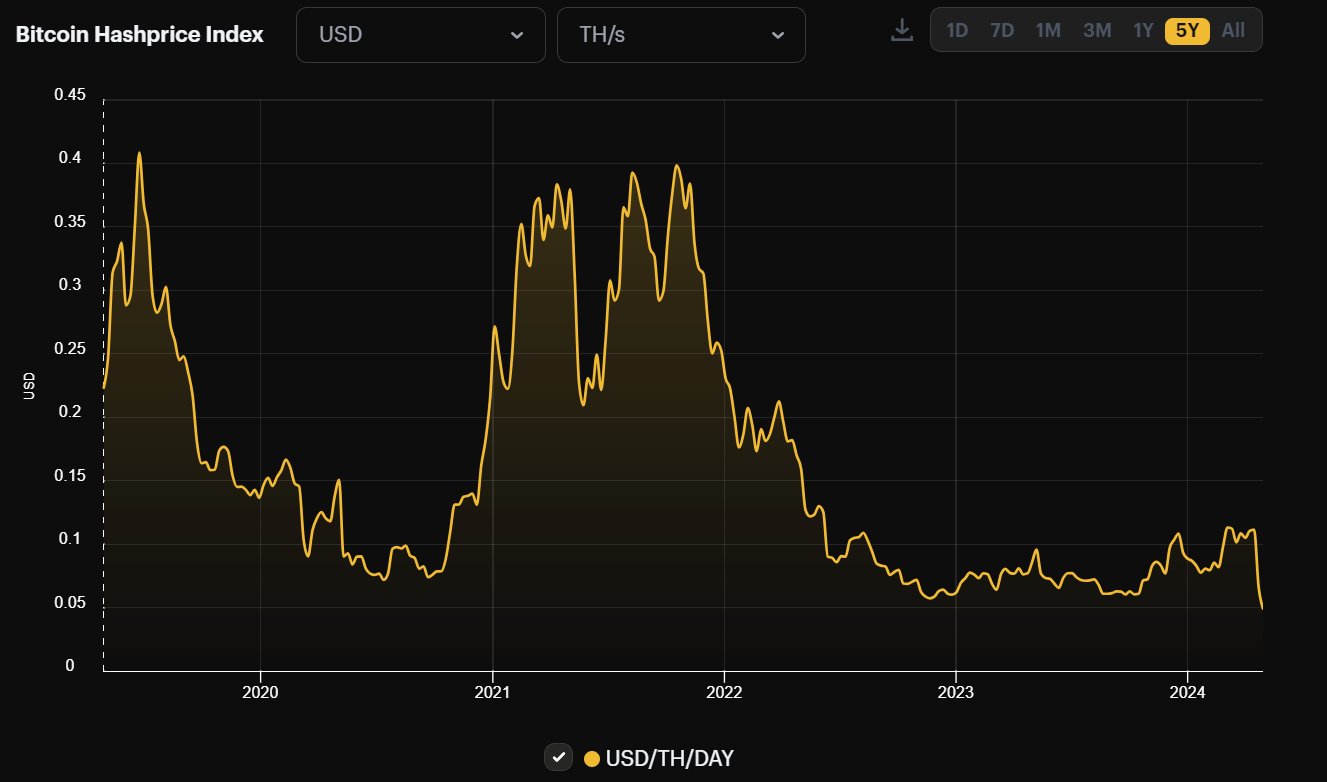

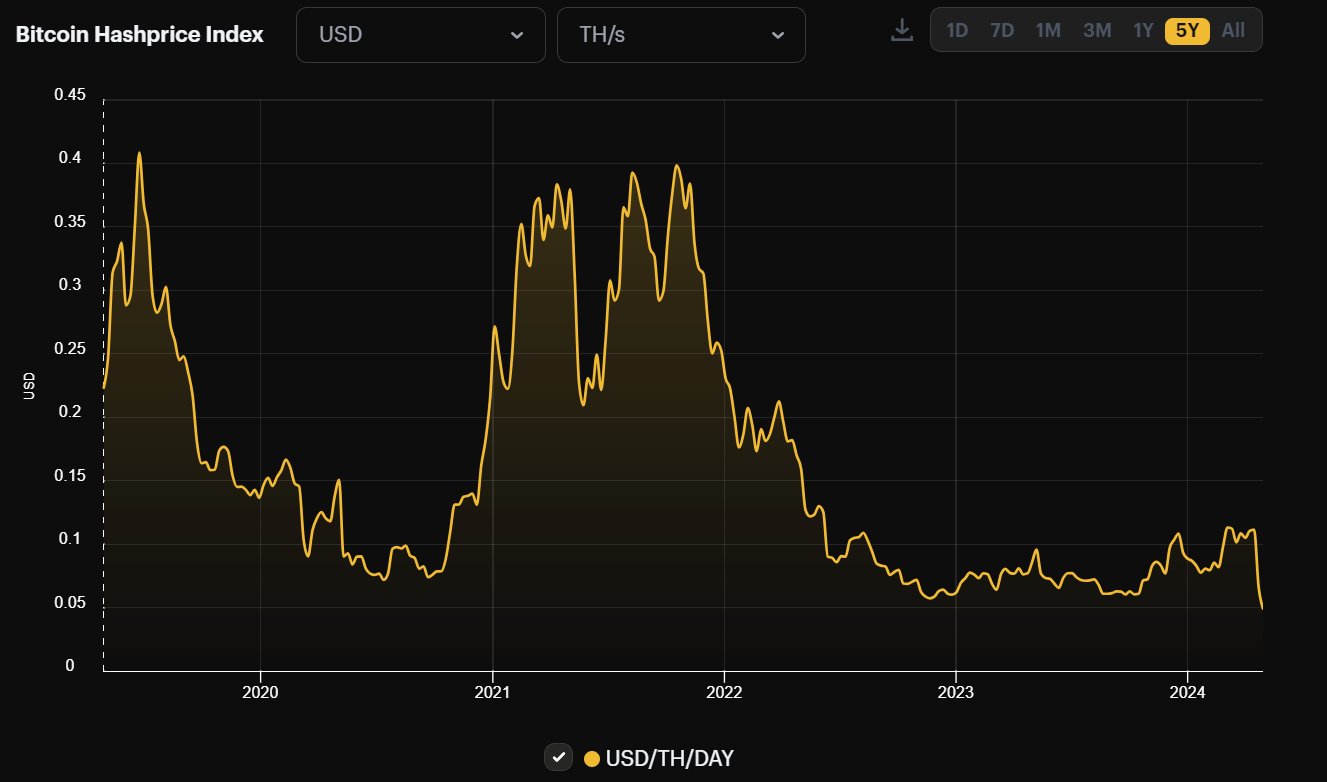

The value of Bitcoin has tumbled from its highs of round $73,500 to under $57,000, and because of this, additional hash fee drops are anticipated. Luxor’s “hashprice” metric, which quantifies the anticipated worth of 1 TH/s of hashing energy per day, presently sits at a five-year low of $0.045 per terahash/second per day.

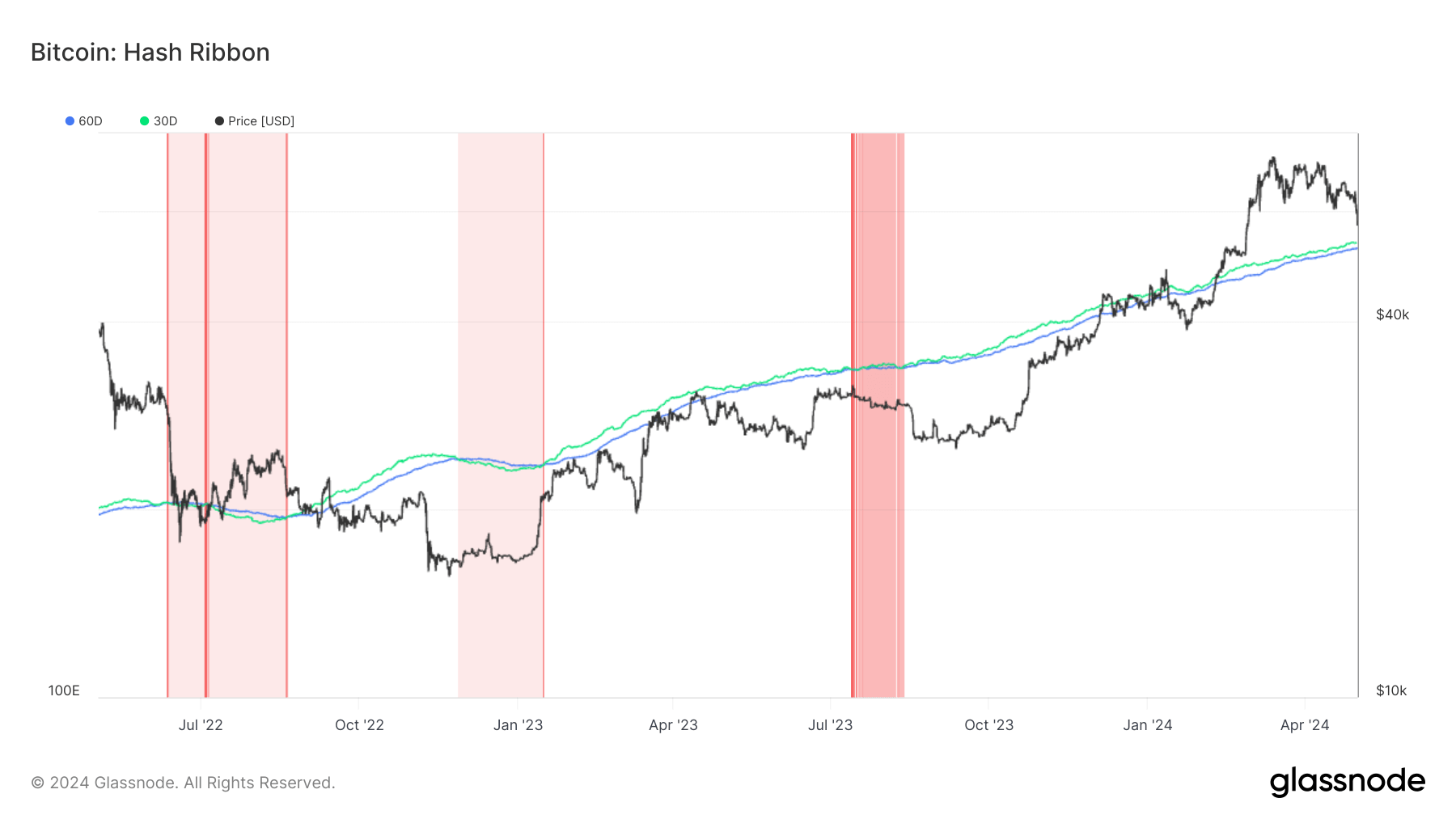

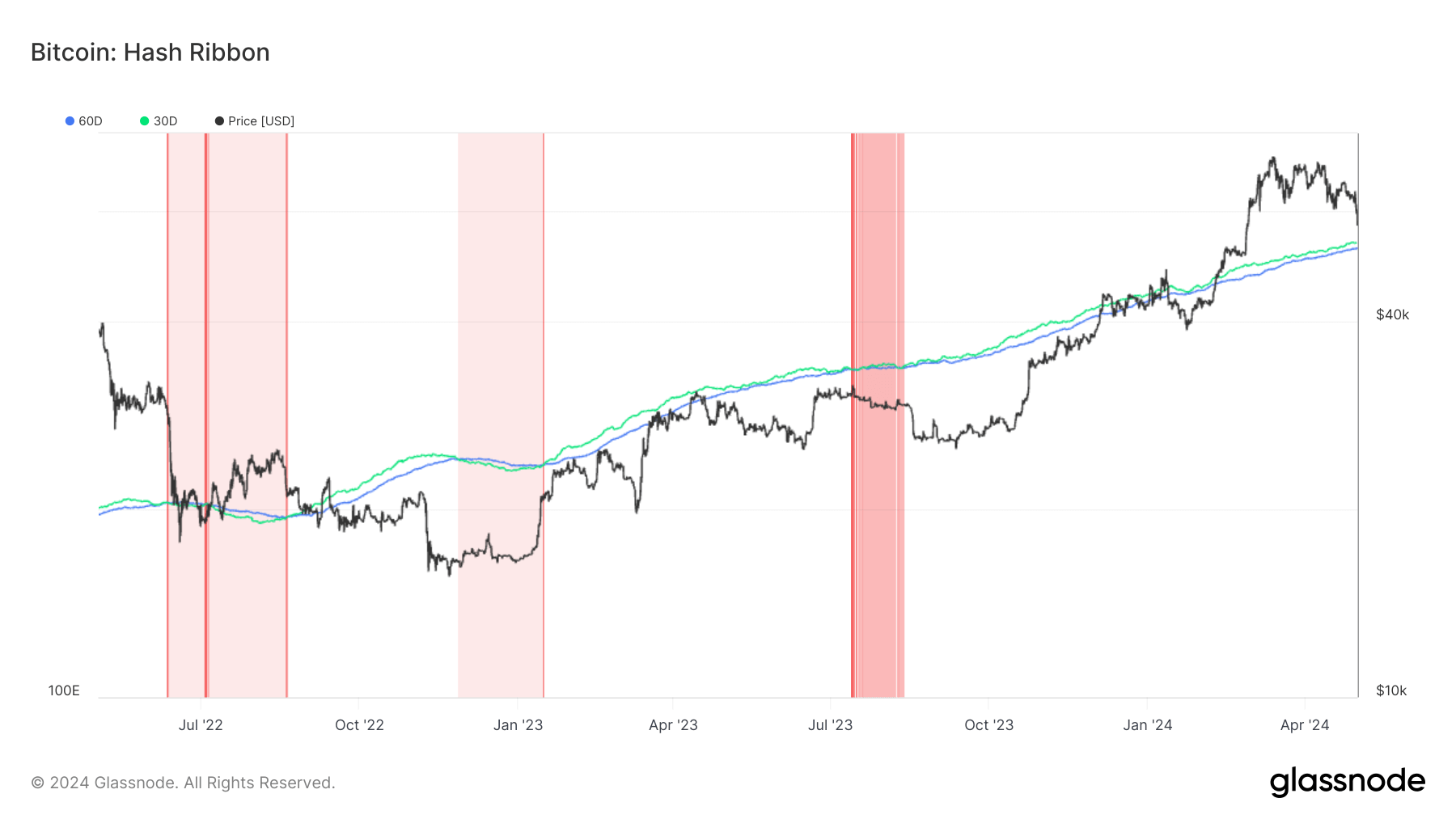

If this pattern persists, the digital asset group could witness a miner capitulation occasion, the place Bitcoin mining turns into too costly relative to the price of mining. This situation is often recognized by Glassnode’s hash ribbon metric, which has traditionally signaled bottoms in Bitcoin cycles.

The upcoming problem adjustment, scheduled for Might 8, is forecasted to lower by 1.5% to 2%.