Bitcoin (BTC) has witnessed a major drop, falling to $56,556 throughout Wednesday morning in Europe, marking the bottom level since late February. This downturn represents the sharpest month-to-month decline since November 2022, with BTC tumbling roughly 7.5% throughout the final 24 hours and breaching the beforehand steady $60,000 help late Tuesday.

#1 Derisking Earlier than Right now’s FOMC Assembly

Anticipation and nervousness are excessive in monetary circles because the Federal Open Market Committee (FOMC) is ready to announce its rate of interest choice later at present. This occasion is essential because the crypto market, notably Bitcoin, has grown more and more reactive to macroeconomic alerts.

Current knowledge, reflecting a slowdown in GDP development coupled with persistent inflation, has considerably diminished expectations of rate of interest cuts by the Federal Reserve. “Bitcoin and different danger belongings are at the moment feeling the strain from a stagflationary setting, geopolitical tensions, and seasonal liquidity variations,” remarked Ted from TalkingMacro.

Initially, as much as seven price cuts had been anticipated by the top of 2024, a sentiment that has shifted dramatically with the market now pricing in just one potential reduce by December 2024. This shift comes amidst an setting the place inflation knowledge is trending upwards, difficult the Federal Reserve’s place and doubtlessly resulting in a extra cautious method from Jerome Powell, the Fed Chairman.

“For the primary time in current reminiscence, the market is looking the Fed’s bluff, shortly front-running the concept the Fed might not reduce in any respect in 2024,” famous Ted.

#2 Cyclical Bitcoin Correction Part

Following an distinctive rally for the reason that yr’s begin, the market is present process a pure correction part. Previous to the value crash, Charles Edwards, founding father of Capriole Investments, famous: “We’re a day in need of breaking the document set in 2011 for days with out a significant dip [-25%],” emphasizing the extraordinary nature of Bitcoin’s current efficiency.

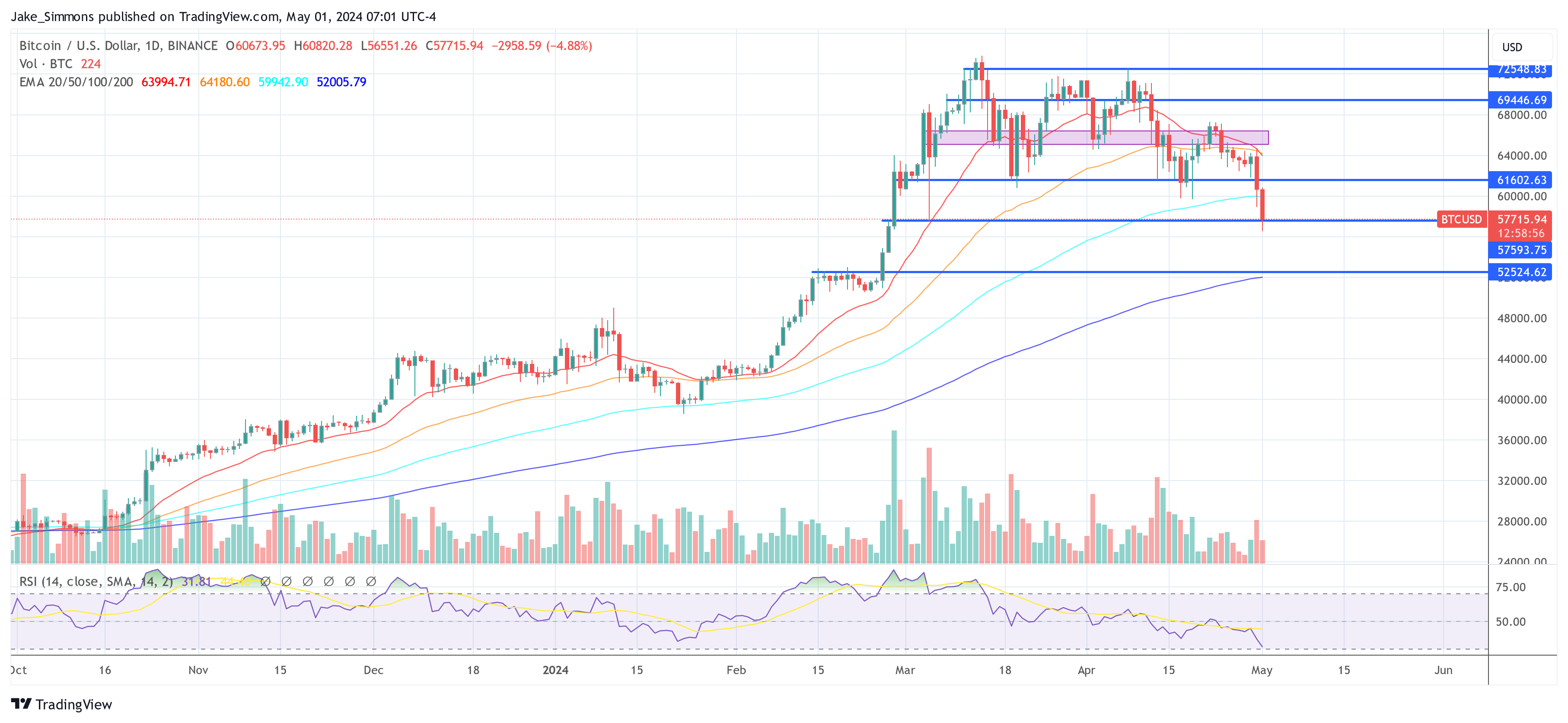

Scott Melker, often known as “The Wolf Of All Streets,” highlighted technical indicators that recommended an impending correction. “Broke and retested vary lows as resistance. […] My greatest concern I’ve been discussing for months [was] that RSI by no means made the journey to oversold. Nearly there now, all decrease time frames oversold. That is nonetheless ONLY A 23% correction, very shallow for a bull market and in keeping with different corrections on this run. We’re but to see a 30-40% pull again throughout this bull market, like these of the previous.”

$BTC Each day

Broke and retested vary lows as resistance. Nothing however air till round $52,000 on the chart.

My greatest concern I’ve been discussing for months (in e-newsletter) is that RSI by no means made the journey to oversold.

Nearly there now, all decrease time frames oversold.

This… pic.twitter.com/5YZTWipBo8

— The Wolf Of All Streets (@scottmelker) Could 1, 2024

#3 Revenue-Taking

Conventional finance markets and seasoned buyers are seizing the chance to take income following substantial good points. “TradFi/Boomers are taking income: CME Open Curiosity is reducing quickly, April twenty ninth 135,6k cash, April thirtieth 123,9k cash, topped round 170.4k cash (March twentieth),” defined crypto analyst RunnerXBT.

This pattern confirms a broader profit-taking technique publish vital occasions just like the ETF approval and the anticipation across the Bitcoin halving. “That […] confirms my thesis that loads of these guys longed in October 2023 due to ETF approval and BTC halving, commerce performed out and now they’re taking income (sure they’re nonetheless up quite a bit), as a result of they longed BTC not useless altcoins.”

TradFi/Boomers are taking income ✅

CME Open Curiosity is reducing quickly

April twenty ninth 135,6k cash

April thirtieth 123,9k cashTopped round 170.4k cash (March twentieth)

That no less than for me confirms my thesis that loads of these guys longed in October 2023 due to ETF approval… pic.twitter.com/M8KY1NfCtK

— RunnerXBT (@RunnerXBT) Could 1, 2024

#4 US ETF Flows And Hong Kong Disappointment

The dynamics surrounding spot Bitcoin ETFs have proven vital strains, evidenced by current actions in each US and Hong Kong markets. In the US, Bitcoin exchange-traded funds (ETFs) confronted substantial outflows, indicating a cooling investor sentiment.

In accordance with current knowledge, the overall outflows from US spot Bitcoin ETFs amounted to $161.6 million. Notably, the Grayscale Bitcoin Belief (GBTC) skilled outflows of $93.2 million, whereas Constancy and Bitwise registered outflows of $35.3 million and $34.3 million, respectively. BlackRock had zero internet flows as soon as once more. These numbers counsel a retreat in institutional curiosity, which has historically been a bulwark towards value volatility.

Parallel to the US, the debut of Bitcoin ETFs in Hong Kong additionally faltered considerably under expectations. Six newly launched ETFs, supposed to seize each Bitcoin and Ethereum markets, collectively reached simply $11 million in buying and selling quantity, starkly underperforming towards the anticipated $100 million. The spot Bitcoin ETFs accounted for $8.5 million in buying and selling quantity. This was markedly decrease than the launch day volumes of US-based spot Bitcoin ETFs, which had reached $655 million on their first day.

#5 Lengthy Liquidations

The market has additionally been impacted by substantial lengthy liquidations, with a complete of $451.28 million liquidated within the final 24 hours alone. The most important single liquidation was an ETH-USDT-SWAP on OKX valued at $6.07 million, however Bitcoin-specific liquidations had been vital as effectively, totaling $143.04 million, in line with knowledge from CoinGlass. These liquidations have amplified the promoting strain on Bitcoin.

At press time, BTC traded at $57,715.

Featured picture from iStock, chart from TradingView.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding choices. Use info offered on this web site totally at your individual danger.