This month, Open Finance turned three years in Brazil, witnessing vital investments from banks and fintechs to innovate merchandise whereas customers progressively embrace its potential. Within the face of the fast triumph of Pix, the central financial institution’s instantaneous cost software launched in late 2020, Open Finance seems to be nonetheless gaining momentum. Nonetheless, behind the scenes, this method that goals to revolutionize monetary companies in Brazil is making regular progress.

The system now boasts over 42 million consents, based on official knowledge, of which 28 million are distinctive to a person or an organization. The entire variety of weekly API calls – Open Finance relies on interactions and knowledge transmission between completely different APIs – reached 1.5 billion by mid-January, tripling from 0.5 billion a few 12 months earlier than. The native banking affiliation, Febraban, stated this makes Open Finance in Brazil the largest on the earth.

Not as fashionable as Pix… for a motive

Open Finance, also referred to as Open Banking, permits prospects to share their monetary data amongst licensed establishments. Every account holder grants permission for banks and fintechs to entry particular knowledge held in one other supplier, with connections established straight between them on the consent of the shopper, who can revoke it at any time. Consultants argue it has an enormous potential to considerably enhance the standard of economic companies and decrease prices for the person.

Nonetheless, for day-to-day Brazilians, that is largely unknown. Open Finance was launched barely a number of months after its massive brother Pix, but it’s nowhere close to its explosive adoption. Pix has rapidly established itself as a cost methodology of alternative for the complete Brazilian inhabitants.

However consultants argue there’s a motive for this. In contrast to Pix, which is a available, extraordinarily helpful, and sensible service, Open Finance is an infrastructure. It permits the event of companies by way of consumer connection and knowledge sharing however on a again finish. “Open Finance won’t ever be as fashionable as Pix,” stated Carlos Augusto de Oliveira, government director at ABFintechs in Brazil. “Like every infrastructure, the consumer could not all the time understand that she or he is definitely benefiting from it.”

The fintech advisor says it relies on additional development and growth of recent companies for its advantages to develop into tangible for the consumer in order to supply consent.

A turning level for Open Finance in Brazil?

Certainly, the infrastructure continues to be in its early phases, and it might take a number of years for contributors to develop new merchandise. As well as, customers say the expertise continues to be removed from ideally suited, and that few functionalities can be found right now to validate the software’s usefulness.

Nonetheless, consultants imagine this may occasionally change in 2024 with the arrival of recent merchandise and, primarily, with the mixing with its older sibling, Pix.

“2024 is predicted to be a 12 months of great progress for Open Finance, particularly as a consequence of its mixture with Pix,” stated Oliveira. Pix is by any account now a cost behemoth in Brazil, transferring round $400 billion per 30 days in transactions. The central financial institution is consistently releasing enhancements and new options, and Pix Automatico – which resembles a direct debit in recurring funds – might actually propel ahead its use this 12 months, and spotlight the advantages of Open Finance.

“Some estimates level that by the tip of this 12 months, about one-fifth of all Pix transactions will likely be carried out by way of this modality, which is made potential because of the integration framework of Open Finance,” stated Oliveira.

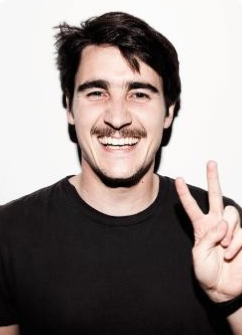

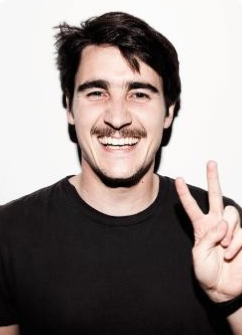

For Pablo Viguera, a co-founder and CEO at Open Finance agency Belvo, Pix-related merchandise will likely be important to propel Open Finance ahead. “This shift could make monetary companies not solely extra accessible but additionally tailor-made to every buyer’s distinctive necessities,” he informed Fintech Nexus. “This evolution may very well be a big milestone, just like the transformative influence Pix had on the cost panorama.”

Open Finance is vital to rising credit score

Above all, Open Finance can play a important function in driving the price of lending down in a rustic notorious for above-normal web curiosity margins the place charges can simply go into the triple-digits within the unsecured segments.

“Open finance will develop into a aggressive benefit in 2024,” Viguera stated. “Within the face of a fancy macroeconomic atmosphere within the area, the place entry to credit score might be difficult, lenders want to search out new methods to enhance their danger evaluation processes and decision-making.”

Belvo believes 2024 will see the consolidation of recent practices that leverage transactional knowledge extracted by way of open finance to measure credit score danger, complementing and even changing conventional strategies in some circumstances. The corporate has partnered with FICO in Brazil to develop a brand new credit score rating which relies on knowledge gleaned utilizing Open Finance frameworks.

“That is an instance of how combining AI with transactional knowledge could be a win-win for monetary establishments and prospects,” he stated to Fintech Nexus. “It’ll drive unprecedented innovation within the Brazilian monetary sector.”